Designed by Freepik

Digitization and innovations in workflow automation and data integration are among the biggest trends driving much of mortgagetech. Whether you are a process facilitator, making the purchase experience easier on the homebuyer, or a loan servicer looking to better target your lending efforts, the efficiencies and insights provided by these technological trends are transforming this growing space within fintech.

In some ways, these are the same trends that are sweeping through not just technology but industry, as well. It’s true that workers and consumers in the 21st century have developed a love/hate relationship with an increasingly digitized, automated, and data-dependent world. But at least with regard to mortgagetech, these innovations are likely to prove more boon than bust, relieving much of the friction and many of the headaches and inefficiencies that plague all sides of the real estate transaction.

Writing at The Home Story, Timothy Ahern quoted the quarterly Mortgage Lender Sentiment Survey produced by Fannie’s Economic and Strategic Research (ESR) Group in which those surveyed put “a need for digitization and automation” at the top of their list of technological innovations they would like to see in their industry. “Survey results suggested that mortgage lenders have a strong interest in a fully digitalized mortgage process,” Ahern added.

With this in mind, we looked at trends in digitization, automation, and data integration in mortgagetech through the lens of a pair of FinDEVr alums: a Bay Area startup founded five years ago called Blend (FDSV16) on one hand, and a loan origination specialist that has been in the mortgage business since 1997, Ellie Mae (FDNY17), on the other.

Blend and the Art of Adding Intelligence to Mortgage Applications

For mortgage application process facilitators, digitization has been perhaps the single most significant technological innovation. And while reams of paper are often still involved in the average real estate transaction, digitization has created massive efficiencies in the process. Describing the current mortgage experience as one that is “paper-driven,” involving “endless back and forth,” lacking in “transparency”, and overly manual, Blend co-founder and CTO Eugene Marinelli discussed last fall at FinDEVr Silicon Valley how his company “makes the process a lot more automated, and a lot more efficient.”

Pictured: Blend’s Eugene Marinelli, CTO & Co-Founder, during his presentation “The Data-Driven Mortgage by Blend” at FinDEVr 2016 Silicon Valley.

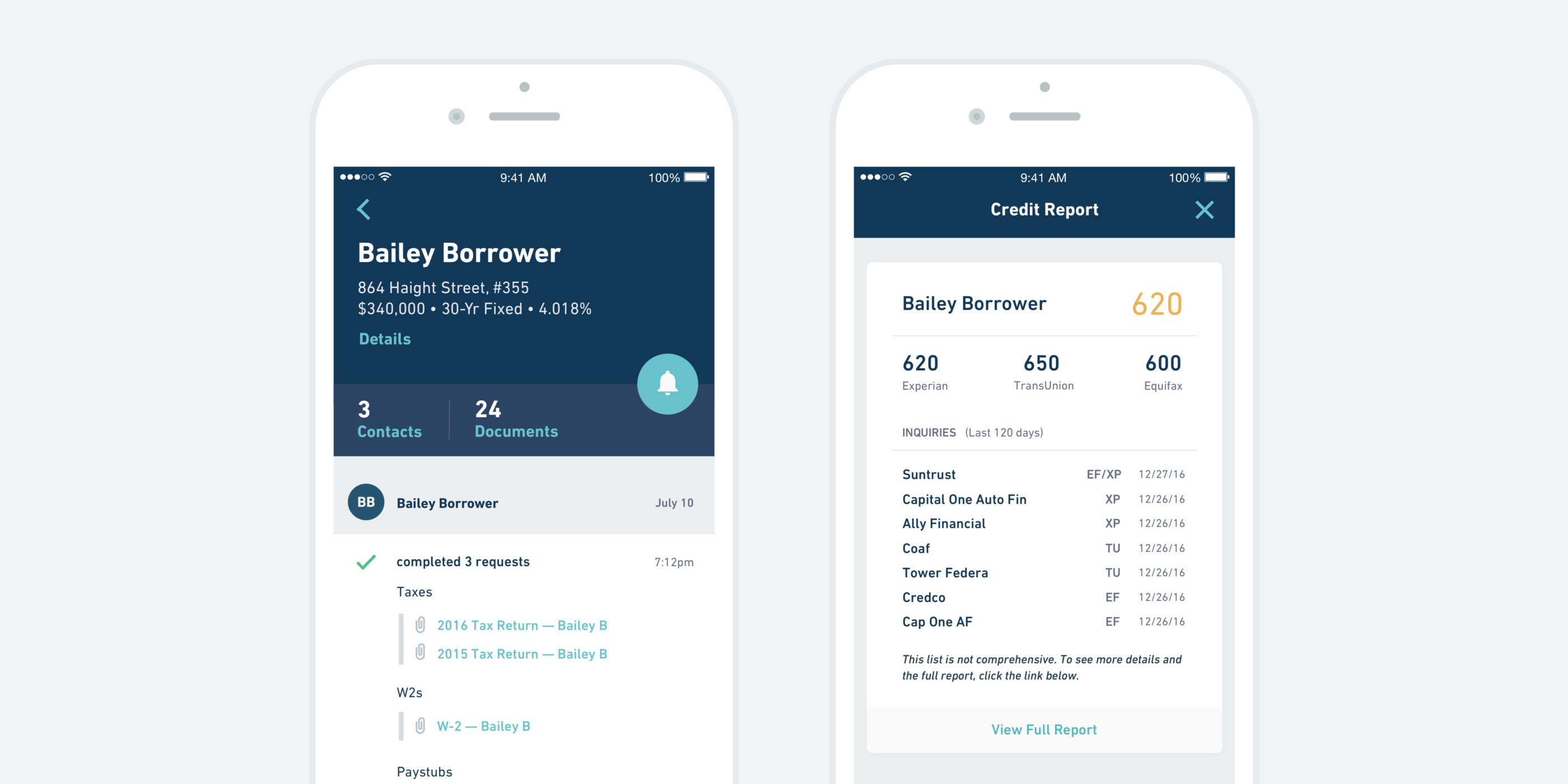

Blend, for example, engages borrowers with straightforward, “very digestable” workflows to provide basic information about assets, income, and other data that will enable the platform to complete the loan application for the borrower. Borrowers can directly connect their accounts to the platform instead of having to login to their separate bank accounts and export the information into the application. The solution also leverages optical character recognition (OCR) technology to read and extract data from uploaded documents such as W-2s and pay stubs.

Under the hood, managing workflows with less friction is similarly a matter of managing data. Blend, for example, houses application data, property data, and borrower data centrally in its data model. The goal is to “add intelligence to the application,” according to Software Engineering Lead Nivi Jayasekar. “How do we only ask the borrowers the questions they really need to be answering and how do we source that information up to them appropriately at her right moment?” she asked. The solution for Blend is “centralized rules,” which ensure that an independent contractor, for example, gets an application with different queries and has different disclosure needs compared to a salaried worker. This process also supports compliance needs by routing the borrower responses to create an audit trail as well as the centralized rules engine.

The tools of digitization, automation, and data integration are ideal for the challenge of mortgages, which Blend describes as “data-rich and insight-poor.” With automatic data extraction and the ability to leverage this data to develop business rules that create more personalized experiences and reduce costs, companies like Blend are helping make one of life’s most important decisions – buying a home – less complicated and more transparent.

“This is by nature very complex,” Jayasekar said. “Some of it doesn’t need to be and we do a good job of reducing that redundancy through the borrower experience and connectivity.”

Automation, Open APIs and Ellie Mae’s Innovation in Loan Servicing

Automating the mortgage process, as Ahern noted above, is a major goal for those firms that are directly involved in loan servicing. Ellie Mae, which made its FinDEVr debut this spring, produces the software that processes nearly a quarter of all mortgage applications in the U.S. The company’s innovations in mortgage process automation and its new focus on open APIs have positioned Ellie Mae as a firm to watch among mortgagetech’s loan servicers.

In February, Ellie Mae unveiled the latest version of its mortgage management solution, Encompass, which automates the loan origination process. The all-in-one package facilitates CRM, point of sale, processing, underwriting, closing, and funding, as well as post-closing and shipping. The platform helps ensure compliance and loan quality with features like automatic loan review and channel-specific workflows. Electronic document management includes automated auditing and intelligent document recognition. Reporting and analytic tools help lending professionals take advantage of the critical data flowing through the system to make real-time performance insights.

But during its FinDEVr New York presentation in March, Ellie Mae’s VP of Platform Engineering Jeff Collins emphasized the platform’s embrace of Open APIs. “We’ve grown really well. We’ve solved a lot of problems,” Collins said of Ellie Mae, adding, “but now it’s time to look for innovation and excitement and new opportunities from partners outside our own walls.” Collins showed how the platform’s developer portal features a “Try It” mode that allows developers to experiment with deploying sample loan objects into any of the various loan fields in a sandbox type environment without having to write the code first.

Pictured: Ellie Mae VP, Platform Engineering Jeff Collins during his presentation, “Ellie Mae Encompass Developer Connect,” at FinDEVr 2017 New York.

In addition to other features, like Pipeline that enables query APIs for loans that match specific criteria, the platform also supports webhooks, which are user-defined HTTP callbacks. Collins demonstrated the example of a how Encompass could send notification of a newly created loan product as a webhook that would enable Ellie Mae’s lender customers to integrate it into their data warehouse or into other services in their business. “Because at the end of the day,” Collins explained, “we are the system that makes the object that makes money for the lender. But that integrates into a whole bunch of other workflows including things like loan servicing, because when that loan is ready to go they may want to start asking for payments from the customer.”

To underscore Ellie Mae’s commitment to open APIs, Collins demonstrated an Alexa-based Encompass Loan Officer Connect voice app for lenders, querying the technology for the status of various loans, including upcoming rate lock expirations, as well as directing the app to “run product and pricing” on specific loans in order to find a better rate. “Anybody can plug into this platform and become part of the ecosystem,” Collins said, “The goal being that by working together … we can make borrowers’ lives easier, to lower the pain for them, to get more people into houses.”

This concludes our series on proptech and mortgagetech in fintech. In case you missed them, check out our review of proptech’s role in fintech and a closer look at real estate investment technology. For more proptech, come to FinovateSpring where we’ll showcase a variety of proptech, mortgagetech, and other fintech at the San Jose Convention Center.

Newly named to Forbes Fintech 50 list, mortgagetech innovator Blend was founded in 2012 and is based in San Francisco. The company, which demonstrated its Data-Driven Mortgage solution at FinovateSpring 2016, leverages intuitive design and data-powered intelligence to help lenders originate loans more efficiently and improve customer engagement. By making it easier for home buyers to provide lenders with the right, accurate information and streamlining the follow-up process for lenders, Blend’s platform enables application decisioning within days rather than weeks.

Newly named to Forbes Fintech 50 list, mortgagetech innovator Blend was founded in 2012 and is based in San Francisco. The company, which demonstrated its Data-Driven Mortgage solution at FinovateSpring 2016, leverages intuitive design and data-powered intelligence to help lenders originate loans more efficiently and improve customer engagement. By making it easier for home buyers to provide lenders with the right, accurate information and streamlining the follow-up process for lenders, Blend’s platform enables application decisioning within days rather than weeks.

Linda Schicktanz, Chief Advisor of CK Mack*:

Linda Schicktanz, Chief Advisor of CK Mack*: Nima Ghamsari, cofounder and CEO at Blend:

Nima Ghamsari, cofounder and CEO at Blend: Jilliene Helman, CEO at RealtyMogul

Jilliene Helman, CEO at RealtyMogul