Who is most likely to detect card fraud? Financial institutions? Payment networks?

Who is most likely to detect card fraud? Financial institutions? Payment networks?

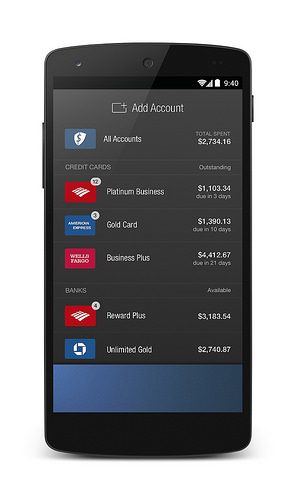

According to Aite Group, the answer is the cardholder. And that makes the news that BillGuard will now be available to the millions of consumers using Android smartphone and tablets all the more worthwhile.

Download BillGuard at Google Play here.

The iPhone app for BillGuard has been available for almost a year (see below). But today’s announcement comes not just with great news for Android users, but also with some pretty nifty news for BillGuard users of all types: the arrival of data breach alerts.

These personalized, individual alerts will let BillGuard customers know when a data breach has occurred at a store they have patronized. BillGuard customers are notified by way of email and push-alerts, and the technology continues monitoring afterwards, letting users know if any suspicious activity takes place on their cards.

The beta version of this technology, according to BillGuard CEO Yaron Samid, helped cardholders identify more than $1 million in fraudulent charges since the Target data breach.

- More than 500,000 users of iPhone mobile app since launch in July 2013

- Identified more than $60 million in suspect charges since inception

- Supports more than 5,000 credit and bank accounts in the U.S. and Canada

- First service to directly alert cardholders to breaches at retailers like Michaels, Neiman Marcus, and Target

BillGuard has been the recipient of high-quality press in recent weeks. The company was featured on ABC World News with Diane Sawyer in early April, and was profiled in the New York Times a few weeks afterward.

BillGuard demoed its technology at FinovateFall 2011 in New York. Founded in 2010, the company has raised $13 million in funding from investors such as Peter Thiel (Founders Fund) and Eric Schmidt (Innovation Endeavors).