The Finovate Debuts series introduces new Finovate alums. SelfScore demonstrated its consumer analytics service designed to supplement FICO scores with its “scoring as a service” approach.

SelfScore

SelfScore.com is a consumer analytics service that uses a proprietary algorithm to combine online profiles, phone and sensor data, psychometric questions, and 360-degree feedback from one’s network to provide insights. The resulting SelfScore can be used in a variety of consumer and business contexts, such as credit scoring, to yield a broader picture of a potential applicant, consumer, or business partner.

The Stats

- Founded in January 2013

- Headquartered in Palo Alto, California

- Kalpesh Kapadia is CEO and Co-Founder

- 10 employees

- Partnerships include: AT&T, Fenway Summer, GradGuard, International Student Insurance

The Story

Consider the case of international students who come to the United States for graduate school. Many of these students were the smartest and hardest workers from their home countries and, further, have been vetted in many ways en route to being admitted to American universities and securing visas. International graduate students disproportionately pursue degrees in science, technology, and business fields that tend to yield high starting salaries.

But despite all these indicators of future success, international students who are new to the U.S. experience many difficulties and have a hard time finding fair deals on the services that are essential to life in modern America: things like credit cards, affordable health insurance, and smartphone contracts.

And while international graduate students are only a small portion of the underbanked in America, SelfScore’s research suggests that college students from the US face many of the same challenges. They have many predictors of financial success, but they face the same chicken and egg problem – you need credit to get credit.

“We believe that with new advances in social web and smartphones, it is now possible to attain a complete, timely, and accurate picture of consumer behavior that benefits both consumers and businesses,” said SelfScore CEO and Co-Founder Kalpesh Kapadia. In the long term, Kapadia thinks that tools such as SelfScore can be used to augment FICO and other traditional scoring methods. As more and more institutions begin to see what their current scoring strategies are missing, the demand for dynamic, comprehensive scores that incorporate social data could grow.

The Solution

To get a free SelfScore, users answer 24 questions at SelfScore.com. The questions range from the financial (“Does your credit card limit affect your spending habits?”) to general attitudes about life (“Do you believe that most people are more or less trustworthy?”) to the more personal (“What do you do when you are stressed?”).

After you’ve answered the questions, SelfScore reveals your score and presents a set of offers you qualify for. My SelfScore of 457 merited an offer for a credit card and another to save $500 on a smartphone.

Each offer is designed to be relevant to the needs of the current target demographic for foreign graduate students. SelfScore also provides a peer ranking as well, in which I learned that my financial score of 73 is above the average of 50, but my 250 Facebook friends is below the average of 340.

“In a sense, we are giving the user a comprehensive measure of their life and various dimensions of their life, and relative strengths,” Kapadia said. He notes that some attributes may be more valuable than others, and suggests this reflects the great flexibility of the platform.

The Future

SelfScore is working to establish mutually beneficial partnerships.The company is especially interested in meeting with lenders, insurers, and companies in the post-paid billing space that might be interested in “supplementing” their current financial metrics. “We want to serve tomorrow’s prime customers today,” Kapadia said.

Another objective is to expand their portfolio of offers. The company currently features an AT&T subsidized smartphone offer and a credit card program, and affordable health insurance will be added soon.

“There are 75 million underbanked customers in the U.S. right now,” Kapadia explained. “A third or 25 million of which would otherwise be categorized as ‘good apples’ who are generally being ignored because of a lack of credit history. At SelfScore, it is our mission to serve this deserving but underserved population.”

Watch a video of SelfScore’s live demo from FinovateFall 2014

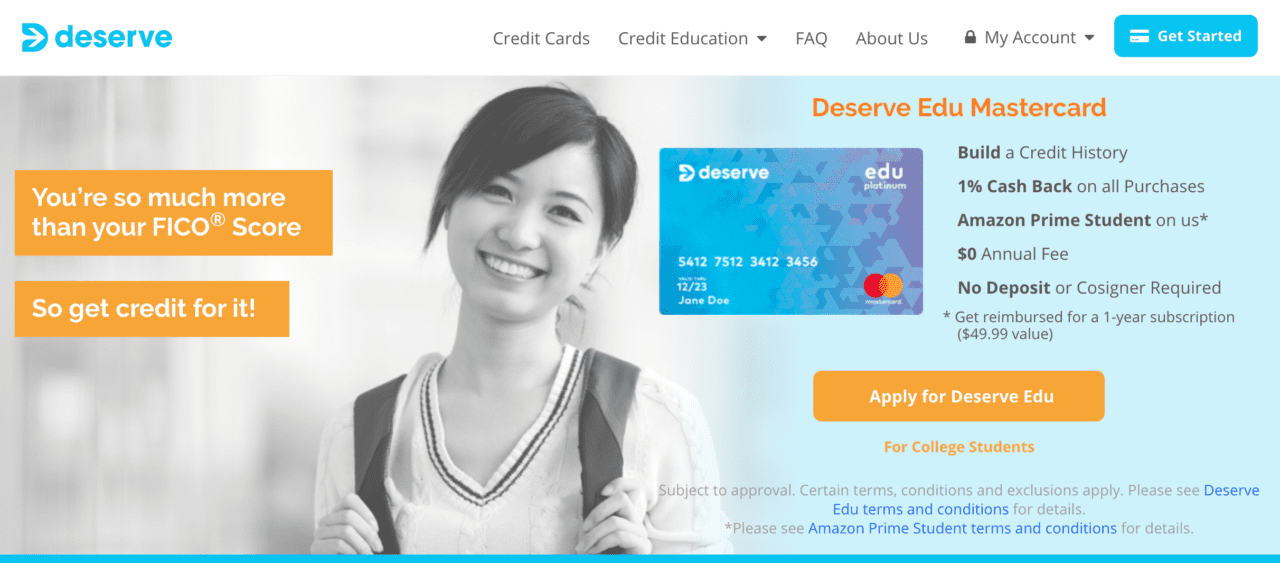

The company’s Deserve Edu card is specifically focused on students, including international students. The card offers benefits such as an 18-month subscription to Amazon Prime Student, 1% cash-back on all purchases, and no fees on foreign transactions. And, for international students, there is no SSN required. To promote and encourage consumers to build their credit score, the company offers incentives for consumers to upgrade to the Deserve Pro Mastercard, which features 3% cashback on travel and entertainment, 2% cash back on restaurants, and 1% unlimited cash-back on all other purchases.

The company’s Deserve Edu card is specifically focused on students, including international students. The card offers benefits such as an 18-month subscription to Amazon Prime Student, 1% cash-back on all purchases, and no fees on foreign transactions. And, for international students, there is no SSN required. To promote and encourage consumers to build their credit score, the company offers incentives for consumers to upgrade to the Deserve Pro Mastercard, which features 3% cashback on travel and entertainment, 2% cash back on restaurants, and 1% unlimited cash-back on all other purchases.