Speaking at FinovateFall 2016 in September, Daon President of the Americas Conor White asked attendees about their own experience with cart abandonment online. “Last year, a Javelin report said that $9 billion was lost due to card fraud. That’s a problem,” White said. “But there was $118 billion in lost revenue because transactions were just abandoned or falsely declined. So do we have a security problem or a convenience problem?”

“As a security professional, I’ve always been told you can be secure or you can be convenient, but you can’t be both,” White said. “Now you can be both. You can be secure and your customers will be happy.”

With clients including USAA and Mastercard, Daon provides both enterprise and public sector customers with biometric authentication technologies including face, voice, and fingerprint recognition. The company offers its variety of authentication options over multiple channels, ensuring that clients have access to the authentication solution or solutions that suits their needs. Daon’s technology can be deployed to provide authentication for digital banking, for payment verification, and employee credentialing, as well as cloud authentication. Importantly, the technology is built to make it easier for individuals to protect themselves, delivering both security and convenience.

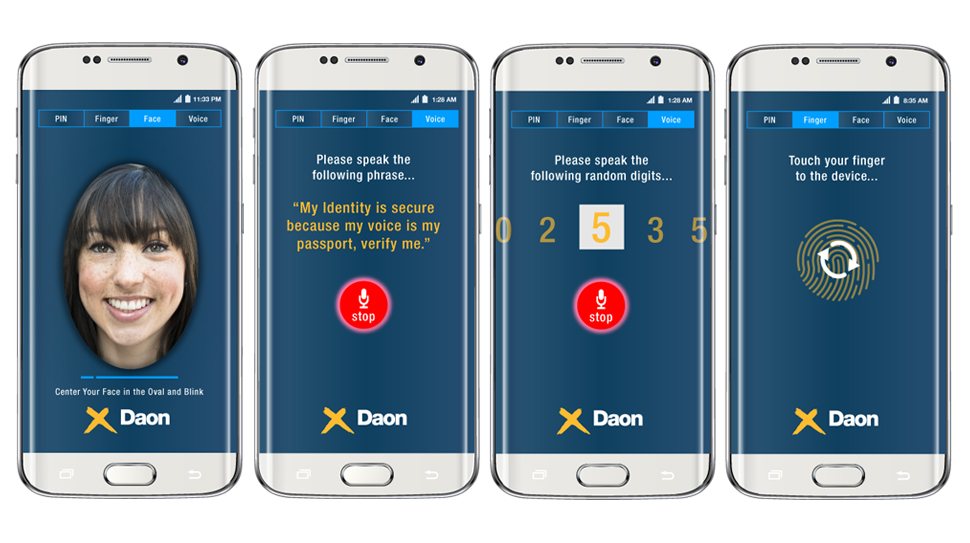

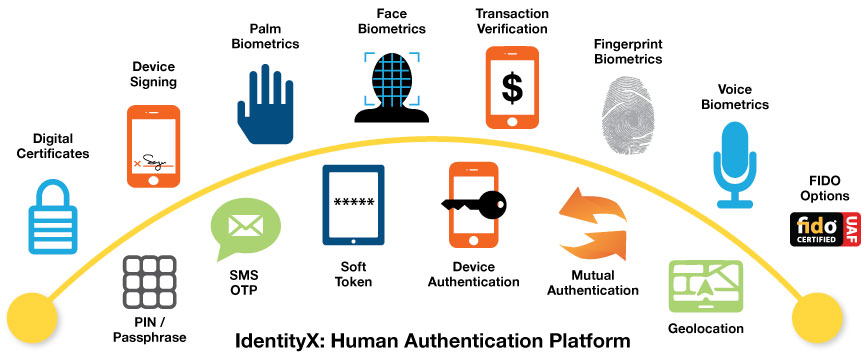

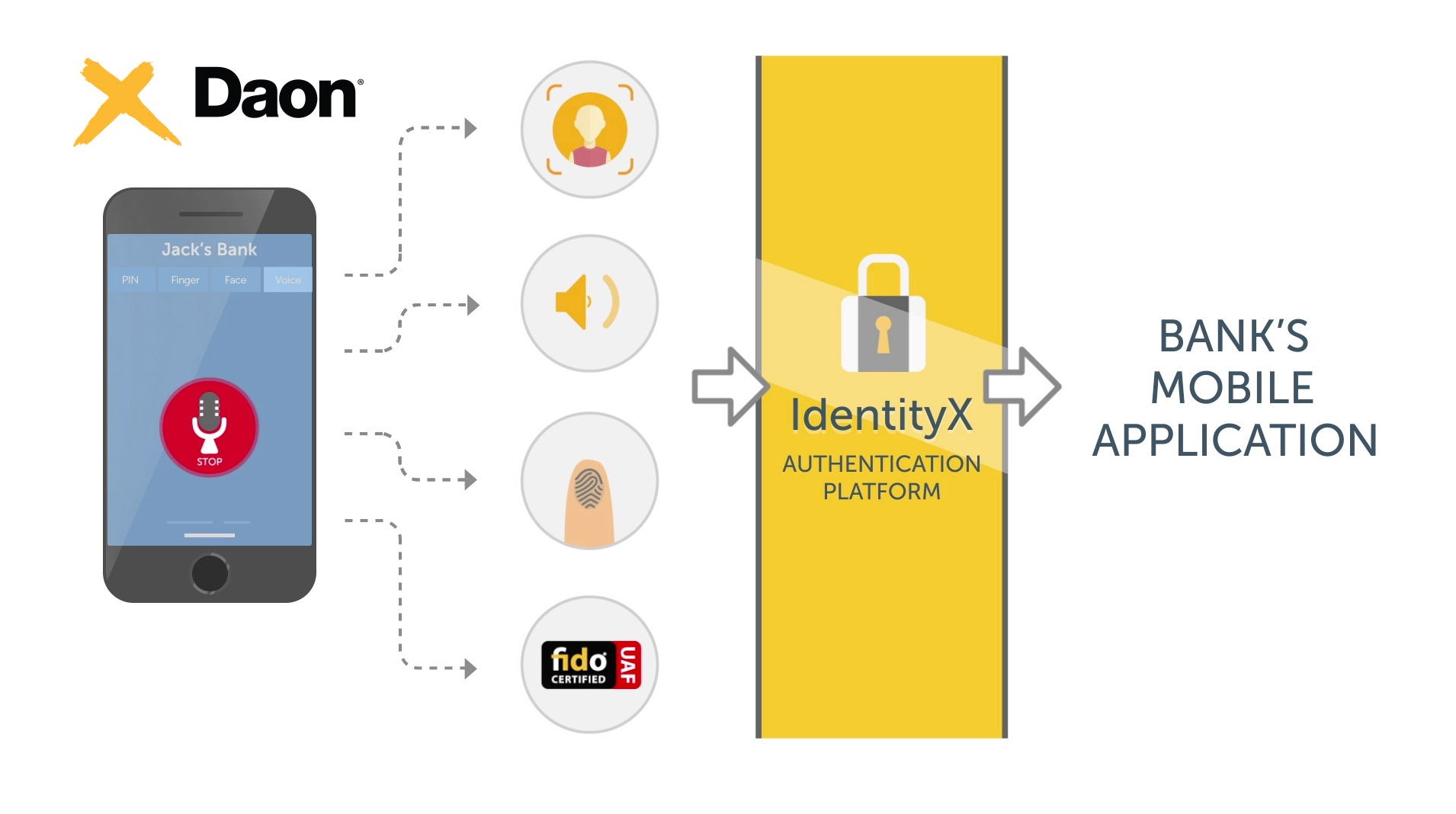

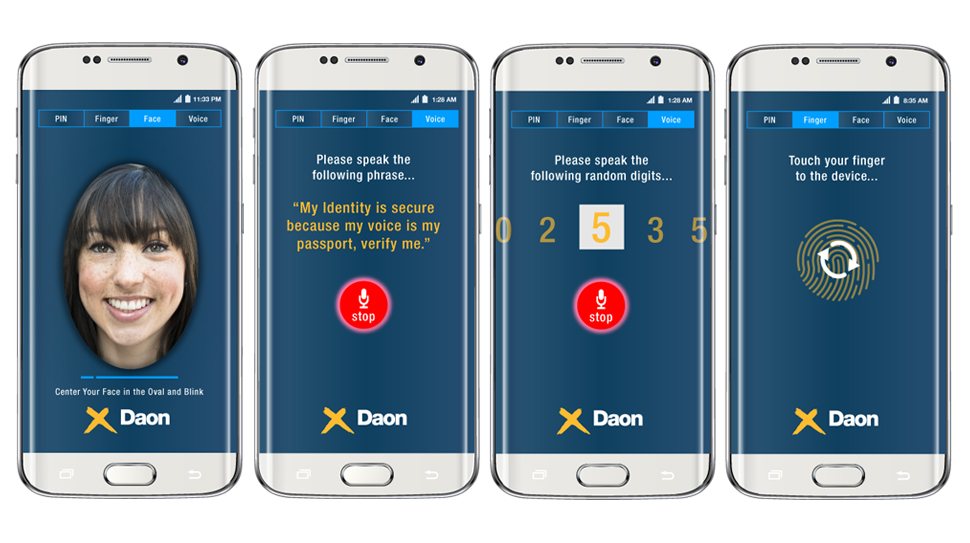

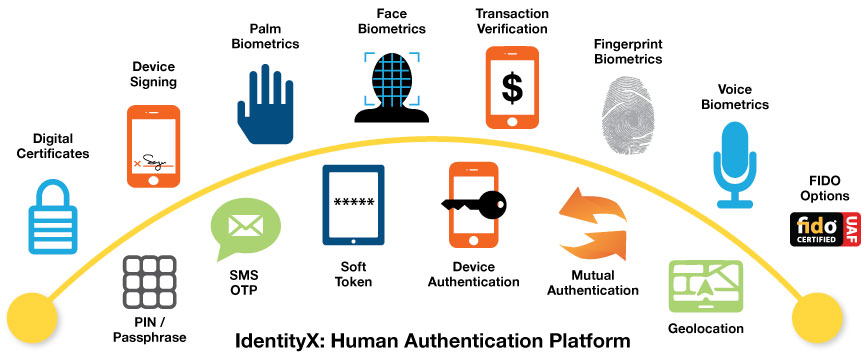

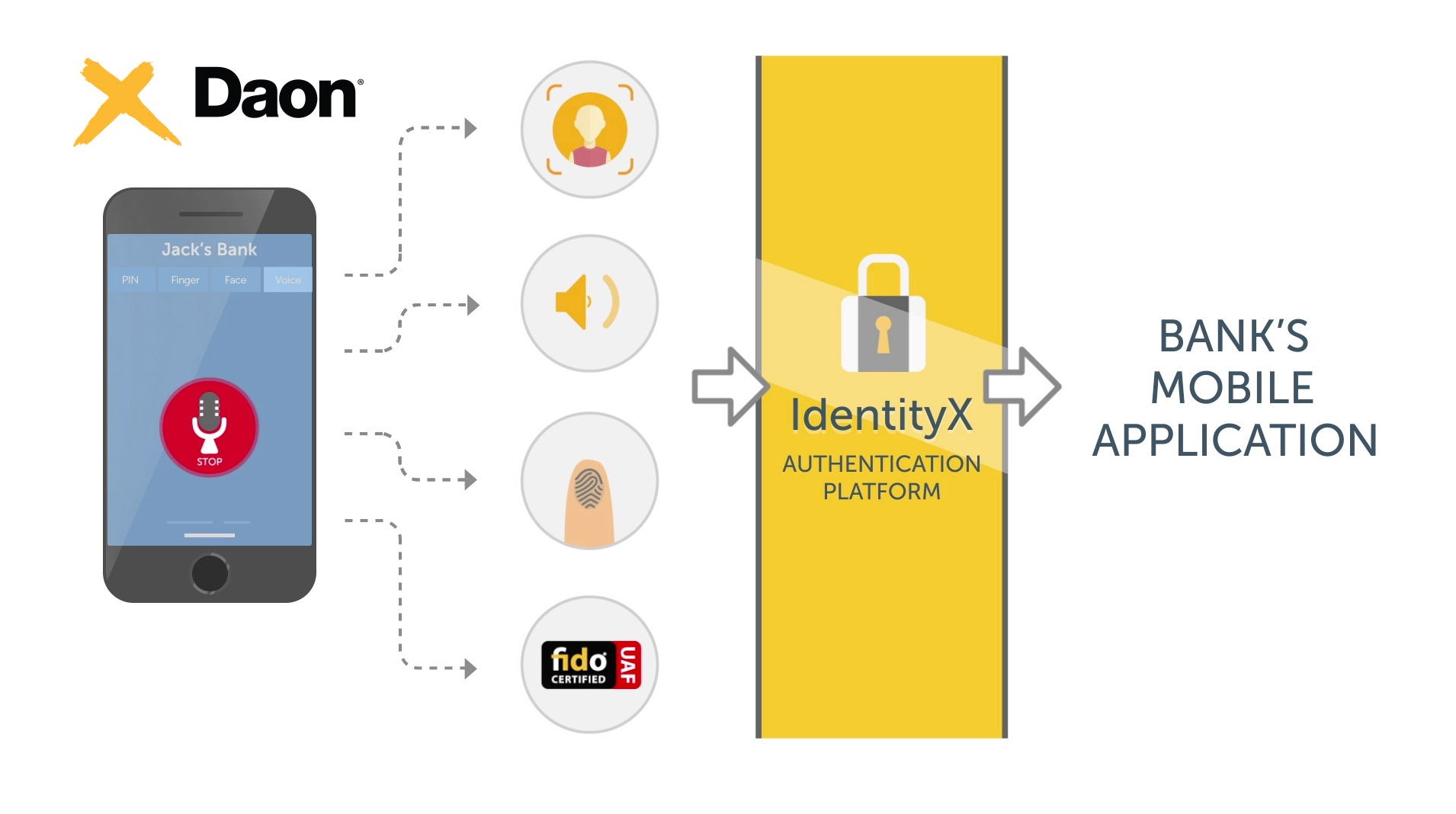

At FinovateFall 2016 in September, Daon introduced IdentityX, a universal mobile biometric authentication platform that enables combinations of the above factors—face, voice, and fingerprint—to be used for authentication. IdentityX also leverages device binding, geolocation, and liveness detection to provide a thoroughly multifactor solution. The platform is designed to allow companies to “innovate as you authenticate your customers,” as well as add the latest authentication technologies available. “That’s what Mastercard seeks, that’s what USAA seeks, that’s what our other customers on five continents seek,” White said.

Company facts:

- Headquartered in Reston, Virginia

- Tom Grissen is CEO

- Daon’s customers include USAA, Mastercard, Atom Bank, Gulf Bank Kuwait, and Banco Neon

Daon’s Conor White, president of the Americas, demonstrated IdentityX at FinovateFall 2016.

We caught up with Conor White during rehearsals at FinovateFall. We followed up later with a few questions by email. Below are our questions and his responses.

Finovate: What problem does Daon solve?

Finovate: What problem does Daon solve?

Conor White: The big challenge being solved across all digital channels is that of security and convenience. Some would suggest you cannot have both. At Daon, we disagree. It’s important that companies think about their customers’ digital security and digital experience, moving away from that one-size-fits-all approach, such as more complex passwords and knowledge-based authentication, to a more nuanced understanding of how different customers think and feel about their security experiences.

Daon’s IdentityX authentication platform provides freedom of choice to use the authentication method that fits their preference—fingerprint, face, voice or alternative biometrics just emerging in the marketplace. Platforms make difficult things easy, such as applying customer segmentation strategies to digital security. More than ever, companies need to be inclusive of all of their customers and provide convenient authentication across all digital channels.

Finovate: Who are your primary customers?

White: Daon is working with some of today’s most innovative companies across five continents with a wide spectrum of industries including financial, healthcare, insurance, and automotive. We are proud to be working with companies such as Mastercard and USAA, Atom Bank, Nequi, Banco Neon, SMBC, NTT Data, and Equiniti who are giving their customers the freedom to choose how they authenticate when they bank or make a payment, which is empowering and, frankly, more simple, convenient, and secure.

Finovate: How does Daon solve the problem better?

White: Millions of consumers are already using Daon biometric authentication, and they love it. As consumers experience the convenience and security benefits that biometrics bring, enormous pressure is being felt by companies that are still using antiquated passwords as part of their digital strategy.

More than 92% of users prefer biometrics over passwords. In addition, passwords are too cumbersome, easily forgotten, and represent a decades-old system of authentication. Research shows that one-third of online shopping carts are abandoned due to consumers forgetting their passwords, which is money lost for any company.

The IdentityX platform future-proofs and protects organizations by allowing for a combination of biometrics—those available today and in the future—in conjunction with other security measures such as cryptography, device-binding, location factors, and more. IdentityX can match on-device or on-server the type of biometric architecture you want to deploy. In order to guarantee a consistent user experience across all operating systems and hardware, the platform approach is the only real solution.

Finovate: Tell us about your favorite implementation of your technology.

White: More than ever, companies need to be inclusive of all of their customers and provide convenient authentication across all digital channels. There are more than 57 million people with disabilities. IdentityX gives companies the opportunity to be inclusive: Whether the person needs to use their voice, fingerprint, or face, they can do so.

Another exciting implementation of the technology is how it’s being deployed in call centers. For instance, when you call USAA’s call center from their smartphone app, the authentication already has taken place. So unlike a typical call-center authentication process, which can often take up to 60 seconds with multiple questions, they can immediately begin to handle your issue and send you directly to the department you need – without ever having to ask! It’s a huge differentiator and only possible today using biometric authentication.

Finovate: What in your background gave you the confidence to tackle this challenge?

White: After 9/11, Daon had the privilege of working closely with global governments who were looking to secure their borders using biometric technology. Daon was involved in the development of many of the larger-scale biometric systems used by democratic nations around the world. We are now using this same technology to help companies around the globe provide simple, convenient and secure ways for their customers to authenticate their online purchases, bank accounts, and much more. This technology is sweeping across all digital channels. Think of our early encounter with the internet. First we “browsed” and used Netscape. Then we “searched” and turned to Google and next we “shared” with Facebook. The next big problem being solved is trust. Daon’s core competency is developing biometric authentication software products that establish trust between two parties.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

White: With marquee brands relying on Daon’s technology, the big excitement is watching their digital channel adoption rates rise rapidly as their customers experience simple, convenient and secure biometric authentication. We are seeing our technology impact top-line revenues and shifting market share for major global companies. The results of Daon’s continuing mission—to ensure IdentityX solves well-understood business problems—are unparalleled in the market.

Finovate: Where do you see your company a year or two from now?

White: We’d like to see Daon regarded as the leading company that customers around the world turn to on their ongoing journey of addressing the high-value task of improving the digital security experience for their consumers, to drive up digital adoption rates and customer-satisfaction scores.

Finovate: What problem does Daon solve?

Finovate: What problem does Daon solve?