New York-based Nvstr demonstrated its machine learning-powered stock selection platform just over a year ago at FinovateFall. By leveraging technology and the collective wisdom of the investing crowd, Nvstr offers individual investors access to the same sort of “smart processes” to discover good investment opportunities and build profitable portfolios that professional investors have long enjoyed.

“Roughly half the U.S. population is invested in the stock market. But in reality, many people do not learn about investing formally. This makes it incredibly difficult to find information on investing intelligently – or to even know what to look for,” Nvstr co-founder and CEO Bernard George (pictured) explained in an email conversation.

“Roughly half the U.S. population is invested in the stock market. But in reality, many people do not learn about investing formally. This makes it incredibly difficult to find information on investing intelligently – or to even know what to look for,” Nvstr co-founder and CEO Bernard George (pictured) explained in an email conversation.

“We understand that building a stock portfolio can be time consuming and intimidating, and that’s why we created Nvstr. Studies suggest that Americans are leaving $60 billion on the table each year due to poorly allocated portfolios,” he said.

We caught up with George to talk about the company’s technology and plans for the future. The company recently launched a promotion to add up to $500 to any newly-opened brokerage account.

Finovate: What does Nvstr do and how does it do it?

Bernard George: Our social trading platform empowers individuals to invest smarter by leveraging technology and the collective experience of other investors to make more educated investment decisions. Our software is based on independent Nobel Prize-winning research that works behind the scenes to guide users towards intelligent portfolio allocations in just one click.

Finovate: Who are your primary customers?

George: Our primary customers are individuals who already have some experience in investing. However, anyone can create a free simulated trading account to familiarize themselves with our platform and to practice investing risk-free. This is a great way for beginners or intermediate investors to get more comfortable investing before having to commit real money.

Finovate: How does Nvstr solve the problem better?

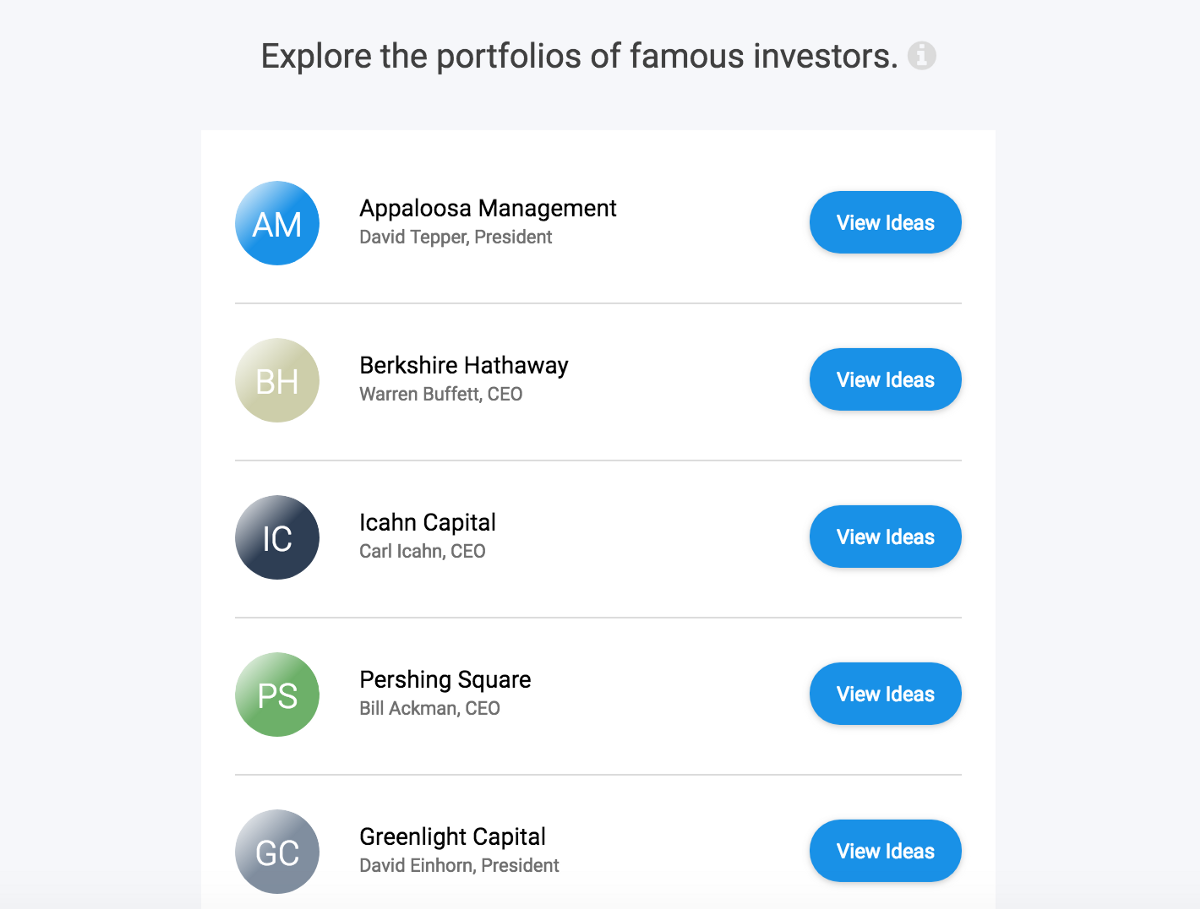

George: Existing brokerages are not designed to help customers achieve their fundamental goal, which is to build wealth by intelligently allocating their money for the long-term. Nvstr fills this void by bringing a social, technology-driven approach to investing. First-time users can buy and sell stocks (at cheaper fees than many competitors) with a front row seat for what other really successful investors are thinking and doing.

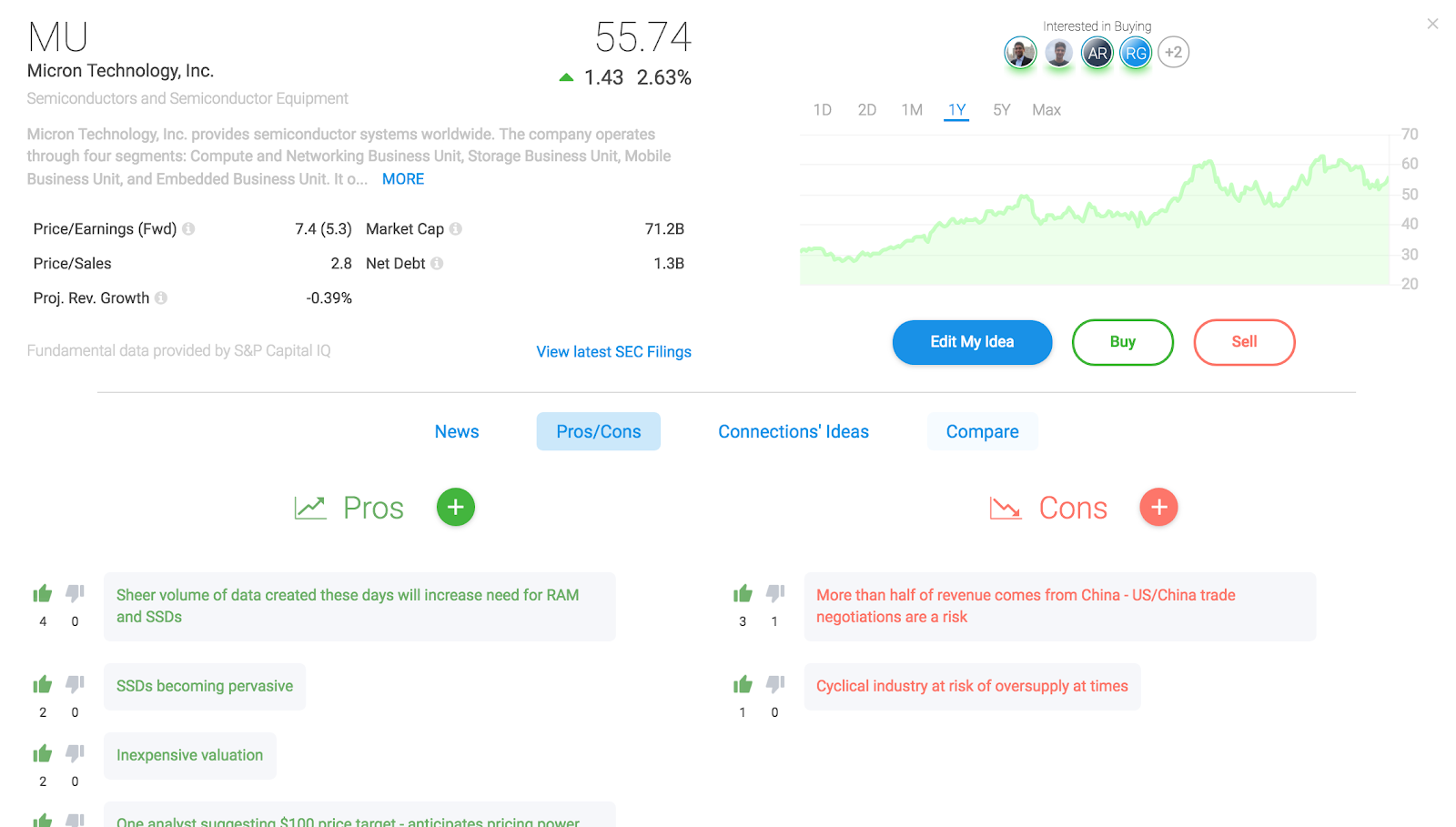

Not only can they view their portfolios, but they can collaborate and discuss investment ideas and their pros/cons. To make things better, everyone’s input on each stock is automatically summarized. This means everyone can access the key benefits – and risks – of each stock at a glance.

Finovate: Tell us about a favorite feature of the Nvstr platform.

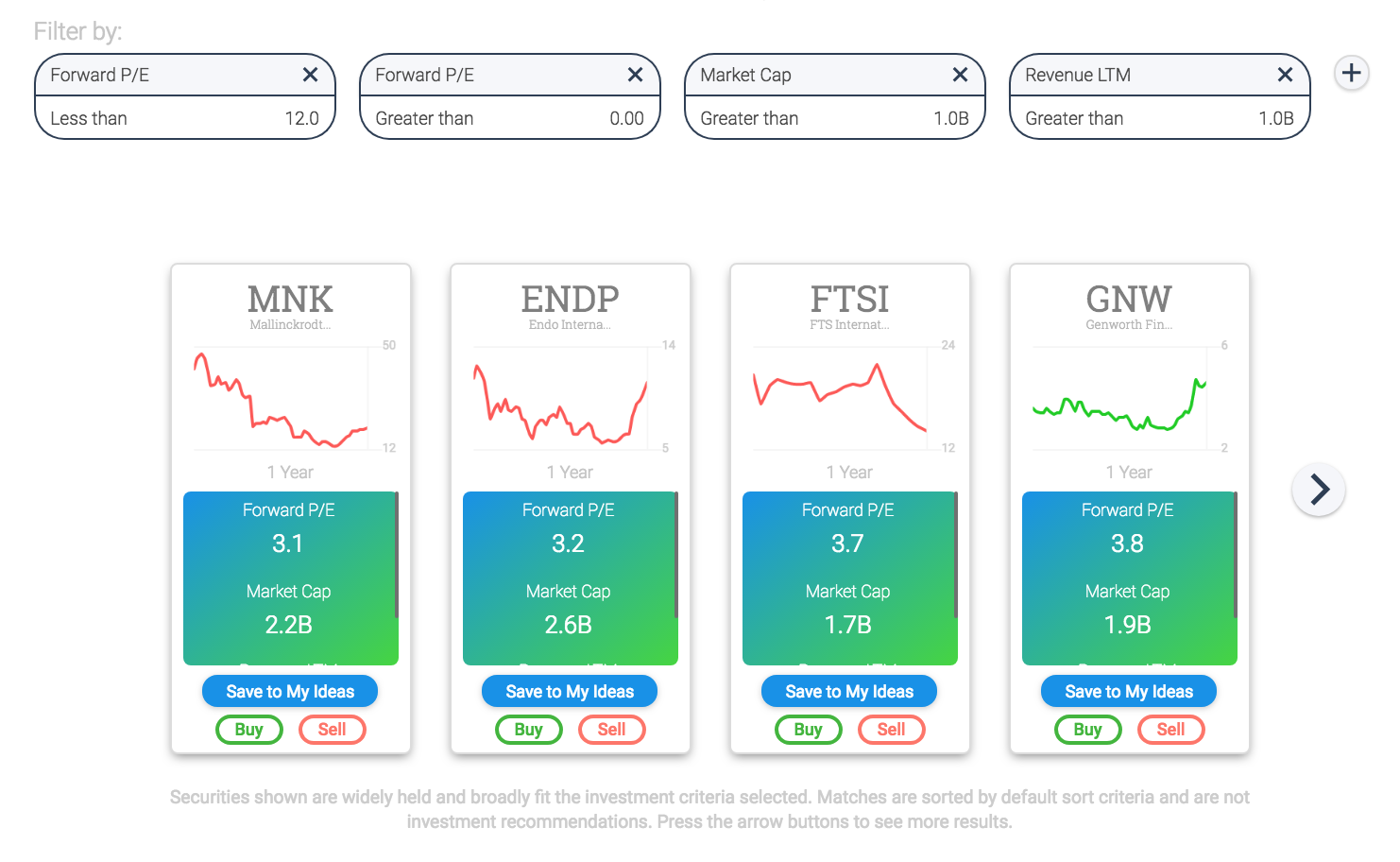

George: Nvstr’s machine learning technology is used behind the scenes throughout the product to surface relevant and interesting ideas to the Nvstr community. One of the most exciting implementations is the Collective Intelligence filter. This filter lets users quickly find stocks that our algorithm determines will be most interesting in based on a user’s actions on the site.

It will even tell them how these stocks might fit into their current portfolio. This list can be further filtered by traditional data like market cap, P/E ratio, industry, and more. It’s like browsing for a new TV series on Netflix, but for stocks.

Finovate: What in your background gave you the confidence to tackle this challenge?

George: We’ve been professional investors at some of the world’s most sophisticated institutions, but we’ve also experienced the frustrations of personal investing. Nvstr’s leaders are former hedge fund managers, game designers and ed tech engineers who left those industries to make intelligent investing easy and engaging.

Our team has spent time working for companies like J.P. Morgan, Merrill Lynch, The Carlyle Group, and Electronic Arts, and we know where the gaps in this market lie, and that’s what we have set out to fix.

Finovate: Where do you see Nvstr a year or two from now?

George: Nvstr is the best place for people to discuss stocks with friends and find new trade ideas from their network and a community of smart investors. As our community continues to grow, more investors will benefit from the advanced portfolio allocation and machine learning technology within the platform.

Our ultimate goal is for Nvstr to be the platform of choice for investors of all skill levels to gain insights and to build and manage their portfolios – all in one place.