Fiserv-owned point-of-sale (PoS) system Clover unveiled Clover PracticePay today. The new solution is an all-in-one payments platform to support small and medium-sized healthcare providers.

To optimally tailor the tool to the healthcare field, Clover partnered with healthcare payments solutions company Rectangle Health. The new solution aims to simplify the way healthcare practices manage payments while providing them with digital tools to help enhance their practice efficiencies.

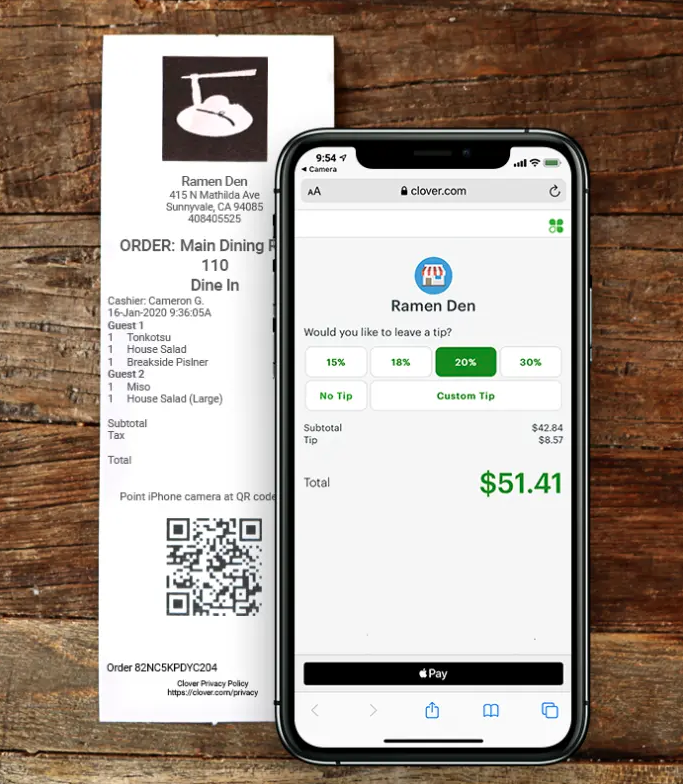

Launching in 2026, PracticePay combines Rectangle Health’s Practice Management Bridge technology with Clover’s PoS hardware and is compliant with HIPAA and PCI requirements. Designed for providers across primary care, dental, behavioral health, and other specialties, the payments solution features financing options, recurring billing, text-to-pay, QR codes, and online payment portals that can be integrated into customers’ existing practice management software.

For Clover, launching PracticePay will help it expand beyond its core verticals, which include restaurant, retail, and personal services. Adding healthcare payments will allow Clover to extend into the high-demand healthcare industry in which providers are seeking to modernize operations to meet expanding patient expectations, increasing administrative complexity, and digitization requirements. PracticePay will help Clover meet these needs while capturing a segment of the $4.5 trillion US healthcare economy.

“As we continue to evolve Clover to meet the needs of small and medium-sized businesses, trusted partners like Rectangle Health play a critical role in delivering specialized solutions for key industries,” said Fiserv SVP, Head of Merchant FI Channels & Small Business Strategy Katie Whalen. “Healthcare is an important vertical for the banking industry, and with this new solution, we are enabling our financial institution partners to better serve a critical customer base within their communities. By uniting Clover’s leading technology with the strength and security of Rectangle Health’s purpose-built software, we are extending our reach into healthcare and enabling providers to operate more efficiently, improve payment flows, and enhance the patient experience.”

A pioneer in the payments space, Rectangle Health was founded in 1992 to create payment solutions for the healthcare industry. The company provides healthcare organizations with a suite of services that streamline payments, enhance patient relationships, and comply with regulatory standards.

“Together with Clover, we are proud to set a new standard for practice management and payment solutions in the healthcare space,” said Rectangle Health CEO Dominick Colabella. “This collaboration will enable providers to enhance their financial systems while remaining focused on what matters most—their patients.”

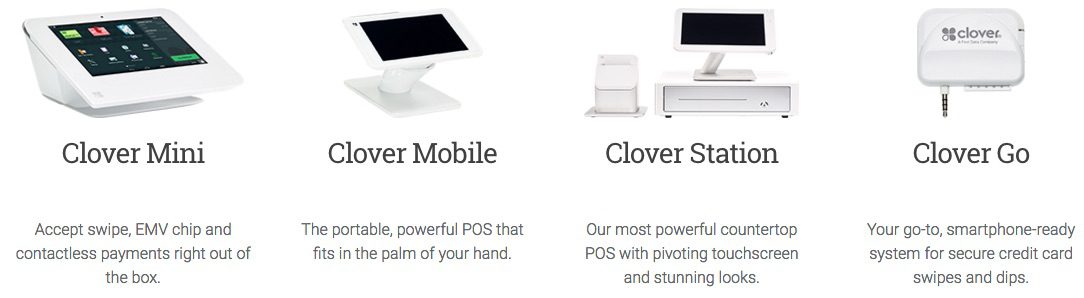

Clover was originally founded in 2010 to help small businesses accept payments. Today, the company serves as a one-stop shop for multiple payment needs. In addition to offering a range of payment acceptance terminals, Clover also has software to help businesses with online orders, accounting, loyalty programs, staff management, inventory, and more. Clover was acquired in 2012 by First Data, which was acquired by Fiserv in 2019.