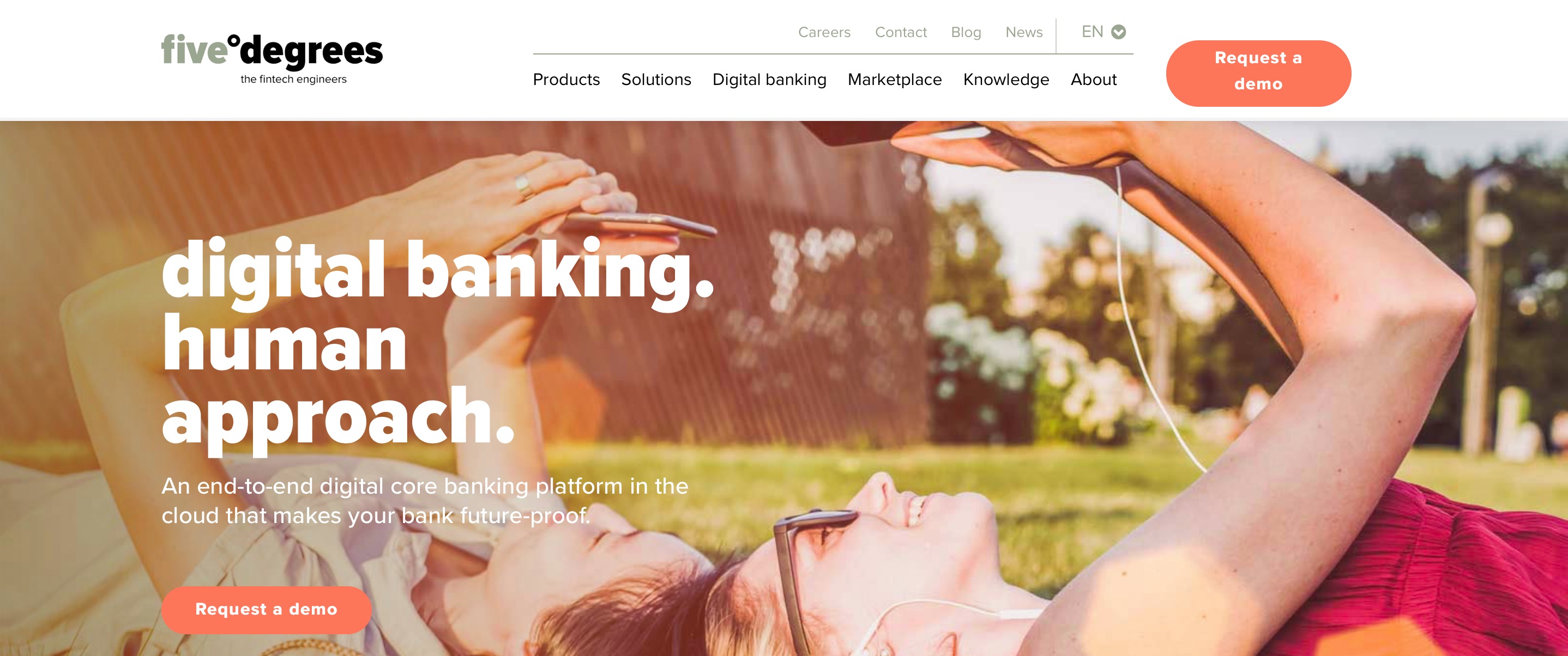

One month after digital core banking provider Five Degrees announced its collaboration with fellow Finovate alum W.UP, the company is back in the fintech headlines with another round of partnership news: digital security platform Entersekt will join its Open Banking Marketplace.

“Partnering with Entersekt is testament to our vision for the future of banking and finance so we are delighted to welcome the company as part of our Open Banking Marketplace,” Five Degrees EVP Peter-Jan van de Venn said. “Our marketplace is championing a culture of collaboration throughout the industry, enabling us to provide a better customer experience via interconnected APIs.”

In their statement, the companies indicate that the partnership between the two companies will help financial service providers perform better both at home in Europe as well as in their global banking and finance operations. Five Degrees Open Banking Marketplace is designed to encourage financial services companies and fintechs to work together to build engaging digital customer experiences, increase their own efficiencies, and make regulatory compliance easier.

“(We) help tens of millions of end users across the globe, securing 150 million digital transactions every month in 45 countries,” Entersekt CEO Schalk Nolte said. “We look forward to being part of five degrees’ Open Banking Marketplace and are confident that our partnership will drive further innovation in (digital services) and help our mutual customers differentiate themselves from the competition.”

Entersekt’s Chief Technology Officer presented “Securing Mobile Applications through Transport Layer Diversity” at our developers conference, FinDEVr Silicon Valley, in 2014. The South African company, which was founded in 2008, opened its second office in Cape Town in April, and that same month was named to the Wealthtech 100. Entersekt teamed up with fellow Finovate alum BioCatch in March to offer financial services companies a “one-stop-shop” for security solutions such as continuous and multi-factor authentication, passwordless login, and enhanced remote user registration.

In its most recent Finovate appearance at FinovateEurope 2018, Five Degrees demonstrated its digital wealth management solution, Prospery. Founded in 2009 and headquartered in Amsterdam, the Netherlands, the company was selected last month to join the Kickstarter Innovation Program. In June, Five Degrees announced a partnership with Bankingblocks to assist challenger banks and payment companies as they offer new solutions to their customers.

With $11 million (€10 million) in funding, Five Degrees includes Karmijn Kapitaal and Velocity Capital Private Equity among its investors.