At the upcoming FinDEVr, 60 leading fintech companies will present their developer-friendly APIs, SDKs, and other solutions to an audience of financial builders and their technical colleagues. It’s the one place to gather tips and techniques from a wide cross-section of fintech players in just two days, all at an affordable price. For a personal touch, all presenters will be available at tables outside the auditorium to answer your detailed questions.

The event will take place 6/7 October at the UCSF Mission Bay Conference Center in San Francisco (check out our event brochure). Tickets are available at our Very Early Bird rate so pick up yours today.

Here’s a preview of what you’ll experience at the event. About half the presentations are listed below; the remaining 27 will be discussed in a few weeks.

Advisor Software will provide an overview of its wealth management cloud platform—an end-to-end suite of APIs, apps and widgets that power digital investment advice and financial planning applications.

Why it’s a must-see

It has nearly 120 APIs that will power the next generation of digital wealth management applications. Developers can tap into its APIs to build a new robo-advisor, develop investment proposal tools for financial advisers, create financial planning and portfolio construction applications, and more.

Apex Clearing will explain its cutting-edge financial services platform and how online brokerage firms and fintech groups can grow their businesses by leveraging our technology.

Why it’s a must-see

Apex will demonstrate the speed and simplicity through which customers can open accounts, fund them, and place trades. Specifically, the presentation will focus on Apex’s API behavior, and how it facilitates customer acquisition.

Avalara will detail the Weird and Wacky World of Sales Tax. Did you know that sales-tax in the U.S. is handled unlike any other place on the planet? There are over 12,000 taxing jurisdictions covering millions of tax-rule combinations. This makes it very hard for businesses to ensure they’re compliant to avoid the wrath of the law.

Why it’s a must-see

This presentation will highlight the complexity, showcase some of the bizarre taxing cases, and demonstrate how this difficult problem can be solved through a robust technology stack. Developers will learn how they can resolve their customers’ pain-points with a simple-to-use REST API.

Backbase will talk about its Digital Banking Platform and its Open Banking Marketplace. Fueled by a strong, open API strategy, Backbase’s platform gives FI’s the ultimate freedom and flexibility to work with any core and third-party vendor, to create a best-of-breed digital banking offering for their clients.

Why it’s a must-see

- For banks: FIs can get an open platform that is truly able to deliver a superior customer experience, while at the same time offering full control to manage and maintain; they’re not locked into any vendor.

- For fintech companies: Fintechs have the option to work with many banks, via the Open Banking Marketplace, to get their services available in a robust platform.

Bankguard provides a revolutionary 2-Factor Authentication (2FA) solution which addresses weaknesses of current technologies that makes it susceptible to Man-In-The-Middle (MITM) attacks. This patented solution also effectively reduces the deployment and maintenance overheads typically associated with 2FA technology solutions offered in the market.

Why it’s a must-see

This solution was widely reviewed and given accolades by industry watchers, media, and academics in Japan. Japanese banks and corporations have shown interest in adopting this technology to either replace or complement their current security solutions.

The Beast Apps has an SDK that when combined with AWS can be used to build, test, and deploy complex pre-trade, trade or post-trade financial applications in the cloud, and within minutes. The application can be accessed in real time by anybody anywhere in the world using any desktop, browser, phone or tablet. Collaboration on the app is fully audit-trailed, for all users on all devices.

Why it’s a must-see

They are delivering battle-tested, robust, reliable, and fault-tolerant technology in real time. They make streaming, interactive, and sharable apps to run on desktops, browsers and mobile devices.

BehavioSec transforms behavior into a transparent layer of security by monitoring in real-time the way users interact with their devices. Behaviosec’s technology recognizes if a conflicting user is operating a device by monitoring the environment, rhythms, and interaction patterns that are unique to each user.

Why it’s a must-see

BehavioSec’s technology is proven to work well in several different verticals and use-cases. For developers, our SDK’s open up a whole world of possibilities to not only minimize fraud but also remove annoying friction such as False Rejects.

Blockcypher will explain how bitcoin and block chains enable programmable money. From simple scripts to complex contracts, code can automate the transfer of value, making it traceable, distributed and cryptographically secure. Dedicated block chains and smart contracts can automate trading with fast settlement as well as encode complex derivatives.

Why it’s a must-see

This session will put you on the right track and create a spark for you to build the next big finance thing if you want to:

- Learn how block chains can fundamentally impact finance and Wall Street

- Learn to rebuild a bank in two days without keeping funds in custody

- Get a sneak-peek at what block chains and peer-to-peer distributed consensus can do

Clarify will demonstrate its API which turns media into actionable data. It auto-detects language, makes audio and video searchable, allows you to extract keywords, determine the topics, and a variety of other things. It allows you to have systems to make decisions based on the information you gather.

Why it’s a must-see

Too often we collect data-like presentations, support calls, etc. and rarely do anything with the results. Clarify.io gives you the ability to extract actionable information from your audio and video to make better decisions, confirm and validate compliance, and understand your media.

Currency Cloud will give builders at FinDEVr an inside look at its technology that fully automates international payments. It will showcase its tools that make it easy for you to integrate with its API and allow you to access its platform.

Why it’s a must-see

Currency Cloud knows that developers want to see how things work. So it will show you not only the tools it has built, but also the code behind them and how they fit together. Currency Cloud will show you how it built its interactive developer center from RAML specs, shortcuts for integrating with the API, and will give you a tour of its open-source SDK’s.

Deluxe‘s eChecks have modernized the oldest non-cash payment instrument, the check. The company will explain how you can easily leverage eChecks in your application to send and/or receive hundreds to thousands of dollars in payments at a time without paying transaction fees.

Why it’s a must-see

Financial institutions process 20 billion paper checks worth $30 trillion every year in the U.S. alone. Deluxe will show you how its eChecks combine paper checks’ most powerful payment and security features, into cutting-edge technology that’s delivered electronically. Deluxe will show you the why and how to use eChecks in your app.

Emailage will demonstrate the best techniques for any company to integrate the Emailage Rest API, giving instant access to information on more than 4 billion email addresses worldwide. Its panel will demonstrate how its API integration allows for the most seamless consumption of Emailage fraud-risk assessment.

Why it’s a must-see

The Emailage Rest API allows for frictionless fraud scoring, enabling businesses to establish customized settings based on risk levels. The Rest API allows for automated scoring and involves only front-line representatives who review transactions deemed as “suspicious,” instead of manually scoring and reviewing all transaction score types.

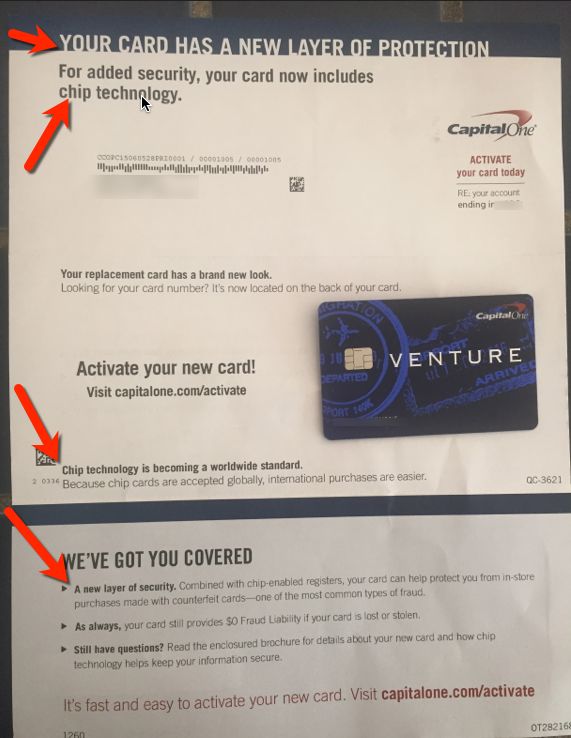

EVO Snap* will help you discover how to quickly add secure EMV global transaction-processing to your mPOS applications with the EVO Snap* Commerce Driver.

Why it’s a must-see

October represents a major EMV liability shift for POS transactions. This means retailers need to be prepared to accept EMV transactions. With the EVO Snap* Commerce Driver—a precertified, plug-and-pay SDK—developers can instantly enable EMV-compliant transactions and get solutions to market quickly and securely.

Fidor Bank introduced community banking five years ago. It embraced Bitcoin and Ripple two years ago. Now it is the first bank to offer open RESTful APIs with OAuth2.0, which gives direct access to its services and customer base. Stefan Weiß, Head of APIs, will talk about the vision, the current implementation status, challenges and solutions.

Why it’s a must-see

Most FinTechs still need banks because of regulation and processing. Fidor Bank provides both regulative support and strong technology. The presentation will show the ease and beauty of Fidor’s APIs. They will share important learnings from one year of developing and providing APIs in a high-risk environment.

Finicity, a fintech aggregator with 14 years of experience and 16,000+ developed data sources, will demonstrate real-time data-delivery via the new TxPUSH API. The instant availability of financial transaction and account data unlocks fintech innovation and improves security.

Why it’s a must-see

The TxPUSH standard pushes transactions as they happen, enabling real-time data delivery and improved security via OAuth. With TxPUSH, account holders will no longer have to “pull” or download transactions from multiple financial institutions. Transactions will be “pushed” in real time to Financial Event Hubs or directly to subscriber apps.

Forte will showcase its new platform that empowers developers with the resources to build the next generation of payment-enabled solutions. Spanning the widest spectrum of capabilities in the marketplace, Forte’s payment solutions provide the flexibility to power even the most unique business needs across any channel.

Why it’s a must-see

You’ll learn about interesting and unique capabilities that developers can leverage to build solutions for traditional and emerging business models such as marketplaces and the new shared economy.

Hyperwallet is the leading outbound payment provider to the independent worker and freelancer economy. It will showcase its REST API that allows technology companies to access turnkey global payout options while maintaining control of the user experience, making it easy for your users around the world to be paid.

Why it’s a must-see

You’ll leave this session understanding the importance of a payout platform vs. a payout method. You will see how building into Hyperwallet’s outbound payments technology will quickly, easily and securely unlock a new world of payout flexibility for independent workers on your platform.

Interxion, Sayua and Vontobel will present a European fintech success story. They will start with the co-located foundation infrastructure necessary to meet European demands, and progress to Sayula’s open-development-framework platform and added open-source components that allow Vontobel to meet the needs for a shared structured-derivatives valuation platform.

Why it’s a must-see

You will learn about the constraints applying to data and infrastructure for European financial services. You will also discover why major Banks value solutions which allow non-IT users to seamlessly snap together data sources, analytical libraries, and models to create new models by adding their business logic with an intuitive Excel interface.

Kofax, a Lexmark company, will present Kofax Insight, a process-intelligent and -aware platform that empowers data consumers to understand process fidelity, regression, deviation and other action-metrics in context to their business challenges. It will focus on mortgage borrower onboarding—SLAs; process exceptions; and artifact life-cycle.

Why it’s a must-see

Kofax will showcase how Kofax Insight can ingest data from a mobile device, ingest the content from the document, leverage a signature device, invoke a third-party data call and fetch data from a native system of record with no code, no third-party tools—all of which you’ll see live.

Kontomatik’s presentation will be about the current issues in banking and how Banking API can help this sector further progress. It will also explain possible integration system (OnPremise, SaaS, client-side). A legal aspect (especially PSD II) will be touched upon during this presentation.

Why it’s a must-see

In general, Kontomatik’s presentation will explain the whole set of benefits that could be derived from the integration of banking API. Various integration options and their pros and cons will also be explained.

Linqto enables customer video, audio and text communication in digital banking applications with a hosted video-communication service. Learn how to leverage the Linqto Application Programming Components to build a video communication piece into your web and mobile solutions.

Why it’s a must-see

According to Accenture’s 2014 Consumer Digital Banking Survey, 56% of millennials are interested in video-chatting with a bank representative by accessing a link on their bank’s website, mobile or tablet application. Build one-to-one and many-to-many video communication into your banking apps with the Linqto APCs.

Lleida.net’s Connectaclick is a customized solution for electronic contracting. Customers can get the deal done immediately, without delays, reaching the balance between legal certainty and conversion by using registered SMS or registered email. Lleida.net, as a telecom operator, acts as a trusted third party.

Why it’s a must-see

Being a tailor-made solution, Connectaclick combines registered SMS/email; email addresses/phone numbers verification; and ID validation. As a customer-data-validation service, the solution becomes more competitive and prevents fraud. Connectaclick lets you close deals anywhere, anytime.

Mitek will give you a behind-the-scenes look at its patented image-capture and computer vision technology powering its Mobile Deposit and Photo Fill products used by nearly 50 million users. It will also touch on its unique MiSnap auto-capture SDK.

Why it’s a must-see

Come check out Mitek’s advanced image-capture and computer-vision technologies. Once available only to financial services, Mitek technologies are now open to developers across all industries via the Mitek developer program. Learn how to make removing friction in your customer experience as easy as snapping a picture.

Personal Capital will show the inner workings of a truly data-driven retirement planner based on user’s aggregated data, enhanced by machine learning. It will also demonstrate how each personalized evergreen plan is refreshed as the market or user’s spending or saving behaviors change. All of this is visualized through a UI that makes sophisticated algorithms and complex data intuitive and actionable.

Why it’s a must-see

It employs machine-learning techniques to better forecast growth of a user’s portfolio and estimate her retirement spending. It uses AWS infrastructure to supercharge its data-driven retirement planner. Personal Capital’s connected ecosystem allows a user and her dedicated advisers to collaborate on the same data and retirement plan.

Praesidio will challenge why logs are unused when they are a great source of information about your application. Learn how, why, and when to collect your software’s logs for security, monitoring, and testing. Be an IT Hero: Perform analytics, find anomalies, stop hackers, measure performance, and more.

Why it’s a must-see

Modern software systems are distributed and complex. Logs are a downright awesome way to manage, monitor, and predict future behavior. Collecting logs is essential for modern cybersecurity and digital forensics; in this presentation, you will learn everything you need to know.

ScriptRock provides complete visibility into the configuration state of any IT environment. Any stakeholder from admin to DevOps to CIO can use this information to quickly ensure consistency and compliance, identify misconfigurations, and painlessly scan an entire infrastructure for potential vulnerabilities.

Why it’s a must-see

In an era where IT security and stability are critical in finserv, having visibility and validating what you’ve got are key to success. Previously, this task was laborious, tedious, difficult, and sometimes impossible. ScriptRock has built a platform which handles all of it with ease, allowing you to deploy faster and safer than ever before.

SnoopWall will explain the year of mCrime (mobile crime) and how all banking apps are easily eavesdropped by ‘trusted apps’ that are actually malware allowed on iTunes, Google Play and Microsoft App store. It will present a live demo of this ‘breaking into my own bank account’ on mobile using a malicious Flashlight App. Then, you’ll learn about AppSHIELD SDK.

Why it’s a must-see

AppSHIELD SDK is the only solution to this problem that works. It will show how IBM TRUSTEER SDK and INAUTH SDK and ARXAN are easily circumvented by cyber criminals to steal consumer PII. If you see AppSHIELD SDK in action (in 95+ financial institutions), you’ll want it in your banking app to protect your consumers and your brand.

Spreedly APIs minimize the complexity, cost, and risk of PCI compliance and payment integration. With “The Uberization of Mobile,” customers want discovery, purchase, and delivery all handled within an app. It’s no longer necessary to redirect end-users to affiliate sites to complete a purchase with Spreedly’s universal vault product.

Why it’s a must-see

Tokenizing with one gateway removes the burden of PCI compliance but locks that card into a single gateway. Building your own PCI-compliant vault is a huge undertaking. A card tokenized with Spreedly can be used multiple times against different gateways or API endpoints.

Thinking Capital will ask the question, “To Build or Not to Build?” This Q&A session with Thinking Capital’s CTO Pat Forgione and CSO Anthony Lipschitz will delve into how a leading fintech organization uses SAS software to create a proprietary platform that facilitates underwriting, decision making, compliance and more.

Why it’s a must-see

This presentation will highlight how fintech developers can use technology to create unique competencies in finance, and help them make the decision of building, outsourcing or customizing tech solutions.

Token will explain how developers can integrate fast, secure and low-cost payments with their applications.

Why it’s a must-see

If you are an app developer and are looking to add payments to your app, and you put great emphasis on fast access to funds, unbreakable security and exceptional customer experience, then you must attend the Token presentation.

Wallaby’s Wallet-as-a-Service and CardBase APIs enable any developer to bring rich, contextual information about credit cards and their attributes to life in their apps. You can see images, understand rewards, fees, features, and more. Integrate the APIs to provide smart-payment recommends in any checkout or financial process.

Why it’s a must-see

Wallaby has the nation’s leading credit-card-information database with more than 2,700 credit cards profiled and classified in an intelligent, structured manner across more than 100 attributes. Simply put, there is no other way to get this data and bring your user’s wallet to life in your app.

Xignite will be joined on stage by two of its clients—a leading robo-advisor and an online brokerage that provides low-cost trades. Attend this presentation to learn how these leading fintech companies easily integrated Xignite market data APIs into their web, mobile and wearable devices, and get a sneak-peek at their platform infrastructure.

Why it’s a must-see

Come see why Xignite was named one of the ten coolest brands in banking, and why leading fintech companies, like Personal Capital, Motif Investing and Robinhood, use Xignite real-time and reference market data to power their websites and mobile apps.

Yodlee Rapid Development Kit (RDK) is the easiest and fastest way to build financial innovation with Yodlee and third-party developed micro-components and services. Connect and engage your customers on any digital channel with Yodlee’s most powerful financial data and Yodlee RDK.

Why it’s a must-see

Yodlee RDK helps fintech developers with a faster development lifecycle by taking advantage of reusable micro components that can be easily integrated into their app on any digital channel. Using standard web technologies—like HTML, JavaScript, CSS and web components—it can seamlessly integrate within any technology stack.

Now that your interest is piqued, pick up your ticket to FinDEVr 2015, and we’ll see you in San Francisco on 6/7 October. Questions? Download our brochure (PDF); check out the FinDEVr homepage; or email [email protected].

FinDEVr is sponsored by Yodlee and is partners with BankersHub, The BayPay Forum, bobsguide, California Bankers Association, Celent, CoinTelegraph, Mercator Advisory Group, and SF Fintech.

We published our first fintech unicorn list in April 2014 with a mere 11 companies. Just 15 months later, that number is up four-fold to 46. And it’s 11 more than our update two months ago (13 new unicorns less 2 falling out). Time will tell whether these valuation bets are temporary insanity from private investors or the beginning of a long cycle of re-imagining financial services. We’ll get back to you on that.

We published our first fintech unicorn list in April 2014 with a mere 11 companies. Just 15 months later, that number is up four-fold to 46. And it’s 11 more than our update two months ago (13 new unicorns less 2 falling out). Time will tell whether these valuation bets are temporary insanity from private investors or the beginning of a long cycle of re-imagining financial services. We’ll get back to you on that.

Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to