This post is part of our live coverage of FinovateFall 2015.

Yseop showed how its business intelligence transforms data:

Yseop showed how its business intelligence transforms data:

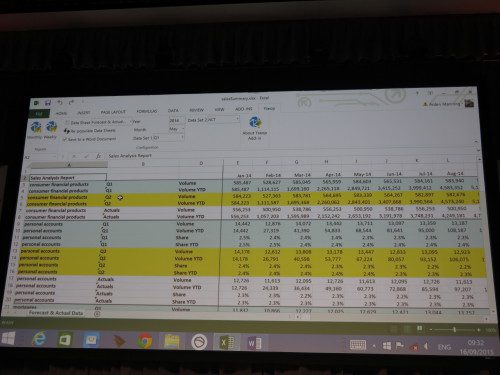

Yseop Smart BI is a Self-Service BI Tool that makes data speak. Businesses have automated data collection, storage, and visualization, but despite all of these investments, they still cannot draw insight from data in real time. Visualizations show you trends, but they don’t tell you what actions to take and why. This conventional process is too slow for the market, too expensive, and too laborious as data reserves grow. Yseop Smart BI turns data into written reports with just the click of a button. These Yseop-generated reports not only explain trends, identify outliers, and offer context, but also go further by offering advice and explaining why the advice was given. Yseop Smart BI turns big data into big revenue instantly.

Presenters: Arden Manning, SVP, global marketing; Mathieu Rauscher, director, pre-sales engineering

Product Launch: September 2015

Metrics: Yseop is a privately owned company with offices in New York, Dallas, London, Paris, and Lyon servicing clients globally. Yseop’s largest customer has more than 12,000 staffers using Yseop’s software on a daily basis.

Product distribution strategy: Direct to Business (B2B); licensed

HQ: Dallas, Texas

Founded: 2010

Website: yseop.com

Twitter: @yseopai

Hypori’s

Hypori’s Presenters

Presenters Joel Schopp, Senior Software Developer

Joel Schopp, Senior Software Developer

Presenters

Presenters Michael Grassotti, CTO

Michael Grassotti, CTO

HelloWallet

HelloWallet Presenters

Presenters Andrew Vincent, Senior Product Manager

Andrew Vincent, Senior Product Manager

Cameron Jacox, Co-founder

Cameron Jacox, Co-founder

Presenter

Presenter

Additiv

Additiv Presenter

Presenter

Presenter

Presenter

Why it’s great

Why it’s great Kate Miroslaw, Key Account Manager

Kate Miroslaw, Key Account Manager