A look at the trending topics of the past two weeks.

Trending highest: No Lush Life for Alt Lenders

If unanimously positive perceptions are the hallmark of a bubble, then rest assured that the alt-lending market has moved past that stage. For every headline-grabbing C-level departure at Lending Club (F09)—CEO Renaud Laplanche stepping down in June, CFO Carrie Dolan announcing her resignation in August—there are successes: Prosper (F09) revealed its plan to sell $5 billion in loans to a group of private investors over the next two years; small business lender OnDeck (F12) surpassed earnings expectations despite its second consecutive quarterly loss and reported year-over-year quarterly revenue gains, as well as a year-over-year increase in loans under management of 47%.

If unanimously positive perceptions are the hallmark of a bubble, then rest assured that the alt-lending market has moved past that stage. For every headline-grabbing C-level departure at Lending Club (F09)—CEO Renaud Laplanche stepping down in June, CFO Carrie Dolan announcing her resignation in August—there are successes: Prosper (F09) revealed its plan to sell $5 billion in loans to a group of private investors over the next two years; small business lender OnDeck (F12) surpassed earnings expectations despite its second consecutive quarterly loss and reported year-over-year quarterly revenue gains, as well as a year-over-year increase in loans under management of 47%.

So if there’s no bubble in the alt-lending part of the fintech universe, should we fear a bust? Diverging fortunes among these companies is a good sign. The more the fates of alternative lenders are linked to the decisions of individual corporate leaders, their business plans, and their customers rather than investing trends among venture capitalists (or hedge funds in the case of alt lenders gone public), the better. Looking at the P2P lending market in the U.K., LendInvest CEO Christian Faes told Business Insider, “Over the next few years, the businesses that can prove they can make a profit will be the ones [still] around in another ten years, making a lasting impact on finance.” In other words, just like any other business.

For Lending Club, the challenge is diversifying away from “fickle funding sources.” In addition to Prosper’s $5 billion move, Social Finance went so far as to launch a hedge fund, the $15 million SoFi Credit Opportunities Fund, to purchase its loans as well as those of its competitors.

- OnDeck Loan Originations (And Loan Loss Provisions) Soar – PYMNTS.com

- OnDeck Defends Strategy After $17.9 Million Loss – American Banker

- Online Lenders Have a Tough Job Ahead – Wall Street Journal

- The U.K.’s historically low interest rate could benefit alternative lenders – Business Insider

- Lending Club’s latest results tell us a lot about the online credit business model – FT Alphaville

Other trending topics

Fintech Advances in Asia

While investors have been bullish on the tech scene in Asia for some time, a slew of new reports appeared this month. TechCrunch recently reported that in 2015 and the first half of 2016, fintech accounted for 21% of all VC funding in Southeast Asia. In a recent blog post, Trulioo (F15) said that fintech startups in Asia garnered $4.5 billion in 2015, triple what European fintech firms received during the same period. Recent developments include:

It’s no coincidence that Finovate is returning to Asia now to bring the innovators together in one place. Join us November 8, 2017, in Hong Kong for FinovateAsia 2016 as we showcase the latest and greatest.

Blockchain Developer, UNICEF Wants YOU!

The United Nations Children’s Emergency Fund is looking for a developer interested in using blockchain technology to help “solve the problems of the developing world.” Interested parties can find out more about the position here. And if the combination of blockchain and the developing world sounds familiar, it may be because you’re thinking of recent Finovate Best of Show winner BanQu (F16) which has developed a blockchain-based identity platform that promotes financial inclusion and empowerment among the underbanked, including refugee populations.

Hello, It’s Me: Voice Auth Comes to Barclays

Barclays adds instant voice authentication for all 12 million retail customers, ending 30 years of maneuvering through tedious telephone prompts and redundant authentication questions. – Bank Innovations

Everbank’s Awesome Exit

1990s digital banking pioneer Everbank exits for $2.5 billion in sale to TIAA. After PayPal (F12), this is the most successful fintech company to come out of the original 1990s dot-com era. – PYMNTS.com

Mastercard on the Move

Early Warning’s clearXchange saw some growth as of late. Mastercard, which announced this week that its Mastercard Send U.S. debit cardholders can send and receive money through the clearXchange network. Fiserv (F16) will also become a distribution partner for clearXchange, leveraging the partnership to provide a turnkey solution for banks.

Speaking of Mastercard, the company is looking at the newly announced partnership between PayPal and Visa (FD14), with an eye toward striking a similar deal. Finextra talked with Mastercard CEO Singh Banga who said it will be “important for Mastercard to provide something in addition to what Visa’s offered” as Mastercard “doesn’t have as much to offer PayPal” as Visa did because it has fewer consumers.

Azimo Goes Social

London-based Azimo (F13) took a step toward facilitating P2P payments by launching money transfers via Facebook Messenger. Interestingly, the transfer is initiated within the Azimo app (via Facebook integration) and completed in Facebook Messenger.

Insurance for Everything

Insurance startup investors are betting big that the smartphone platform allows a new breed of insurance products to flourish, so-called insurance on demand. The classic example is an alert when arriving at the airport asking if you would like to buy travel insurance. But the bigger market automobile/motorcycle policies are offering coverage only when you are using the vehicle. Our Insurance for Everything example of the week? On-demand insurance for your drone courtesy of Verifly. – Techcrunch

Also keeping our eyes on …

- On August 2, 2016, Bitcoin dropped 20% after $70M worth of bitcoin (around 12,000 BTC) was stolen from Bitfinex exchange. The company is now offering a reward of up to $3.6 million for the recovery of the digital currency. Bitfinex said it has taken “significant steps” to improve its security, and resumed trading on its platform on Thursday, August 10. – TechCrunch

- The U.K.’s FCA has granted app-only bank Mondo a banking license, thereby joining the ranks of neobanks Atom Bank, Tandem, and Starling. – The Financial Times

- “An Interview with the Inventor of the Credit Card Chip Reader” – The New Yorker

- “The Dawn of the Virtual Assistant” – The New York Times

Parentheticals after a company name refer to the year of their most recent Finovate or FinDEVr conference appearance (F = Finovate, FD = FinDEVr).

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016. Register today.

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016. Register today.

Robert Levine, Global VP Business Development

Robert Levine, Global VP Business Development

Presenters

Presenters

If unanimously positive perceptions are the hallmark of a bubble, then rest assured that the alt-lending market has moved past that stage. For every headline-grabbing C-level departure at

If unanimously positive perceptions are the hallmark of a bubble, then rest assured that the alt-lending market has moved past that stage. For every headline-grabbing C-level departure at

Robo-adviser solutions-provider

Robo-adviser solutions-provider

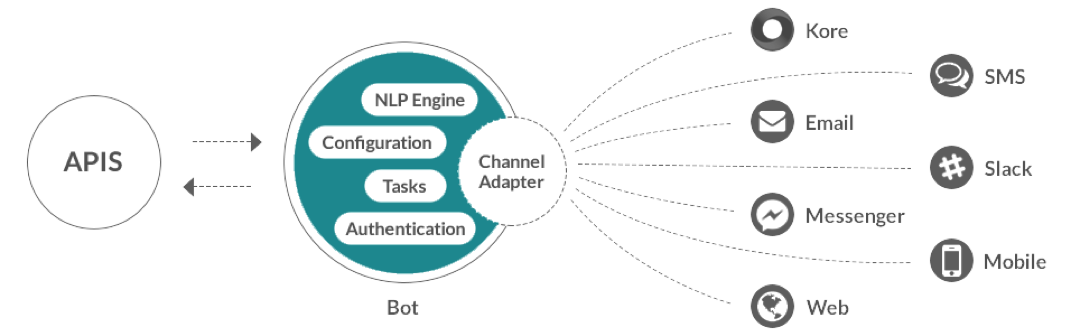

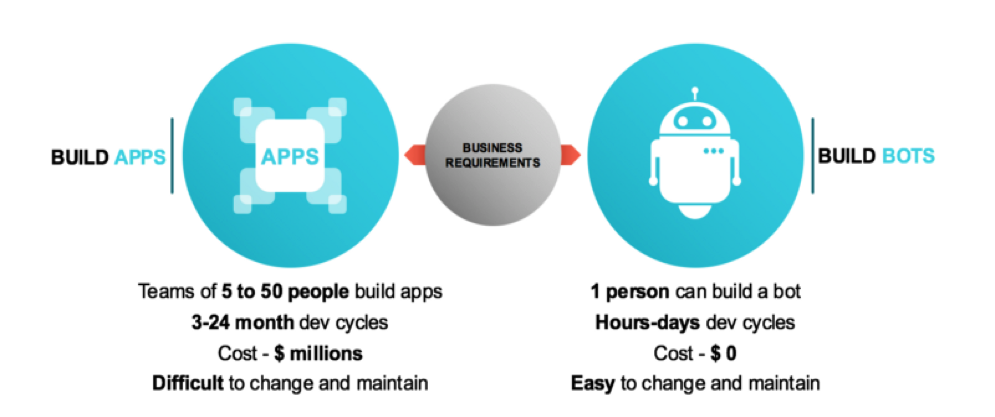

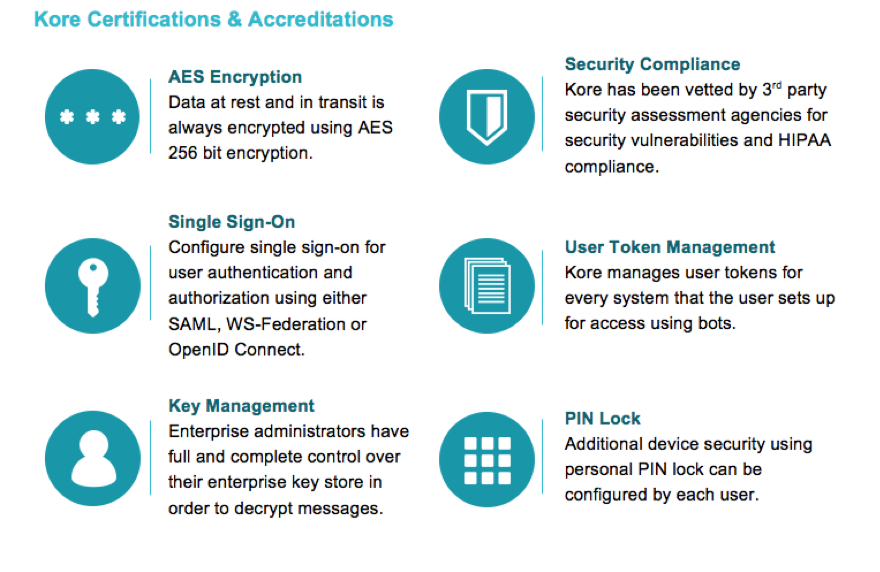

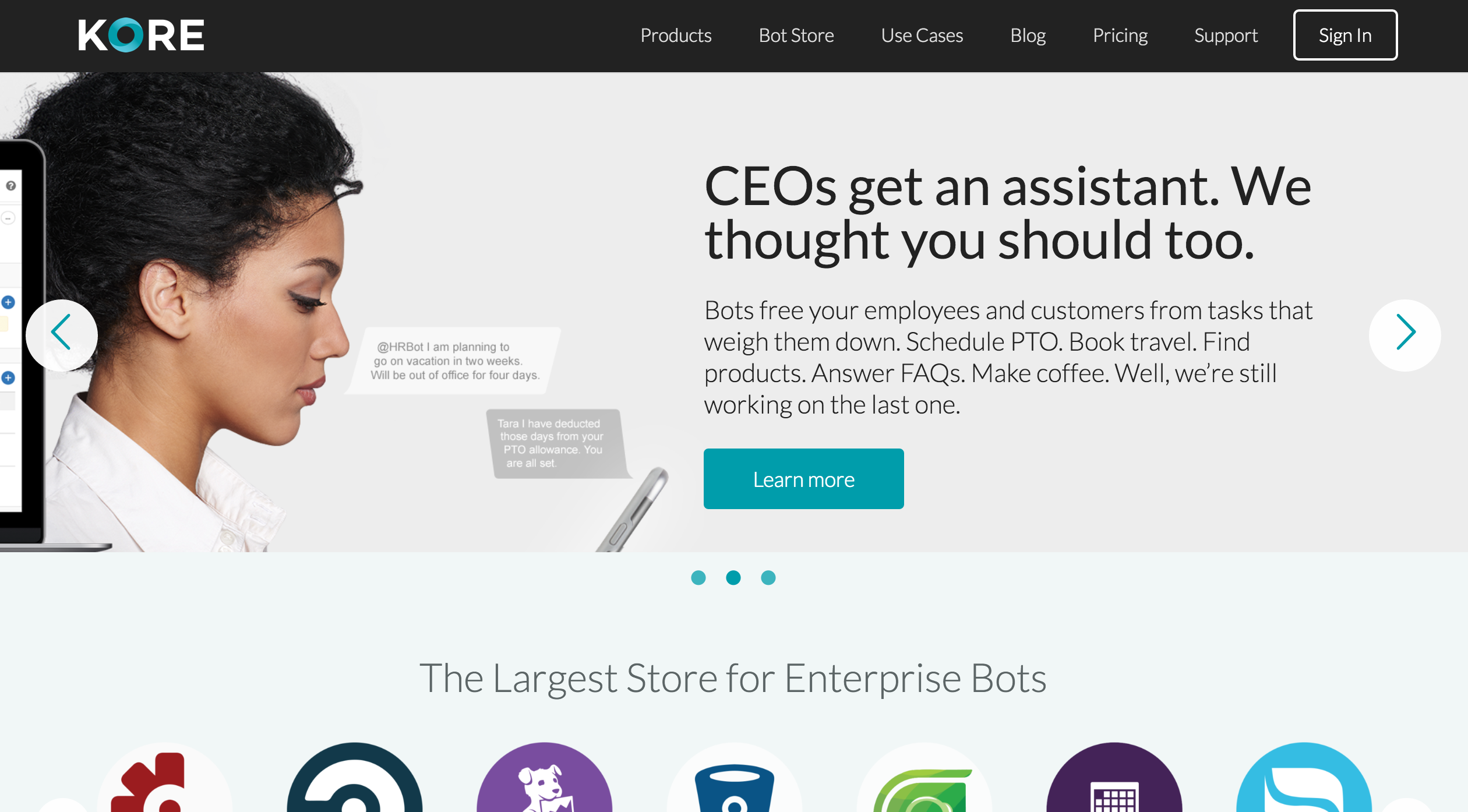

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.