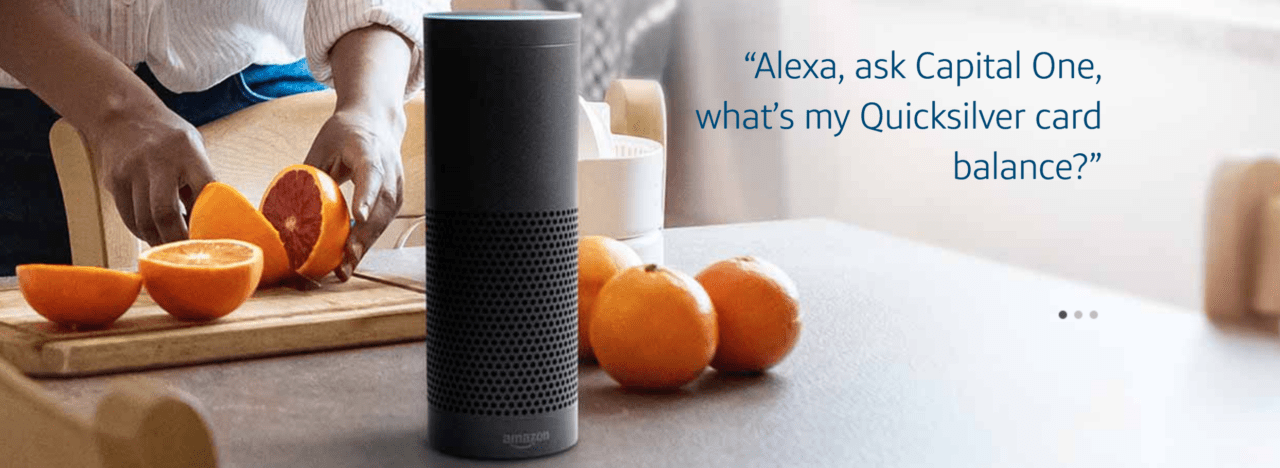

Capital One was the first bank to go live with an Alexa integration. Other banks are following suit.

Capital One was the first bank to go live with an Alexa integration. Other banks are following suit.

Artificial intelligence (AI) is not new to fintech, but in the past two years we’ve seen a jump in the sophistication and scale of its use across the industry. The advances in chatbots and IVR solutions have done a lot to spur the growth of machine learning and AI.

In a Fintech Trending post earlier this month, we highlighted Capital One’s live integration and Lloyd Bank’s proof of concept with Amazon’s Alexa. We noted that Cap One was the only bank with a Skill (an Alexa-specific app) that’s currently live. Over the past couple of weeks, however, a handful of banks and financial services companies have launched their own A.I. initiatives in voice forms such as Alexa and GM’s OnStar Go, as well as text, such as Facebook Messenger.

UBS pilots Amazon’s Alexa

Last week news broke that UBS is soon to follow with an Alexa Skill of its own. The Swiss investment bank will launch a pilot program next month that allows a select group of UBS clients and non-clients to interact with Alexa.

However, compared to Capital One’s integration and Lloyd’s proof of concept, the UBS pilot is a bit stunted. In the UBS pilot, when users begin their inquiries with, “Ask UBS,” Alexa currently answers only general financial and economic questions, such as, “What is inflation?” and “How is the EU economy doing?” The pilot aims to test users’ comfort levels with spoken bot interactions.

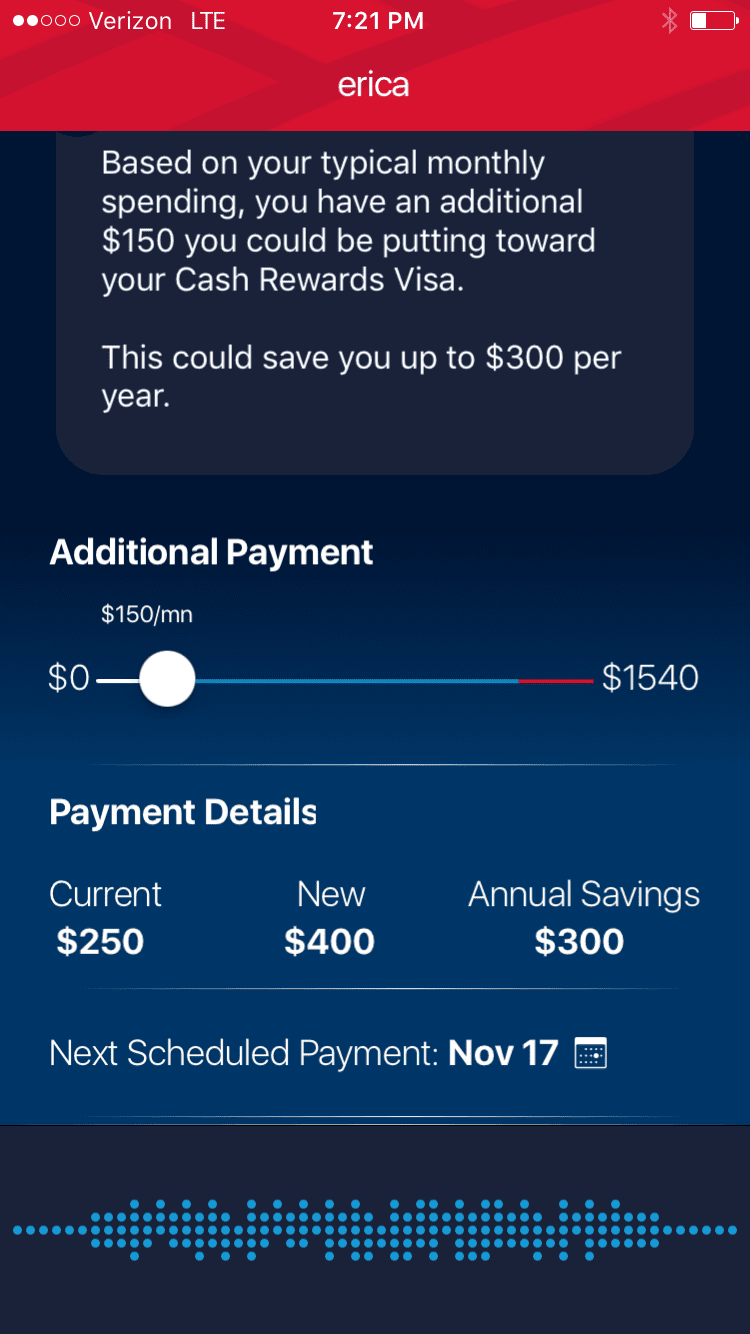

Bank of America’s Erica

Also this week, Bank of America demo’d its smart chatbot, Erica, said to be coming in “late 2017.” While many banks offer this capability, Bank of America’s bot shows more emphasis on the intelligence piece of artificial intelligence. As Daniel Latimore, senior vice president of Celent’s banking practice, said in an interview with CNBC, “Though many banks have bots with some level of artificial intelligence, the customer experience has not always been great. Consumers are now accustomed to the types of seamless mobile experiences provided by apps like Uber and Airbnb and want better banking experiences.”

Also this week, Bank of America demo’d its smart chatbot, Erica, said to be coming in “late 2017.” While many banks offer this capability, Bank of America’s bot shows more emphasis on the intelligence piece of artificial intelligence. As Daniel Latimore, senior vice president of Celent’s banking practice, said in an interview with CNBC, “Though many banks have bots with some level of artificial intelligence, the customer experience has not always been great. Consumers are now accustomed to the types of seamless mobile experiences provided by apps like Uber and Airbnb and want better banking experiences.”

Erica will use AI, predictive analytics, and cognitive messaging to enable customers to make payments and check their account balances. She will even help them save money and offer advice to pay down debt by directing them toward educational videos and articles. Bank of America had a lot of consumer-usage data to draw upon while it was building Erica. In Q3 of this year, the bank saw 246+ billion payments and 950 million mobile banking sessions across 21 million active users.

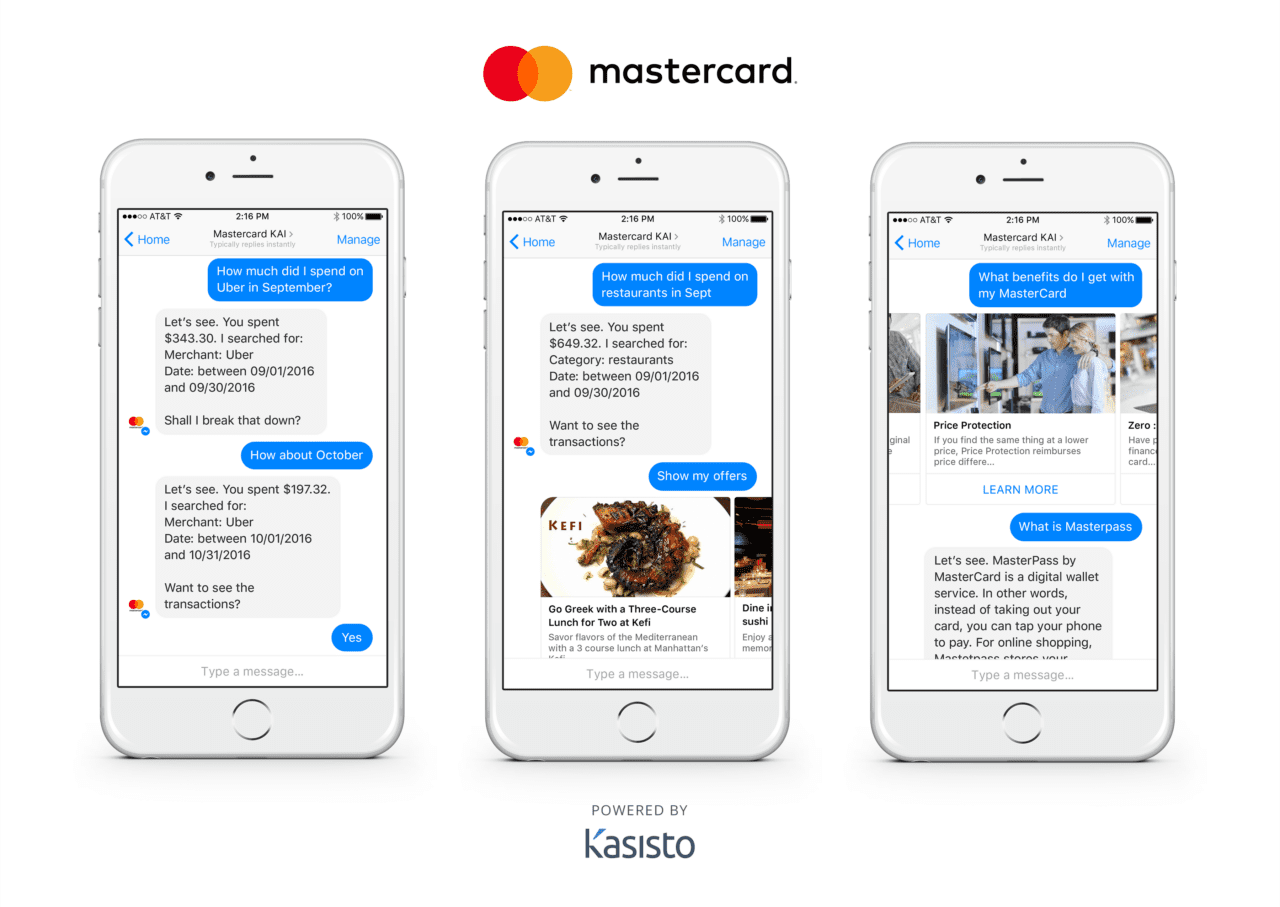

Mastercard’s Facebook Messenger chatbot

Mastercard (F14) launched its own chatbot this week to deliver a personalized customer experience in messenger platforms. The company partnered with Kasisto to create Mastercard KAI, a bot for banks, which will launch next year on Facebook Messenger. The bot was created in-house in Mastercard Labs. It aims to offer a way for merchants to allow consumers to shop and transact in messaging platforms and check out with Masterpass.

The payments giant also announced partnerships with GM and IBM (FD16) this week to launch Masterpass payment functionality on OnStar Go, a digital platform that will be embedded in 2 million GM vehicles by the end of 2017. The OnStar Go platform will feature a marketplace of select merchants from which drivers can order and pay directly from their vehicle. Over time, OnStar Go learns the consumer’s purchasing behaviors and is able to push personalized and contextual offers to the driver. ExxonMobil, Glympse, iHeartRadio, MasterCard, and Parkopedia are the first brands to join the platform.

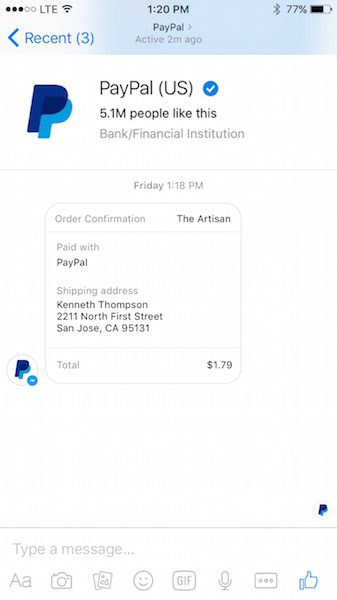

PayPal expands Facebook Messenger capabilities

PayPal expands Facebook Messenger capabilities

PayPal (FD16) first announced it was integrating with Facebook Messenger last month, when the social media giant unveiled payments capability within Messenger. This week, the company announced further integration. In the U.S., PayPal will not only serve as one of the payment options within Messenger, but also:

- Roll out as a payment option across more of Facebook’s commerce experiences (including Messenger)

- Make it easy for PayPal customers to link their PayPal accounts to Facebook and Messenger at PayPal checkout

- Offer the ability to get notifications in Messenger, facilitating receipt management for PayPal transactions in one place

The biggest takeaway is that as Messenger rolls out a native payment experience, merchants can accept PayPal payments directly within their bots. As an early pilot of this capability, PayPal’s Braintree partnered with Facebook and Uber in December 2015 to allow users to hail and pay for an Uber directly within the app.

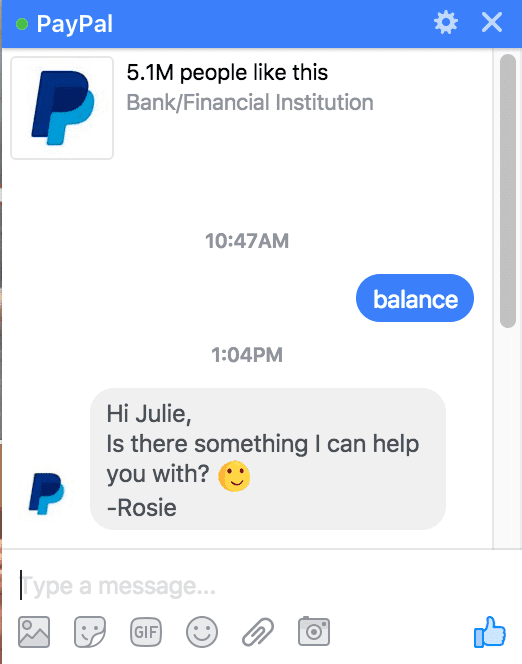

Contrary to some reports, PayPal’s integration isn’t a chatbot. I learned this the embarrassing way when I typed “balance” in a Facebook message to PayPal and a half-hour later received a message from an actual person:

That awkward moment you learn you’re chatting with a real person, not a chatbot

That awkward moment you learn you’re chatting with a real person, not a chatbot

SimplyTapp launches mobile payments app with chatbot

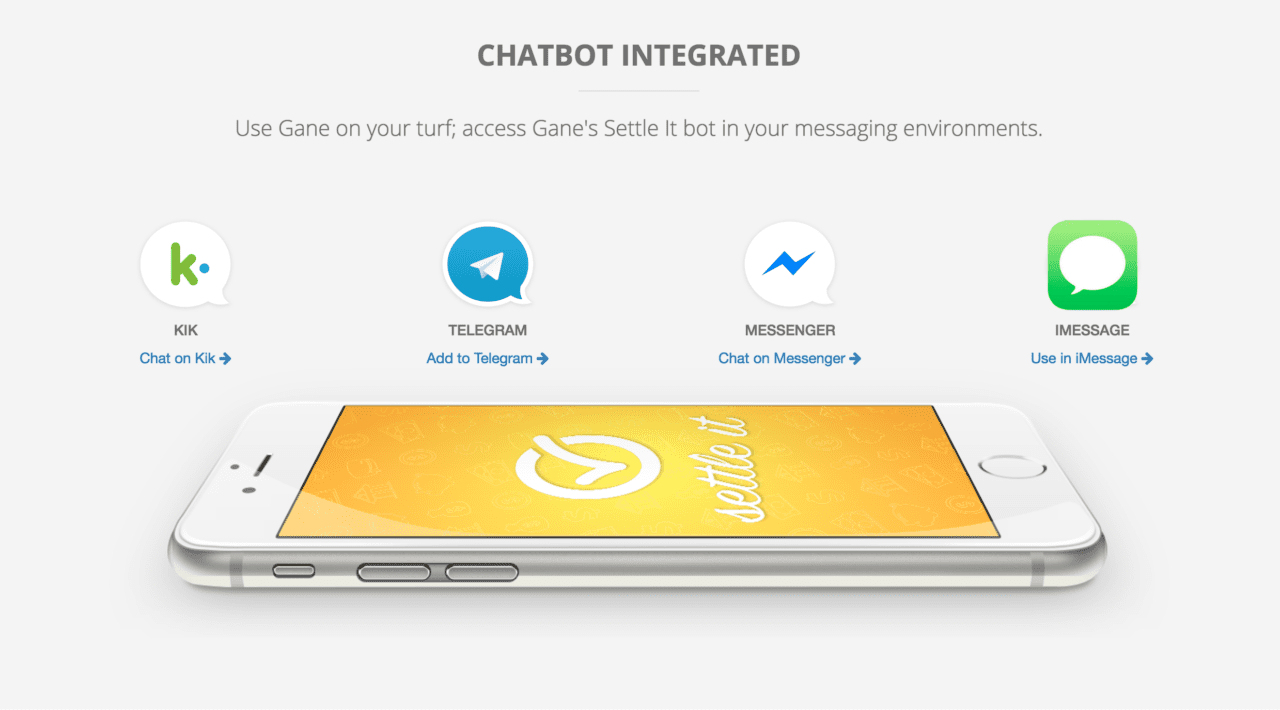

SimplyTapp’s (FD14) newly launched mobile payments app, Gane, works on both Android and iOS and offers tap-and-pay functionality at the POS. With the companion mobile app, users can collect and apply discount offers. Aside from mobile payment and offer-redemption capability, Gane works with chatbots embedded in Facebook Messenger, iMessage, Kik, and Telegram messaging platforms. The company plans to integrate with additional platforms in the future.

Why all the AI?

Banks and financial services companies aren’t just trying to farm out the jobs of their tellers and customer service agents to bots that don’t require a salary, paid time off, and health insurance, though that does play a role. Aside from the obvious role chatbots and AI play in answering simple customer inquiries without using up the time of customer service agents, banks’ motives are twofold.

First, it helps them meet customers where they are by operating in the same channels in which their consumers spend hours a day, such as Facebook. Financial services companies can offer a better user experience by not requiring users to open a separate app or launch a new window to view their balance. In cases such as PayPal’s and Mastercard’s integrations with Facebook Messenger, it also serves as a way to become the customer’s preferred payment method in that channel, i.e., becoming top-of-wallet in Messenger.

Second, it establishes the financial services company on the millennial map. Many of the incumbent players are struggling to attract their next generation of clients for payments and wealth management. Offering services that reach into channels such as Alexa and social messenger platforms help banks engage with potential millennial wealth management customers. It’s the same reason established wealth management players are launching robo-adviser—to serve as training wheels.

Note: A Finovate alum’s most recent appearance is shown by a capital F followed by the year; for example, FIS first appeared at Finovate in 2009, so you will see (F09) after their name, with a link to that first demo.