We recently caught up with Jim Collas, founder, president, and CEO of OnBudget. The San Diego-based company made its Finovate debut at our Spring show, demoing its Budgeting Solution.

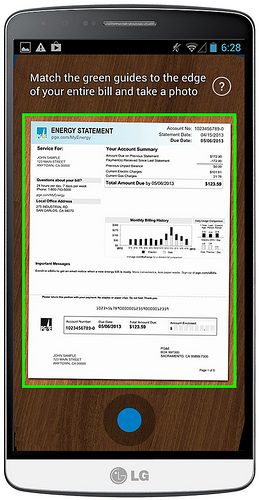

OnBudget takes the tried-and-true Envelope Budgeting System used by our parents and grandparents and updates it for the 21st century. The technology consists of a prepaid card for daily purchases and a mobile app that automatically sets up a budget.

Finovate: You demoed OnBudget at FinovateSpring in April. What was the question you heard most frequently from attendees?

Collas: The most frequently asked question from people who saw us at Finovate was, “How is this different from other PFM tools, like Mint.”

It’s a good question, and rather than focus on a person’s total financial life, OnBudget is completely focused on daily living expenses. Since the OnBudget platform is connected directly to the prepaid card processing systems, we get real-time transaction information, which allows us to present real-time notices and trends, including a “Left to Spend” amount for each budget category that’s always up-to-the-second accurate.

Beyond that, it’s effortless to set up. Unlike most PFM tools, a user doesn’t have to input any account information or spending data. Perhaps most importantly, it uses the prepaid card as digital envelopes, which is a huge consumer trend for segmenting, tracking and controlling spending.

Finovate: Any news to report since April’s FinovateSpring?

Collas: At OnBudget, we have shifted our focus exclusively to private labeling the solution for bank partners and distributing through the banking channel. We’re primarily focused on banks with assets of $10 billion and above, whose debit profits have been severely affected by the Durbin Amendment. We have significant traction with our Business Development activities and we are currently in discussions with 15 of the top 50 U.S. banks.

Finovate: What is the best way for people new to OnBudget to understand how your technology helps people better manage their finances?

Collas: People seem to get the concept and how it can hep them when we describe the service as the digital version of the Envelope Budgeting System: where a prepaid card replaces physical envelopes and the mobile app tracks various spending categories (i.e. envelopes) in real-time.

Finovate: OnBudget is different from other prepaid cards because it’s free. What’s the catch – how does OnBudget make money.

Collas: Like all prepaid cards, OnBudget Card makes money on interchange fees. What sets us apart is that our mobile app motivates and compels users to use the card for all their daily living expenses, which generates significant revenues.

The average U.S. household spends $1,800 per month on the categories we track for them, which is 38% of total household spend. That generates monthly recurring interchange revenue of $22 per month per account.

Finovate: How does OnBudget remove the pain from the traditional budgeting process?

Collas: It’s effortless to set up and manage a budget. The cardholder just uses the card for 30 days and the app automatically categorizes transactions, tracks the user’s spending, and then suggests a budget for each of their budget categories. To adjust their budget, users can use our simple budget balancer, a slider tool that easily adjusts budgets. Meanwhile the card continues to auto-categorize spending and offer insights with no additional effort required.

Finovate: You’ve mentioned that the number one reason consumers use prepaid cards is to help them budget. Why do you think this is the case?

Collas: Prepaid cards have a high propensity to help consumers budget because they are a physical metaphor for and follow the same dynamic that makes the Envelope Budgeting System so popular. Segmenting by spending buckets (envelopes) that are easily trackable makes it easy to understand and simple to use.

Finovate: Do you view OnBudget as a competitor of banks or as a more complementary solution?

Collas: Since we’ve shifted our focus to partnering with banks, it is totally complementary. In fact, we believe it’s really compelling way for banks to regain their competitive advantage in prepaid and debit, as well as recover lost Durbin revenue.

It also increases debit spend per household from $843 to $1,596. Banks can quadruple debit revenue on an average of roughly 90% increase in spending.

Finovate: What can we look forward to seeing from OnBudget in the second half of 2014 and into 2015?

Collas: We will be launching a version of a student and teen card, and we will be launching our private-label service with our first bank partners later this year.

Learn more about OnBudget. Watch their live demo from FinovateSpring 2014 here.

PayPal announces partnership with MyOrder to enable PayPal payments at 1,500 locations in the Netherlands.

PayPal announces partnership with MyOrder to enable PayPal payments at 1,500 locations in the Netherlands.