On Finovate.com

- Check out our latest FinovateFall Sneak Peeks:

- “Finovate Debuts: Slice Introduces Intelligent Shopping API”

- “Arxan Technologies Drafts Joe Sander as CEO”

Around the web

- Kasasa reaches milestone: 300+ community FIs now offer Kasasa to members, a total of 823,000 accounts.

- NY Times lists Betterment, Coinbase, Wealthfront, ZenPayroll as companies that may be the next startup unicorns.

- Crowdfund Insider: Zopa tops £1 million in loans, a U.K. first for peer-to-peer lending.

- Global News interviews Karl Martin, Nymi CEO and founder.

- Trustly bolsters team with appointments from H&M and Klarna.

- FIS launches financial inclusion lab in India.

- SME Insider interviews CurrencyTransfer.com‘s CEO Daniel Abrahams.

- Silanis to deploy eSignLive technology with TransGuard and Occidental Fire & Casualty.

- Puerto Rico-based Evertec to enable mobile e-commerce courtesy of Acculynk’s PaySecure.

- Payoneer wins contract with Dailymotion.

- LoanNow expands into New Mexico.

- NPR interviews Pindrop Security‘s CEO Vijay Balasubramaniyan.

- Selling Power ranks OnDeck 17 out of 50 on its list of 2015 Best Companies to Sell For.

- Nostrum Group receives FCA authorization for debt administration to cover its involvement in customer loan accounts and debt collection.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

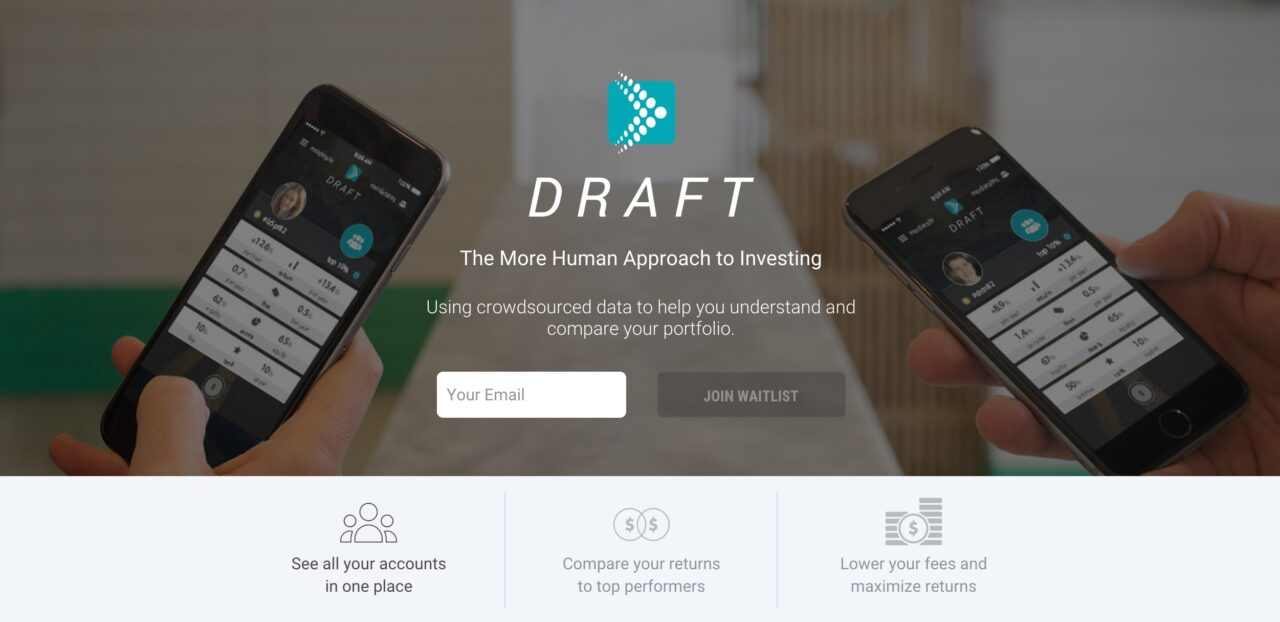

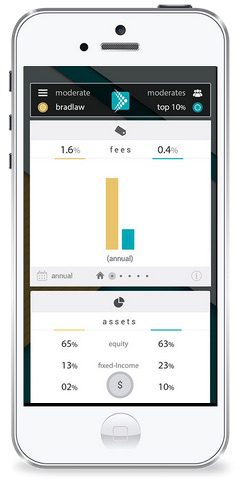

Draft facts:

Draft facts:

Gro Solutions’

Gro Solutions’ Presenters

Presenters Paul Mackowick, CRO

Paul Mackowick, CRO

Kapitall

Kapitall

Presenters

Presenters Craig Eagle, COO, Co-Founder

Craig Eagle, COO, Co-Founder

TransferTo

TransferTo Eric Barbier, CEO

Eric Barbier, CEO Charles Damen, EVP Global BD, Mobile Money

Charles Damen, EVP Global BD, Mobile Money

RedCloud’s

RedCloud’s

Soumaya Hamzaoui, Chief Product Officer

Soumaya Hamzaoui, Chief Product Officer

Ethoca

Ethoca Julie Fergerson, SVP, Industry Solutions

Julie Fergerson, SVP, Industry Solutions Steve Durney, SVP, Issuer Relations

Steve Durney, SVP, Issuer Relations

1) Receive email addresses

1) Receive email addresses

Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to