Automated wealth management advisory specialist SigFig has raised $50 million in new funding in a round led by General Atlantic. The Series E round also featured the participation of existing investors UBS, Eaton Vance Corporation, DCM Ventures, New York Life, Nyca Partners, and Bain Capital Ventures.

“For over a decade, SigFig has provided access to premium, tech-enabled financial services for customers, banks, and wealth advisors,” CEO and co-founder of SigFig, Mike Sha said. “We are now aggressively expanding our services and reach to improve how banks utilize technology with their clients and increase the number of everyday people using technology to manage their finances.”

The company said it will use the additional capital to invest in new technology and to expand its service to larger FIs like current partners UBS and Wells Fargo. This week’s investment takes SigFig’s total capital to $117 million.

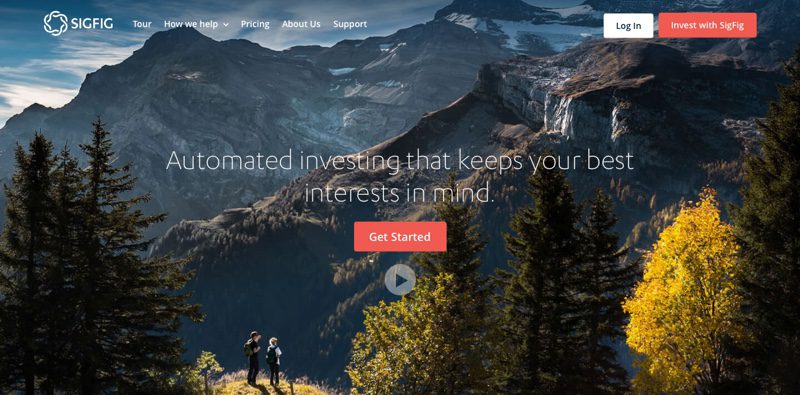

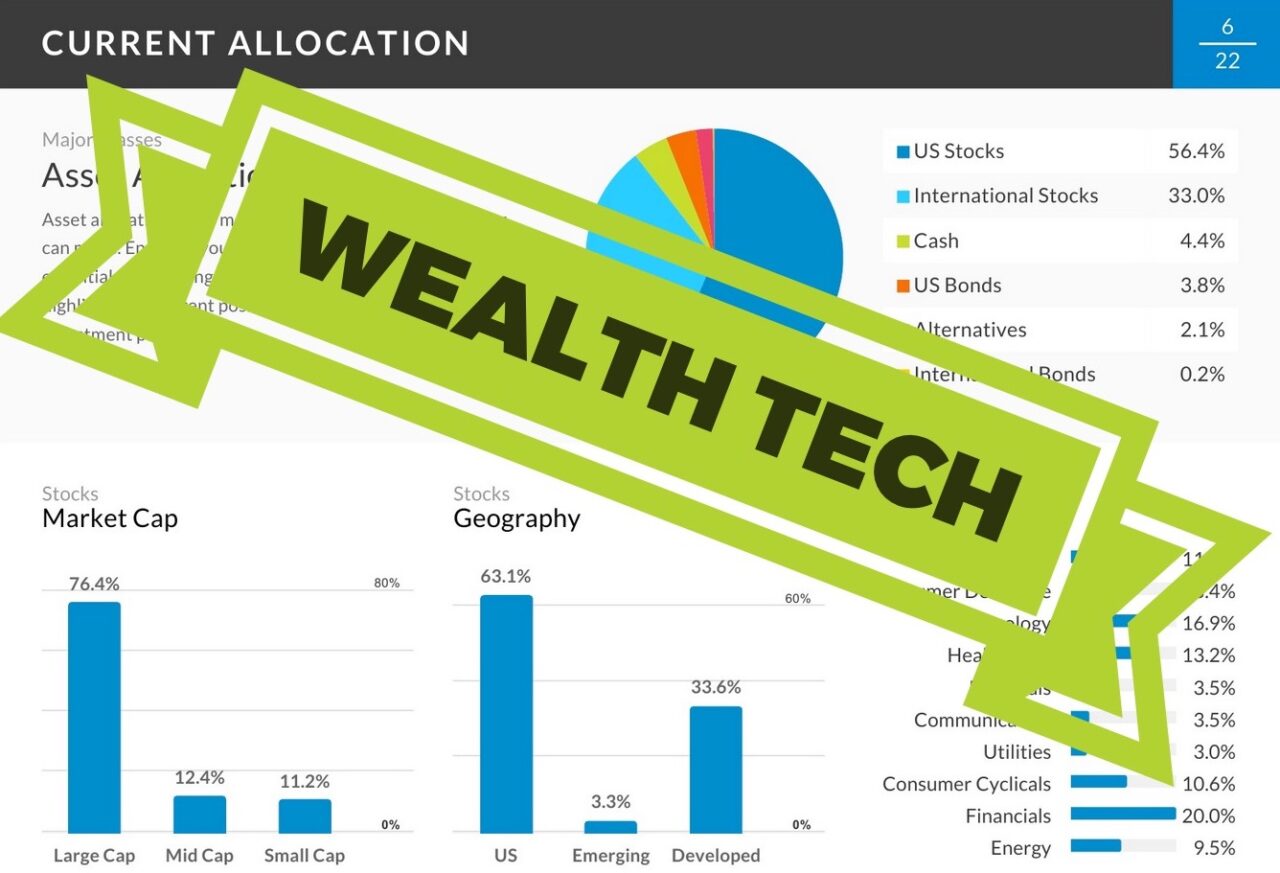

Founded in 2007 and headquartered in San Francisco, California, SigFig demonstrated its portfolio management service at FinovateFall 2011. The company enables financial service providers to offer their customers a way to build tax efficient, diversified investment portfolios that are personalized, mobile-accessible, and less expensive than using traditional financial advisors. SigFig’s platform provides tax reduction strategies, reinvests dividends, and monitors the portfolio, rebalancing when allocations get out of balance.

SigFig clients get their first $10,000 managed free and accounts can be opened with as little as $2,000. Accounts above $10,000 are charged a 0.25% annual fee. All clients get free portfolio monitoring and analysis, unlimited access to professional investment advisors, and minimized brokerage commissions. SigFig supports individual and joint accounts, as well as all IRA types.

General Atlantic Managing Partner Paul Stamas, who will join SigFig’s board of directors as part of the investment, praised the company’s B2B2C business model, which he said could help SigFig take advantage of the growing market for “digitally-native investment advisors.” Stamas added that the company “leverages its industry-leading technology alongside its partners’ existing physical infrastructure and human capital to create a best-in-class advice solution.”

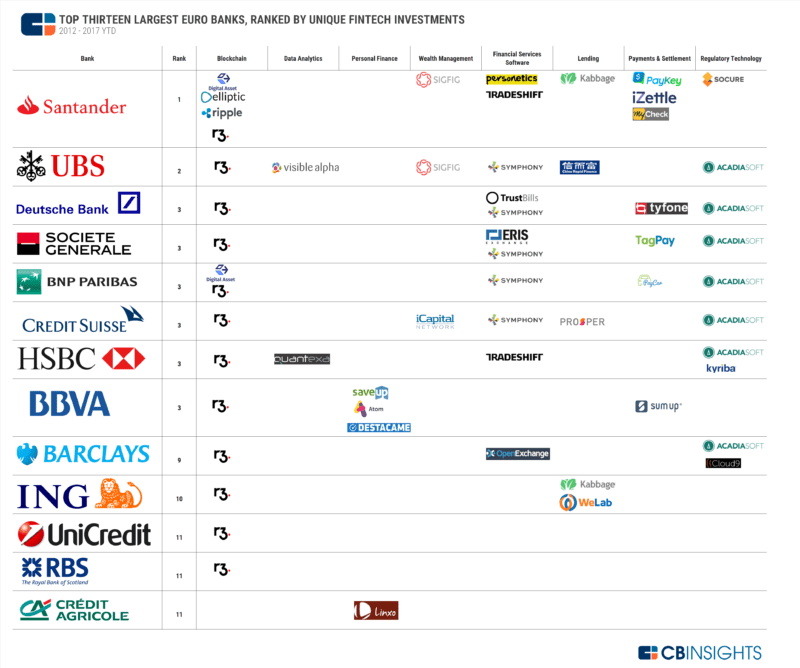

The funding for SigFig comes in the wake of a pair of major deployments of its platform. Earlier this year, UBS Wealth Management USA went live with SigFig-powered, robo advisory solution, UBS Advice Advantage. The UBS solution is geared toward clients with $10,000 to $250,000 in investable assets, and follows just a few months after Wells Fargo unveiled its own SigFig-developed robo advisor.

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

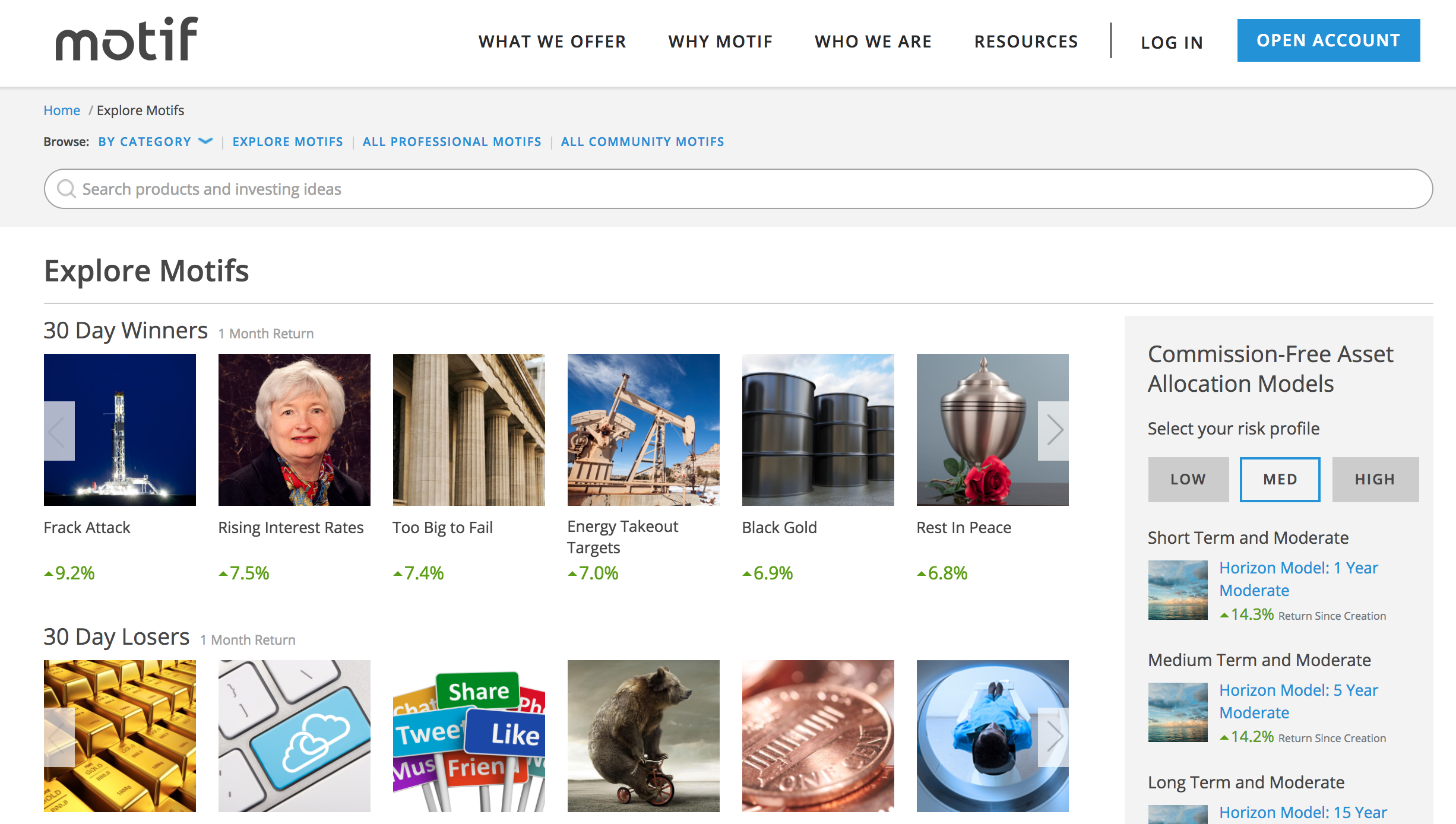

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

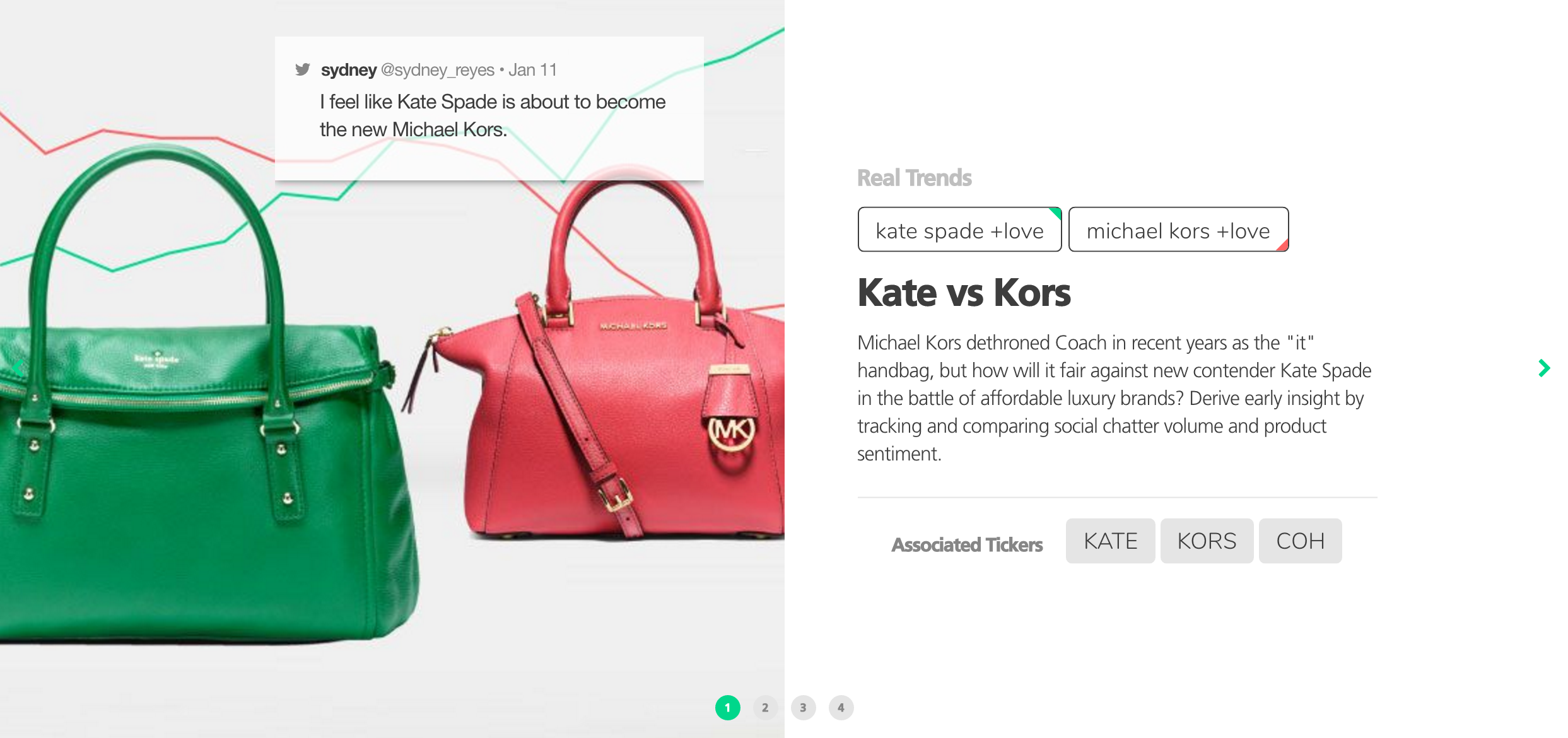

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme TickerTags helps users discover trends even before they become news

TickerTags helps users discover trends even before they become news