Margin calls—the “friendly” shoulder-tap from your brokerage that means you’re in a losing investment position and your broker needs more capital to cover it—are the bane of every trader and investor who uses leverage. But for those on the DriveWealth platform, the technology’s new real-time margin feature all but makes traditional margin calls a thing of the past.

Instead of calculating margin requirements only once a day like most traditional brokerages, DriveWealth’s real-time margin will recalculate and update margin requirements over the course of the trading day. This intra-day limiting of purchasing power makes it less likely that an investor will be forced to liquidate holdings or come up with additional capital to satisfy a margin call. Robert Cortright, founder and CEO of DriveWealth said, “With the release of real-time margin, we are now giving investors who want to trade on leverage a way to increase control and decrease risk relative to traditional margin accounts.”

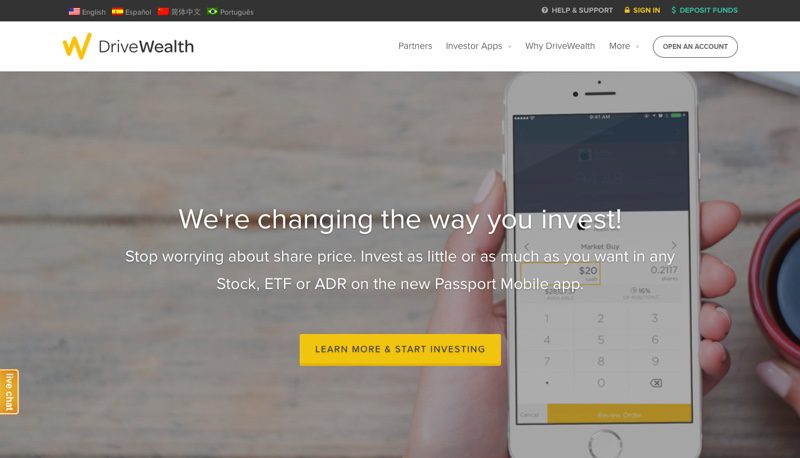

From left: CIO Harry Temkin with Michael Fitzgerald, head of corporate strategy, demonstrated DriveWealth’s real-time fractional trading with Passport 2.0 at FinovateEurope 2016.

Using margin is admittedly a strategy for experienced investors: Even seasoned professionals often find themselves suddenly forced to sell other positions or raise cash to defend a losing leveraged investment. In addition to giving investors greater protection against intra-day market risk, real-time margin also promotes a more efficient market, limiting buying power intra-day when volatility rises rather than waiting for an urgent, late-in-the-trading-day phone call from the brokerage. Real-time margin is available via API for DriveWealth’s partners as well as a feature on the app.

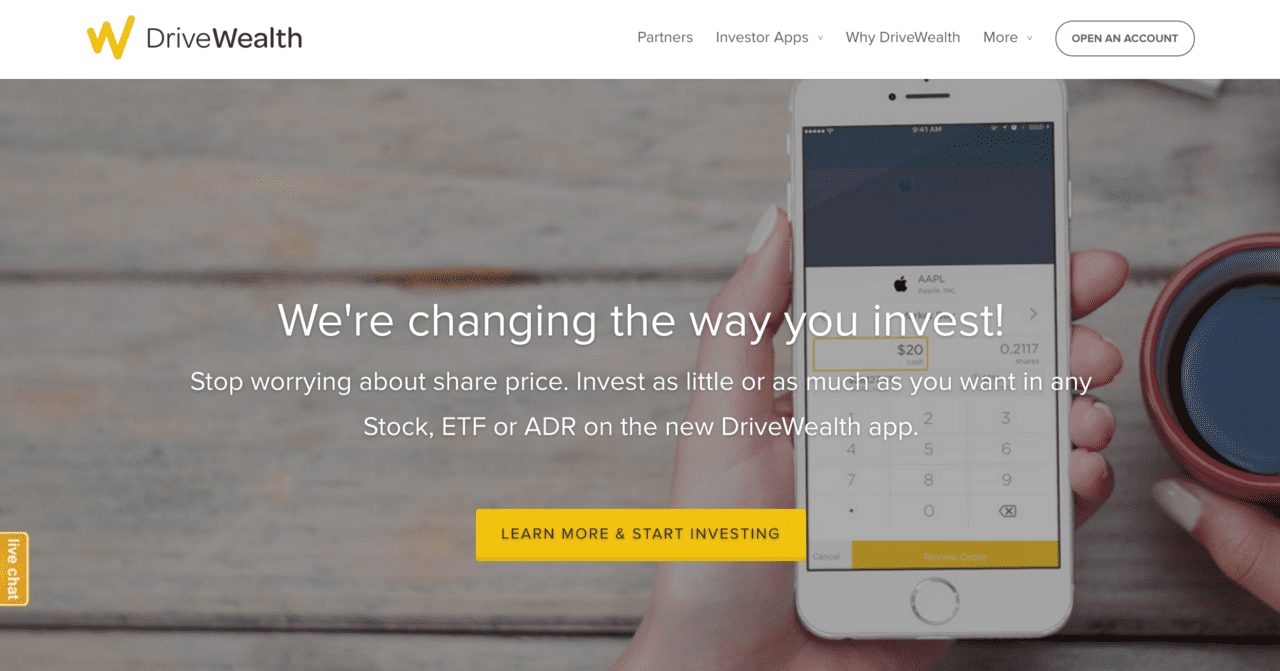

Founded in May 2012 and headquartered in Chatham, New Jersey, DriveWealth pioneered the use of APIs and cloud-based technologies as a way to provide international investors and traders access to the U.S. equities market. The company’s mobile-first, full-stack platform includes real-time fractional share trading, which it demonstrated earlier this year at FinovateEurope, winning Best of Show.

In what has been a busy year for DriveWealth, the company expanded its APIs to support investment advisers in August, teamed up with CreditEase to bring robo-advisery to China in June, and partnered with Australian fintech company Stoxs to provide Australian investors with access to U.S. stocks in February. DriveWealth has raised more than $8 million in funding, and includes Fenway Summer Ventures, Route 66 Ventures, and SenaHill Partners among its investors.

Find out more about how companies like DriveWealth are building APIs that help connect investors and markets at our upcoming developers conference, 18/19 October, FinDEVr Silicon Valley 2016.