In a round led by Point72 Ventures, contextual data intelligence specialist Flybits has raised $35 million in new funding. The fresh capital takes the company’s total equity financing to $50 million, and will help drive its growth in EMEA, Latin America, and the U.S.

The Series C round featured participation from Mastercard, Citi Ventures, and Reinventure, which was backed by Westpac Banking Corporation of Australia. Existing investors Portag3 Ventures, TD Bank Group and Information Venture Partners contributed to the round, as well.

The financing will also enable Flybits to commercialize its portfolio of AI and machine learning patents, as well as make enhancements to UX and design. Flybits also plans to launch a marketplace to make it easier for financial institutions, fintechs, and financial data providers to collaborate on new products and services.

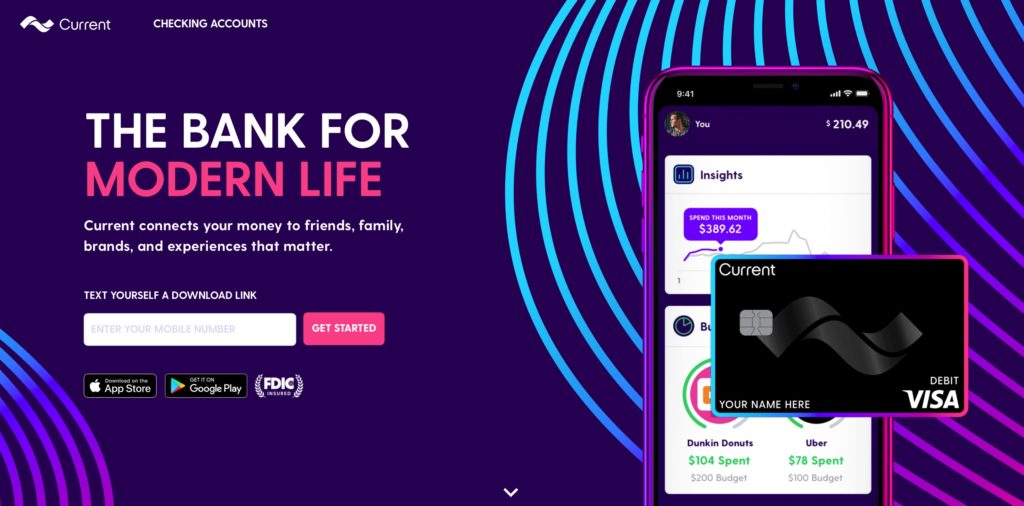

“Banks are looking for ways to maximize their use of data and better engage with customers, but are having a hard time executing and scaling this on their own or by leveraging passive PFM (personal financial management) services,” Flybits founder and CEO Dr. Hossein Rahnama explained. “Flybits enables banks to use real-time data and contextual intelligence to shift to those new models and go to market with them faster without over reliance on their IT department.”

Point72 Ventures Partner Tripp Shriner shared Rahnama’s view on this new challenge for banks and other FIs, whom Shriner said “are struggling to communicate with their customers about their products and services in the digital environment.” He praised Flybits for developing a “superior end-to-end solution for personalization of the digital customer experience.”

Today’s investment comes just a few months after Flybits announced that it was a key enabler of the Mastercard Contextual Engagement Solution. The technology is the first product built using the Mastercard Innovation Engine and helps drive contextually-relevant and personalized digital engagement. Last fall, Flybits announced it would work with TD Bank Group to provide enhanced, “micro-personalized” mobile experiences to the bank customers.

Founded in 2013 and headquartered in Toronto, Ontario, Canada, Flybits demonstrated its contextual recommendation engine at FinovateSpring in May. The technology leverages behavioral data and combinations of data sets to provide a deeper understanding of individual customer behavior and preferences based on collective experiences.