Revolut is fintech’s latest unicorn. An investment round of $250 million led by DST Global has boosted the company’s valuation to $1.7 billion and made Revolut the first U.K. digital bank to gain the lofty status among fintech’s most richly-financed startups.

“Three years ago, Revolut was nothing more than a few coders with a crazy ambition to disrupt financial services forever,” Revolut’s Chief Blogging Officer Rob Braileanu wrote. “In the beginning, our vision was laughed at and we were told that the big banks were too powerful.”

“Fast forward to today.”

Revolut said the Series C investment will be used to drive international expansion and to add talent. The company plans to be live in the U.S., China, Singapore, Hong Kong, and Australia by the end of 2018, with a goal of 100 million customers around the world within five years. Revolut also expects major increases in its workforce, more than doubling headcount from 350 to 800 employees.

“Revolut is developing and delivering technology that reduces the complexity and cost of financial services for consumers and small businesses,” DST Global’s Tom Stafford said. “We are delighted to support Nik and the Revolut team as they continue to innovate, roll out new services, and expand geographically.”

Nikolay Stronosky, Revolut CEO, added, “Our focus, since we launched, has been to do everything completely opposite to traditional banks. We build world-class tech that puts people back in control of their finances, we speak to our customers like humans and we’re never afraid to challenge old thinking in order to innovate.”

In a blog post discussing the news, Revolut shared an advance look at some of the new features the company has in store. Revolut Crypto will gain two new currencies: Ripple (XRP) and Bitcoin Cash (BCH) alongside current listings Bitcoin (BTC), Litecoin (LTC), and Ether (ETH). Revolut Platinum will provider cardholders with a bespoke contactless stainless steel metal card coated in a “custom shade of metallic black paint for a truly unique look,” and Revolut Wealth, an expansion of Revolut’s services that will allow the platform’s users to invest their funds in stocks, index, ETFs, and other financial instruments.

And while Revolut’s fundraising news is hard to beat, the company has been making fintech headlines all year. Earlier this month, Revolut launched a new solution called Vaults that helps users save more by rounding up their transactions to the nearest whole number and setting aside the difference. Also in April, the company unveiled an update to its business accounts to expand their cross-currency transfer functionality. Revolut introduced both its new disposable virtual cards for online payments and its Euro Direct Debits in March, and began the year with a new insurtech offering, providing travel insurance for its users.

Headquartered in London, Revolut demonstrated its Personal Money Cloud at FinovateEurope 2015. Storonsky discussed Revolut’s plans for expansion in APAC with TechWireAsia last month and more recently talked about the company’s planned entry to the Romanian market with Business Review.

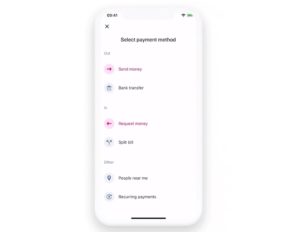

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.