- LendingTree has partnered with insurtech Coverdash to integrate small business insurance into its platform.

- Adding insurance solutions complements LendingTree’s existing SMB loan products by helping insured businesses qualify for more financing due to their lower risk profile.

- The partnership also strengthens LendingTree’s position as a one-stop shop for SMB financial needs, while helping Coverdash expand its reach through a trusted, established brand.

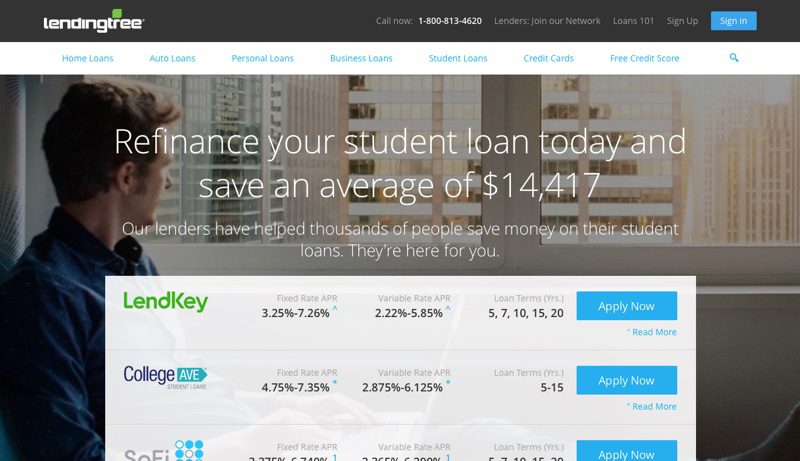

Online loan marketplace LendingTree has partnered with SMB-focused insurtech broker Coverdash to offer LendingTree’s business clients small business insurance. The ability to add Coverdash’s insurance options will be embedded into LendingTree’s platform.

This partnership strengthens LendingTree’s connection with small business owners by broadening its SMB offerings beyond loans to include insurance solutions. LendingTree anticipates that this product expansion will complement its existing SMB loan products, as insured businesses typically present a lower risk profile, enabling them to qualify for additional financing. For Coverdash, today’s partnership with a trusted, established brand like LendingTree will broaden its reach and cement its role as a small business insurance provider.

“We’ve always played an integral role in helping small businesses get off the ground with our loans and financing programs, so offering business insurance was the natural next step,” said LendingTree General Manager, Small Business & Student Loans, Jenn Ash. “This partnership with Coverdash deepens our commitment to supporting our customers’ growth, reinforcing our position as their trusted, long-term partner for all of their financial services needs.”

North Carolina-based LendingTree maintains a marketplace of over 600 financial partners that offer a wide range of personal loans, mortgages, auto loans, and credit cards, and more. By enabling consumers to compare competitive rates and terms, LendingTree empowers individuals to make informed financial decisions. Since it was founded in 1998, the company has served over 120 million customers.

“LendingTree’s legacy in financial services is unmatched, and we’re incredibly proud to have our embedded experience power their expansion into business insurance,” said Coverdash Co-founder and CEO Ralph Betesh. “Meeting financial requirements while starting a business is complex – our partnership lets business owners easily access trusted resources in one place at every stage of their company’s life cycle.”

Founded in 2022, Coverdash is a newcomer to the insurtech space, which is typically dominated by more established companies. Based in New York, Coverdash is licensed in all 50 U.S. states to provide insurance solutions tailored to small businesses, including freelancers, e-commerce operations, and startups. Its offerings span general liability, workers’ compensation, cyber insurance, and more. Earlier this year, the company secured $13.5 million in Series A funding, bringing its total funding to $16 million, according to Crunchbase.