The Finovate Debuts series introduces new Finovate alums. WingCash demoed its “cash in the cloud” mobile wallet technology at FinovateFall 2014 in New York this fall.

WingCash combines card payments and loyalty/gift value to provide a “cash in the cloud” mobile wallet solution.

The Stats

- Founded in November 2009

- Headquartered in Lehi, Utah

- Privately funded

- Bradley Wilkes is CEO and President

The Story

Bradley Wilkes and the team from WingCash are out to solve a simple problem: relieving consumers of the burden of managing and using paper and plastic cards. For Wilkes, these cards are both inefficient and inconvenient. They can be easily lost or left behind. “Extra cards require extra swipes and extra time at the point of sale,” added Wilkes.

That’s not to say that cards have no value – similar to cash, which is likely to stock around despite industry disruptions, cards are here to stay. WingCash is saying that there is a way to take the best parts of cash – speed and safety – and the best parts of cards – convenience and added value – and combine them into a single payments solution.

The Technology

WingCash is a system of cloud-based wallets that hold payment cards, currency, and brand cash. Wilkes refers to it as “cash in the cloud tied to a payment card.”

The payment card and currency aspects of the technology are straightforward. Brand cash is a technology that WingCash uses move move gift/loyalty card value from the plastic card to the app. And it is brand cash that eliminates the need for plastic gift and loyalty cards. All the value is on the app.

This way, WingCash provides a seamless transition from earning a reward, paying for an item or service, and having that reward instantly applied to the transaction. The technology also updates rewards automatically, to enable consumers to enjoy rewards or loyalty points from another transaction that was completed only minutes before.

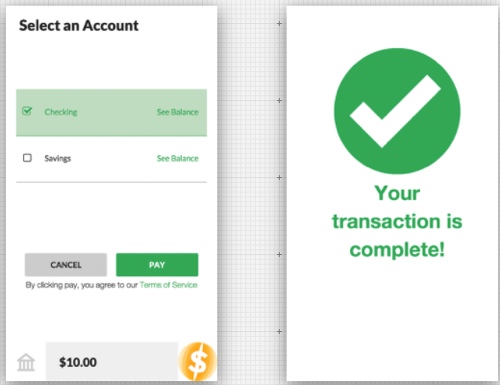

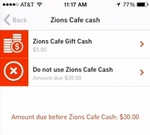

To use WingCash, a consumer loads cards onto his WingCash wallet app: payment cards, gift cards, rewards and loyalty cards, and so on, including, for example, a $5 gift card from the local deli. All of this, including the $5 value from the gift card, appear in the app.

When it is time to pay, the customer hands the merchant one of the payment cards that is loaded on the app. When the card is swiped, the app will recognize that the customer has $5 in gift value (or brand cash) and ask if he wants it applied to the current transaction. If yes, the total amount due is adjust to reflect the subtracted gift card value, and all the customer has to do is sign when promoted and both transactions – the purchase and the application of the rewards points – are completed in a single swipe.

“We now have cloud-based gift and loyalty inside of a mobile app for consumers,” Wilkes said. “It’s a smart app so consumers don’t have to do anything more than enroll a card.”

(Above: left to right: Bradley Wilkes, CEO & President; Steve Curtis, VP & Director, Sales; Vilash Poovala, CTO, Clip)

The Future

A large part of WingCash’s future is now. The company

recently announced a partnership with

Clip, a payment processor and merchant acquirer based in San Francisco and Mexico City. One of the reasons why the Mexican market was selected had to do with the relative prominence of cash compared to cards. “Cash is a bigger deal,” Wilkes said. “Card penetration isn’t as high.”

Vilash Poovala, co-founder and CTO of Clip, pointed to the specific way that WingCash connects all of the key pieces of the transaction: the rewards, the mobile app, and the merchant. “If a consumer adds a gift card to a mobile app, that doesn’t solve for how that (app) will be accepted at the merchant,” Poovala explained. “Plastic is ubiquitous and when you use your credit card, you should be able to tap into all of your gifts and rewards.”

Going forward, more partnerships are the plan, especially with acquirers and processors. “If you’re an acquirer or a processor and you would like to have a custom app that drives differentiation of acquiring merchant accounts, and connecting with consumers in your own custom app,” Wilkes said. “I’d encourage you to come and see us.”

Money Facts looks at how TransferWise helps consumers save on money transfer fees.

Money Facts looks at how TransferWise helps consumers save on money transfer fees.