On Finovate.com

- Tinkoff Brings Stories to Mobile Banking

- Meed Leverages ID Verification Solutions from Jumio to Serve the Underbanked

Around the web

- The 61-member Japan Bank Consortium launches Ripple pilot with South Korean banks Woori Bank and Shinhan Bank.

- Thomson Reuters adds compliance training courses to help ensure MiFID II compliance.

- PayPal makes undisclosed investment in Berlin-based deposit marketplace Raisin.

- ACI Worldwide partners with HyperPay to bring real-time fraud prevention solutions to ecommerce merchants in the MENA region.

- SME Finance Forum honors Strands with Best Partnership award at its First Membership Engagement Awards event.

- nCino EVP of Product Development Trisha Price joins Jim Marous’ fintech roundtable to discuss the future of digital banking disruption.

- Stash Invest presents its Auto-Stash feature to help investors make automatic, recurring investment contributions.

- SuiteBox introduces its VideoSign Proof of Signature technology.

- defi SOLUTIONS earns recognition as one of the top 100 fastest-growing privately-held businesses in Dallas, Texas area.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

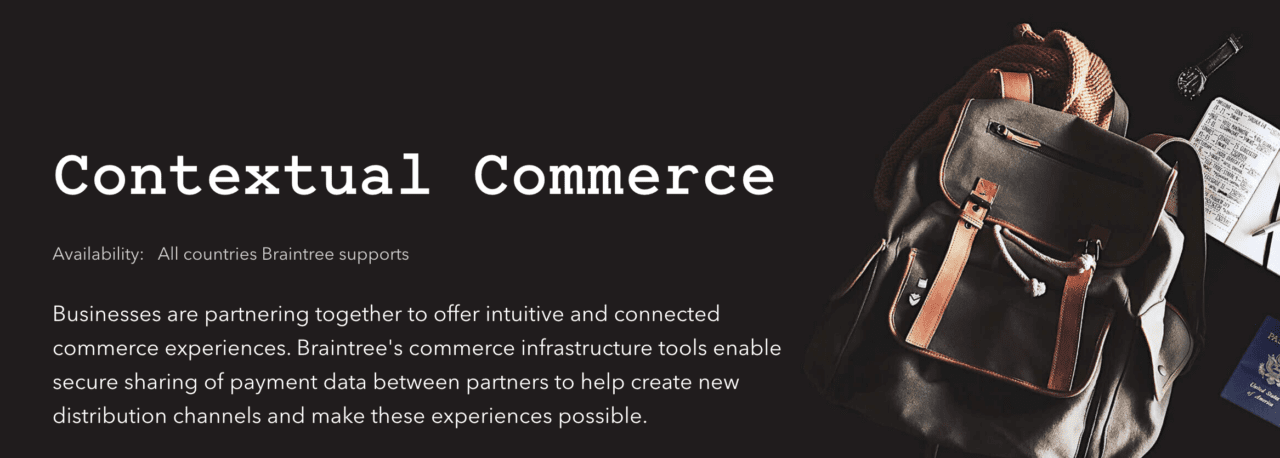

Braintree’s Contextual Commerce tools enable businesses to create a seamless purchasing experience for consumers

Braintree’s Contextual Commerce tools enable businesses to create a seamless purchasing experience for consumers