Foreign currency exchange platform TransferWise just landed a new partnership with challenger bank Monzo. This agreement marks the fintech’s first U.K. bank client to go live and comes just weeks after the company announced a similar partnership with France’s BPCE Group.

Through today’s agreement, TransferWise will power international money transfers for Monzo’s 750,000 users. Starting today, Monzo has integrated with TransferWise’s API to allow its users to send money from their Monzo checking account in 16 currencies. The bank is working to add more currencies in the near future.

Monzo opted to leverage TransferWise for international money transfers because of the positive user experience co-founder Tom Blomfield has had with TransferWise in the past. Blomfield told TechCrunch in an interview, “I’ve personally been a TransferWise customer for five or six years and the service is amazing. Compared to my old bank, it’s really, really transparent, the fees are really fair, and they’re continually working on bringing fees down and to make transfers more instantaneous. So I can’t think of a better partner to do foreign transfers with than TransferWise.”

Many Monzo clients already use TransferWise, but for those who do not, TransferWise will automatically set up an account for them when they initiate their first bank transfer. For all users, the international transfers will be syndicated across both their Monzo and TransferWise accounts.

With more than 3 million users, TransferWise facilitates the movement of more than $2.65 billion each month. Today’s partnership marks TransferWise’s first U.K. bank client to go live, adding to the fintech’s other bank partnerships, including N26 and LHV. TransferWise had– at one point– announced an integration with Starling Bank in the U.K., but the partnership was never finalized and fell through.

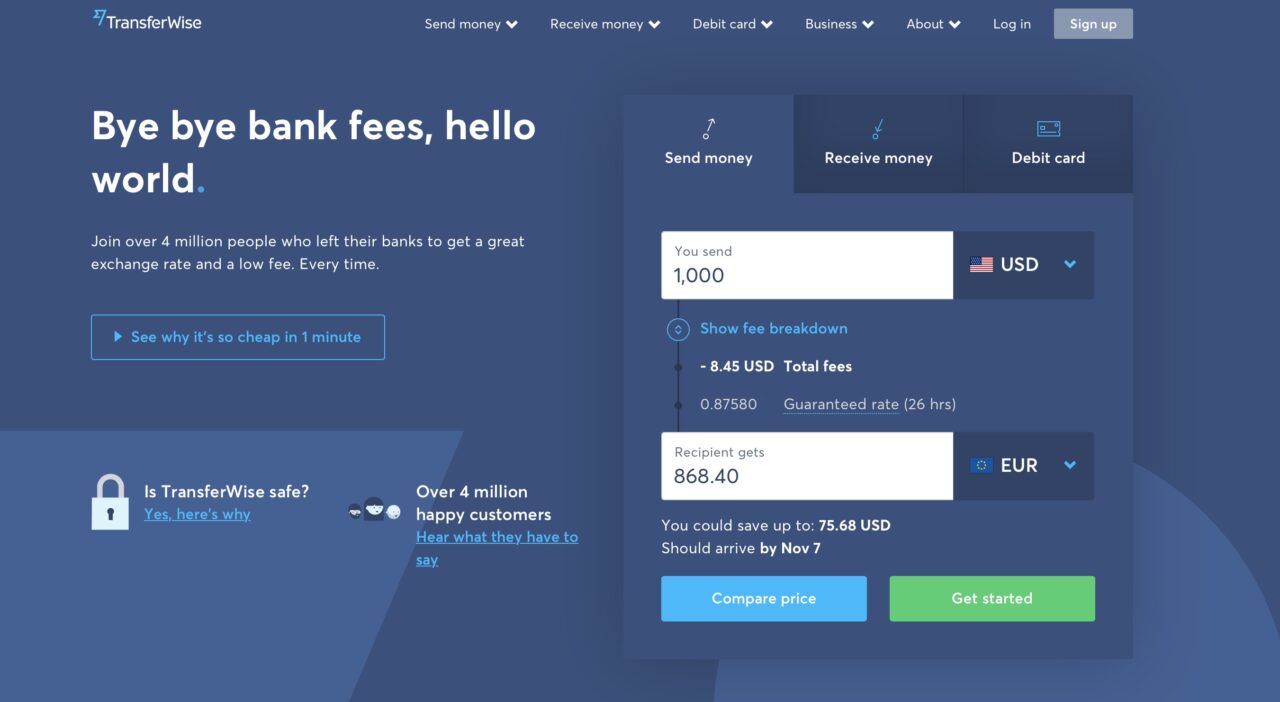

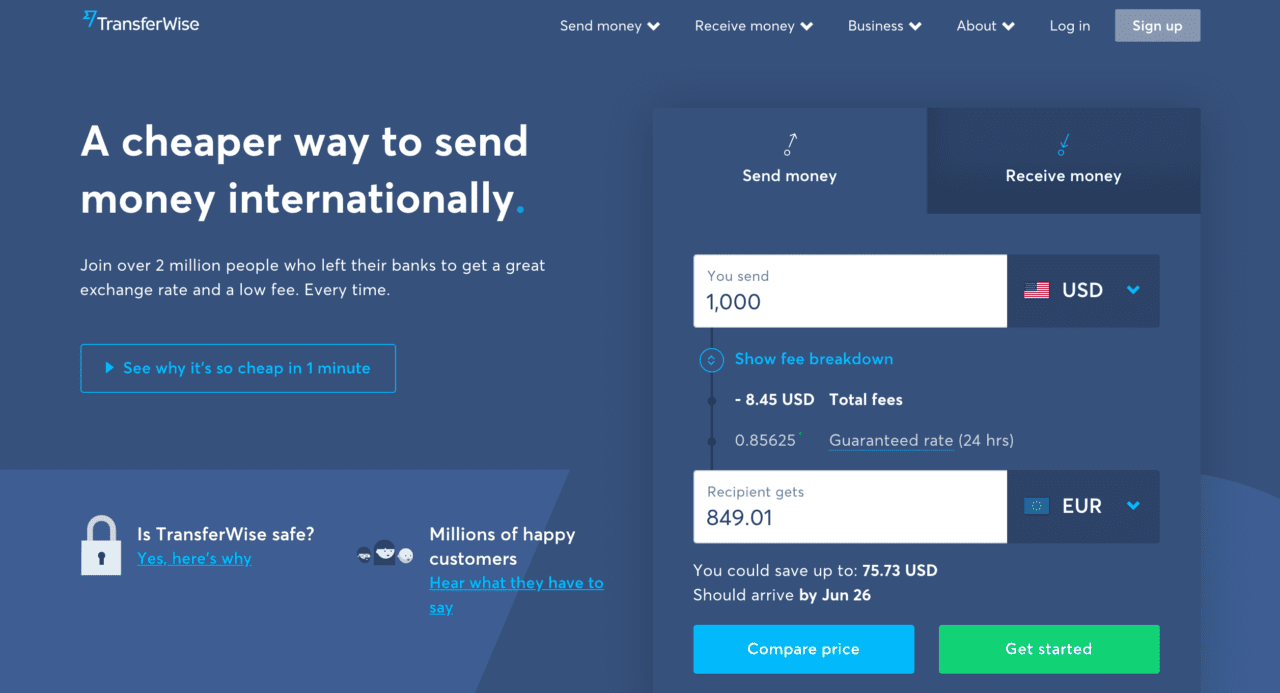

TransferWise does not charge users to sign up and there are no monthly fees. By leveraging the ability to transfer money within its network of banks, the company makes sending money abroad up to 7x cheaper than using a bank account. The company was founded in 2010 and showcased its P2P currency exchange services at FinovateEurope 2013. TransferWise recently launched in Argentina to allow Argentinians to move money to and from more than 60 countries.