![]() FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

On FinDEVr.com

- “CTO Talk with Eugene Marinelli, CTO of Blend“

- “Nubank Raises $80 Million in Series D Funding”

The latest from FinDEVr Silicon Valley presenters

- Aerospike announces 100% year-over-year bookings growth.

- NuData Security partners with Arvato Financial Solutions to combat fraud and enable a smoother customer experience.

- Worldpay appoints Ruth Prior COO.

Alumni updates

- InComm partners with MOL Global to launch PlayStation Network prepaid products to be distributed through 7-Eleven stores in Indonesia.

- Commerce Bank chooses Temenos to upgrade core deposit banking system.

- Token signs memorandum of understanding (MoU) with Fidor Bank for digital payments.

- PYMNTS.com interviews Nick Thomas, cofounder of Finicity, in the wake of his company’s latest funding round.

- Arxan Technologies wins six industry IoT security awards.

- Temenos‘ MarketPlace receives the Banking Technology Readers’ Choice Award for “Best emerging/innovative technology product/service” at the Annual Banking Technology Awards.

- InComm expands partnership with Target Australia to offer gift cards in stores and online.

- PayPal teams up with Citibank, FIS to expand cross-channel presence.

Stay current on daily news from the fintech developer community! Follow FinDEVr on Twitter.

Student loan repayment platform

Student loan repayment platform

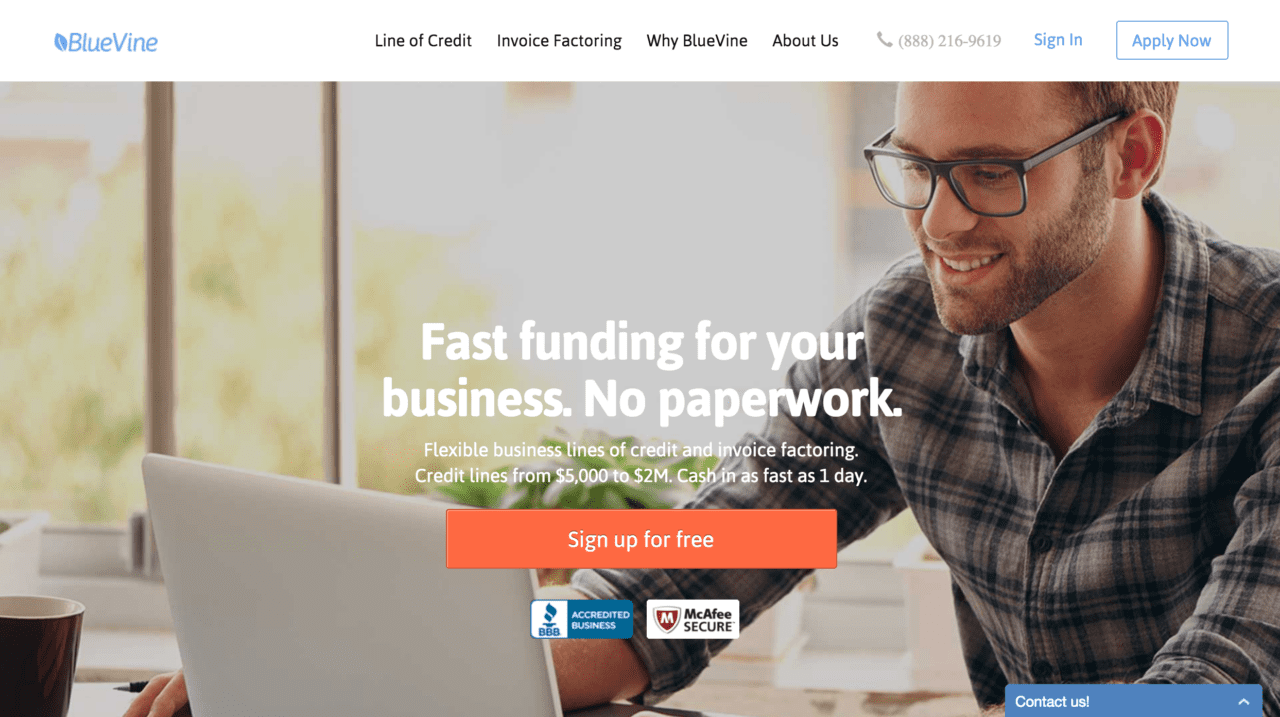

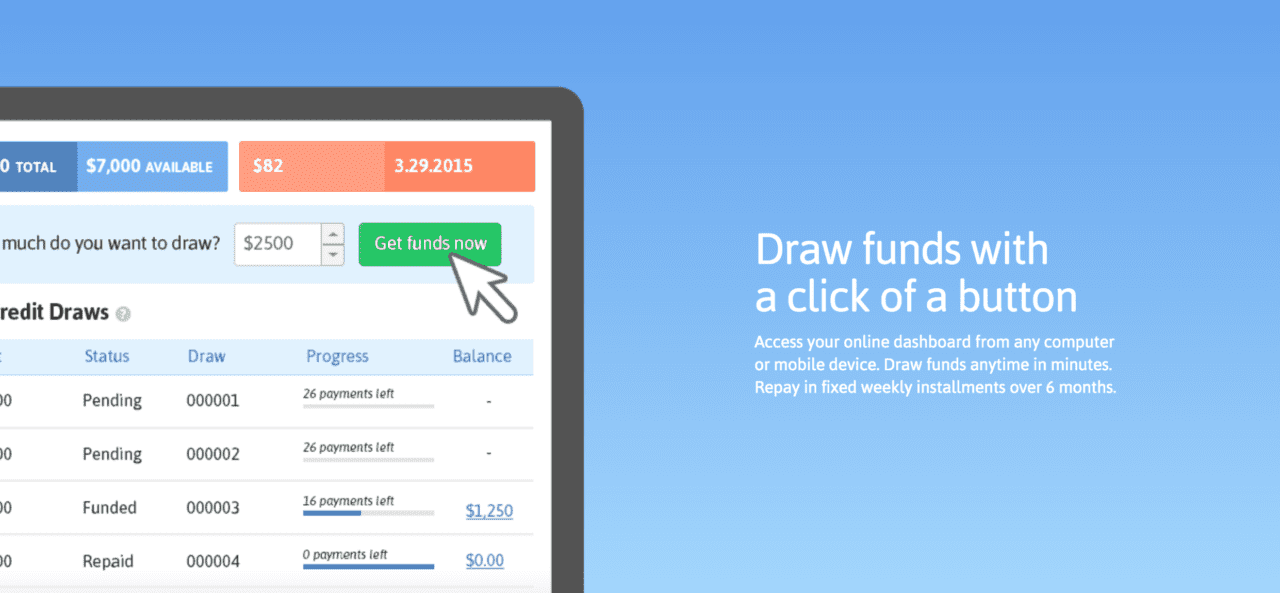

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.