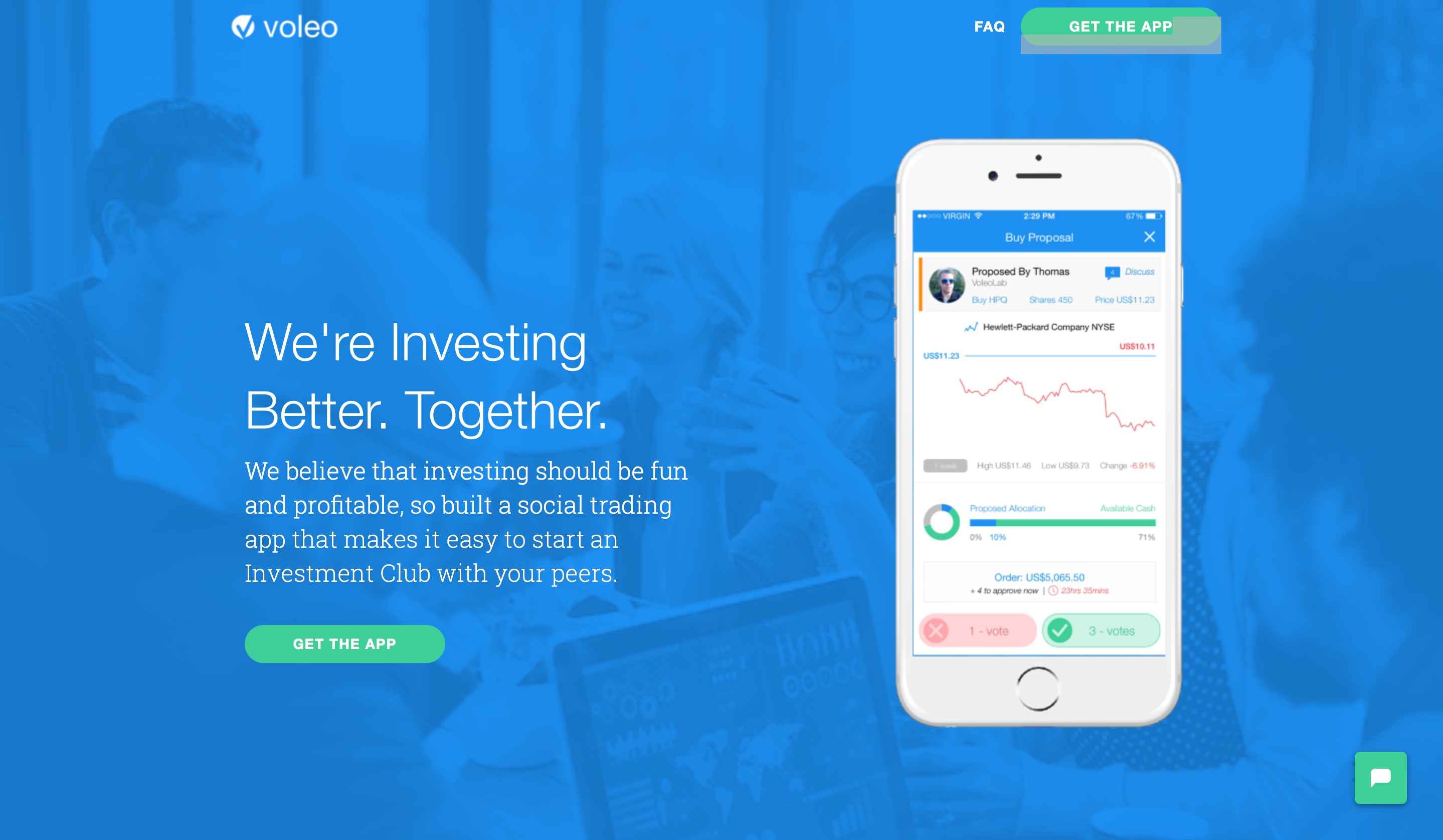

Canada’s Voleo is teaming up with the Nasdaq once again to promote financial literacy and awareness among college-age students. The Best of Show winning social investment platform and the Nasdaq have announced this year’s Student Equity Trading Competition – with cash prizes and the opportunity to attend a Nasdaq market opening for the winners.

“We are thrilled to team up with Nasdaq to provide students with an opportunity to invest in their futures,” Voleo CEO Thomas Beattie said. “We understand that there’s a steep learning curve to understanding financial markets, and our organizations are both strong believers in building financial literacy.”

The competition empowers teams of three or more to form or join an investment club on the Voleo platform. Once onboard, teams use Voleo’s Simutrader solution to manage simulated portfolios of $1 million, and can access Nasdaq Basic Data in order to guide their trading and investing decisions. The contest ends in April 2019.

Above: Members of the winning team from the 2017-2018 competition, the New Haven Bulldogs, at the Nasdaq with members of Voleo.

In the first year of the collaboration between Voleo and Nasdaq, more than 300 teams were formed. The team that came in first place, the New Haven Bulldogs from Yale University (pictured above at the Nasdaq with members of Voleo), gained 37.8% – more than doubling the gains of the second and third place finishers (the Baruch College Bearcats and the Colorado College Tigers, which finished with respectable gains of 16.3% and 15.3%, each). The top individual finisher produced a gain of 17.2% during last year’s competition.

“At Nasdaq, our mission includes encouraging greater market participation through education and access to market data,” said Nasdaq Director of Global Information Michael Taylor. “We believe that Voleo’s SimuTrader platform, combined with Nasdaq data, will provide students with a real investing experience that is innovative and social.”

Voleo’s technology – available on both iOS and Android – provides investors with a collaborative platform that supports social trading and investing by making it easy to join and manage investment clubs. Recently featured in the Financial Post, the Vancouver, British Columbia-based company demonstrated its technology at FinovateFall 2017, winning Best of Show.

In December, Voleo announced that it would partner with OP Financial Group to help launch a new social trading platform for the European market. The company began the year with news that B2B digital marketing executive Nicky Stenyard was joining its board of directors. Read our February feature on Voleo, including a Q&A with CEO Beattie.