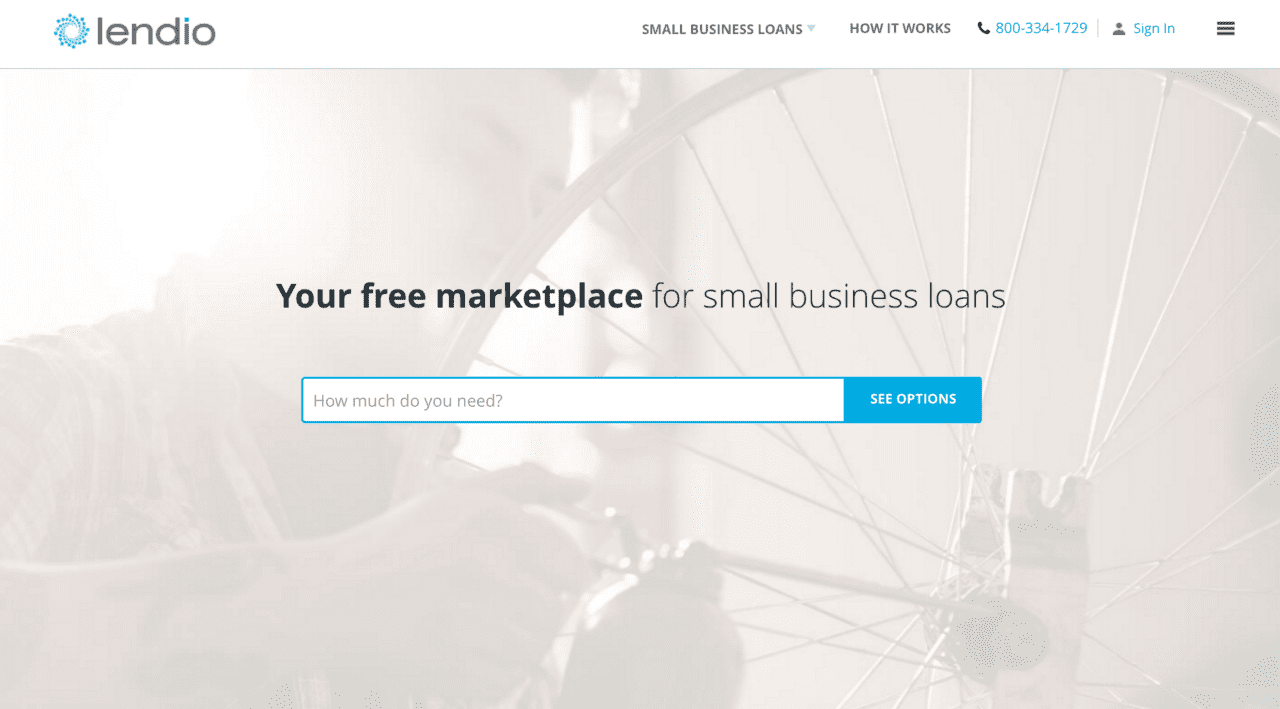

Small business loan marketplace Lendio announced it has matched borrowers with more than $500 million in loans on its platform since it facilitated its first loan in 2013. That’s more than half a billion dollars in working capital extended to empower small businesses.

These funds have been distributed from Lendio’s network of more than 75 small business lenders to more than 21,000 businesses across the U.S. This growth comes after the company reported an increase of more than 1.4X in loans originated via the Lendio platform in the last year.

“Small businesses create the lion’s share of economic growth and jobs in this country. Lendio is proud of the impact that $500 million in business loans is having on the American economy,” said Brock Blake, CEO and founder of Lendio. “From restaurants and retail shops, to plumbers and landscapers, our team is passionate about providing the access to capital to help these businesses grow, recharge and thrive.”

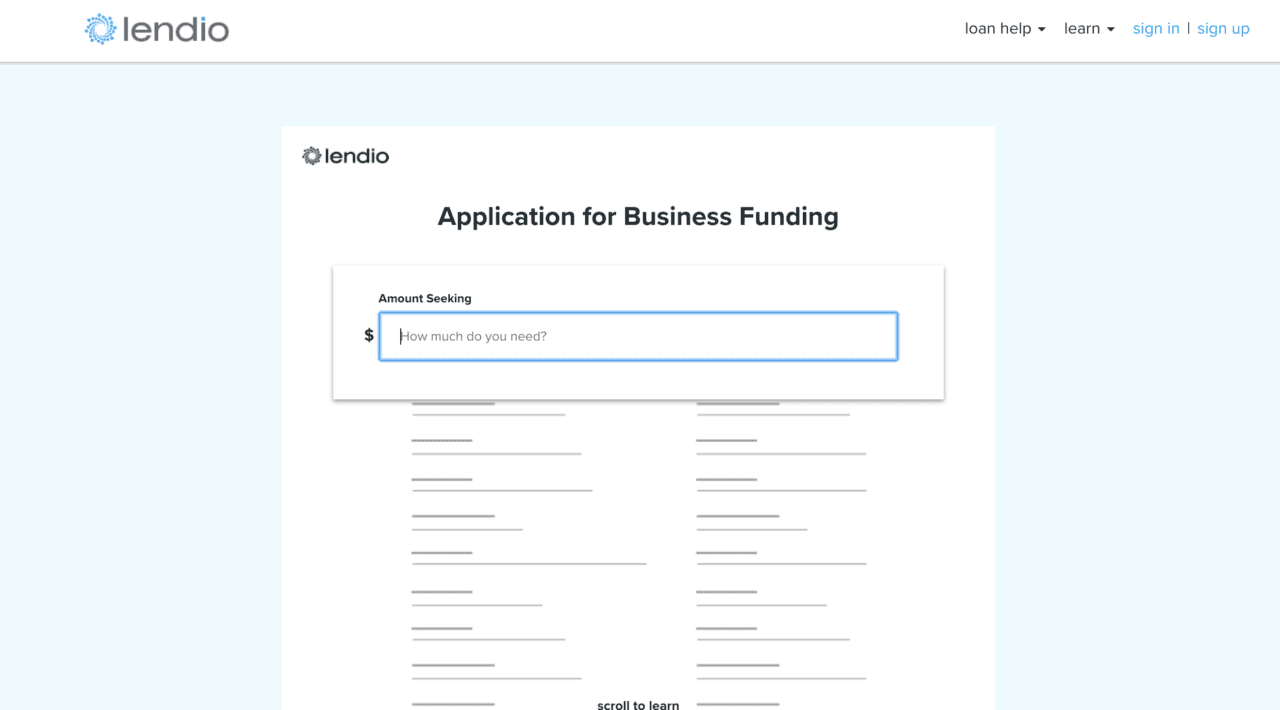

Lendio showcased its marketplace at FinovateSpring 2011. The company’s average loan size is just under $27,000 and Lendio reports that 70% of businesses received the funds they requested within five days of submitting an application. The top business categories funded on Lendio’s marketplace include construction, restaurants, retail, healthcare, and manufacturing.

Last month, the Utah-based company began a pilot with Comcast Business customers that offers streamlined access to the Lendio marketplace. Earlier this spring, the company launched a marketplace lending franchise program that gives Lendio franchisees get access to Lendio’s marketplace and technology, training, branded marketing tools and advertising, partnerships, and training. In the fall of 2016, the company landed $20 million in funding, bringing its total raised to $31 million. Lendio’s partners include American Express and Finovate alums BlueVine, Lending Club, On Deck, and Kabbage.