This week, we’re featuring BodeTree, Roostify, and SmartAsset whose solutions range from a small business management platform, to a home mortgage application solution, and a mobile financial education product.

Previously in our Behind the Scenes feature, we’ve looked at:

- Pellucid Analytics, Red Giant, and Zumigo

- ChiaraMail, Dealstruck, and LendingRobot

- Market Profit, Nearex, and Sureify

- Tactile Finance, Visible Equity, and Vorstack

- Rippleshot, TextPower, and WePay

- CUneXus, ID.me, and Venovate

What they do

BodeTree focuses on helping owners of revenue-generating small businesses, who are required to play many roles in their company, to better manage their operations.

BodeTree gives its users a complete view of where their business stands, what their competitors are doing, and offers tools to help them determine where they want their business to be in the future.

To help users reach their business goals, it works with funding sources to provide financing to serve as working capital. Because BodeTree has visibility into the small business’ operational data, it can work with the funding source to help underwrite and furnish the loan in as few as seven days.

Stats

- Minimizes loan acquisition time from 120 days to 7 days

- Raised $4.5 million

- 13 funding partners

- 50,000 small business users

The experience

BodeTree gives small business owners an all-in-one business management tool by serving up accounting, sales, and CRM tools on a single, intuitive interface. It helps them understand their budget and business data by showing the information graphically, and provides tools for planning.

Additionally, BodeTree gives users a an automated view of their business’ valuation and even shows how they are doing in comparison to their business’ peers.

Simply said, the platform shows them:

- Where their business has been

- Where it is currently

- Helps them determine where they want to go

Within 30 minutes, the small business can apply for funding, which they can receive in as few as seven days, as opposed to the traditional 120 days it takes to get a loan.

If the user is pursuing a loan, BodeTree gives its funding partners visibility to the individual business’ performance metrics to help them underwrite the loan.

In addition to helping its users understand the daily operations of their business and providing funding options, BodeTree also enables business owners to view:

- Valuation of their small business

- A quick view of their business’ health

- A peer comparison to other small businesses

- Financial statements with easy-to-understand graphs

The platform’s report-building tool gives them an easy way to customize and build professional looking reports, like the one below, to serve as a tangible item they can share about their business.

Overall, BodeTree serves as a home base for small businesses to see how their business is doing, determine where they want to go, and access quick funding to help them get there.

Roostify

What they do

By bringing transparency to the home buying process, Roostify seeks to demystify the home loan and closing experience by making it easier and faster for both the borrower and the lender. Its platform facilitates communication between lenders and borrowers, enabling them to share and track information necessary for the mortgage and closing process.

This visibility, combined with the platform’s ability to gather key documents, helps speed the entire home-buying process.

Stats

- Can process a full mortgage application in 10 minutes

- Can process a full loan package (mortgage application plus documentation) in 20 minutes

The experience

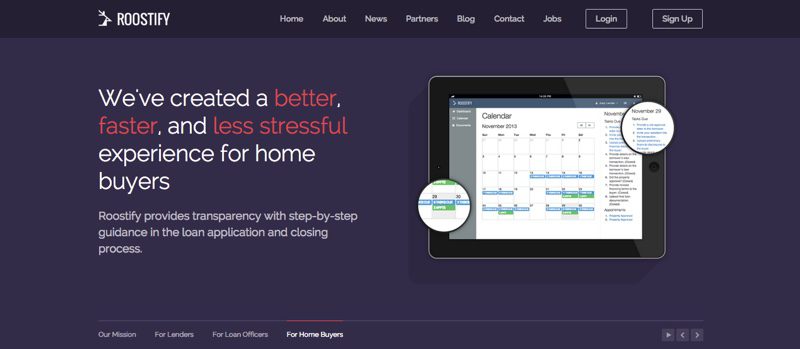

For the homebuyer, Roostify works a bit like TurboTax for a mortgage application. It customizes fields on the application based on the user’s answers to previous questions.

Once the loan application is submitted, the borrower’s dashboard walks the prospective homebuyer through the remaining process. Three notable items include:

1) The explanation on the right panel of the screen, which provides transparency into why certain items are needed and how they will be used in the process

2) The calendar view, which shows both the borrower and the lender due dates of action items

3) The documents page, which helps borrowers and lenders submit and manage the necessary documents for the mortgage process

All documents are held on the Roostify platform in a secure repository, which eliminates the need for the lender to download the documents. Additionally, its esignature capabilities eliminate the need for printing and faxing documents.

To assist with the underwriting process, borrowers can connect their external accounts directly within the Roositfy platform. The borrower can give lenders access to bank accounts, retirement accounts, and savings accounts without ever leaving Roostify.

Roostify also benefits the lender by giving them complete visibility into the process. The screen below shows a feed of completed tasks (on the right) and outstanding tasks (in the center) for both the borrower and lender.

Even after the home loan application process is complete, the system details the home closing workflow, notifying the two parties what items need to be completed by what time frame.

Lenders can white label Roostify to create a branded solution that gives their borrowers an end-to-end service that consumers have come to expect.

What they do

SmartAsset’s website serves as a resource for personalized and automated advice about personal finances. At FinovateSpring 2014, SmartAsset launched its native mobile app on iOS and Android.

Its platform combines user information with its automated financial modeling technology to answer questions across a range of subjects. Its goal is to help people make better financial decisions.

To serve as a guide, SmartAsset’s referral service matches users with targeted financial products to help them maximize their net wealth.

Stats

- Has grown at 40% per month for the last 15 months

- Expects roughly half a million people to visit Smartasset.com this month

- Has 130 different data partnerships, including Moody’s

The experience

SmartAsset’s greatest penetration is with users between the ages of 25 to 40 who are planning to make one or more big financial decision this year, such as get married, have a baby, or buy a house.

The screenshot below illustrates the user experience of determining whether to rent or buy a home. Note the targeted ad from Quicken Loans at the bottom, offering a 30-year FHA mortgage.

If the user wants to purchase a home, they can use SmartAsset’s in-app tools to determine how much house they can afford. The sliders make it easy to change the estimation of the down payment and mortgage. When adjusted, all other calculations are immediately updated to reflect the change.

It also helps in planning for retirement. The screenshot below illustrates the recommended amount of retirement savings the user needs to put away per month in order to retire at their desired age of 67.

Aside from real estate and retirement calculations, and SmartAsset also uses its algorithms to assist with:

- life insurance questions

- credit cards

- bank accounts

- student loans

Stay tuned later this week for our final Behind the Scenes look at fintech from FinovateSpring 2014.