Since its launch in 2011, socially responsible lender LendUp has surpassed $2 billion in consumer financing via its digital lending platform. This represents 6.5+ million loans, with an average loan value of $300.

“We’re very proud of this significant lending accomplishment, the progress we’ve made in driving disciplined, profitable, and sustainable growth, and our role as a standard bearer for responsible and inclusive lending and banking,” LendUp CEO Anu Shultes said.

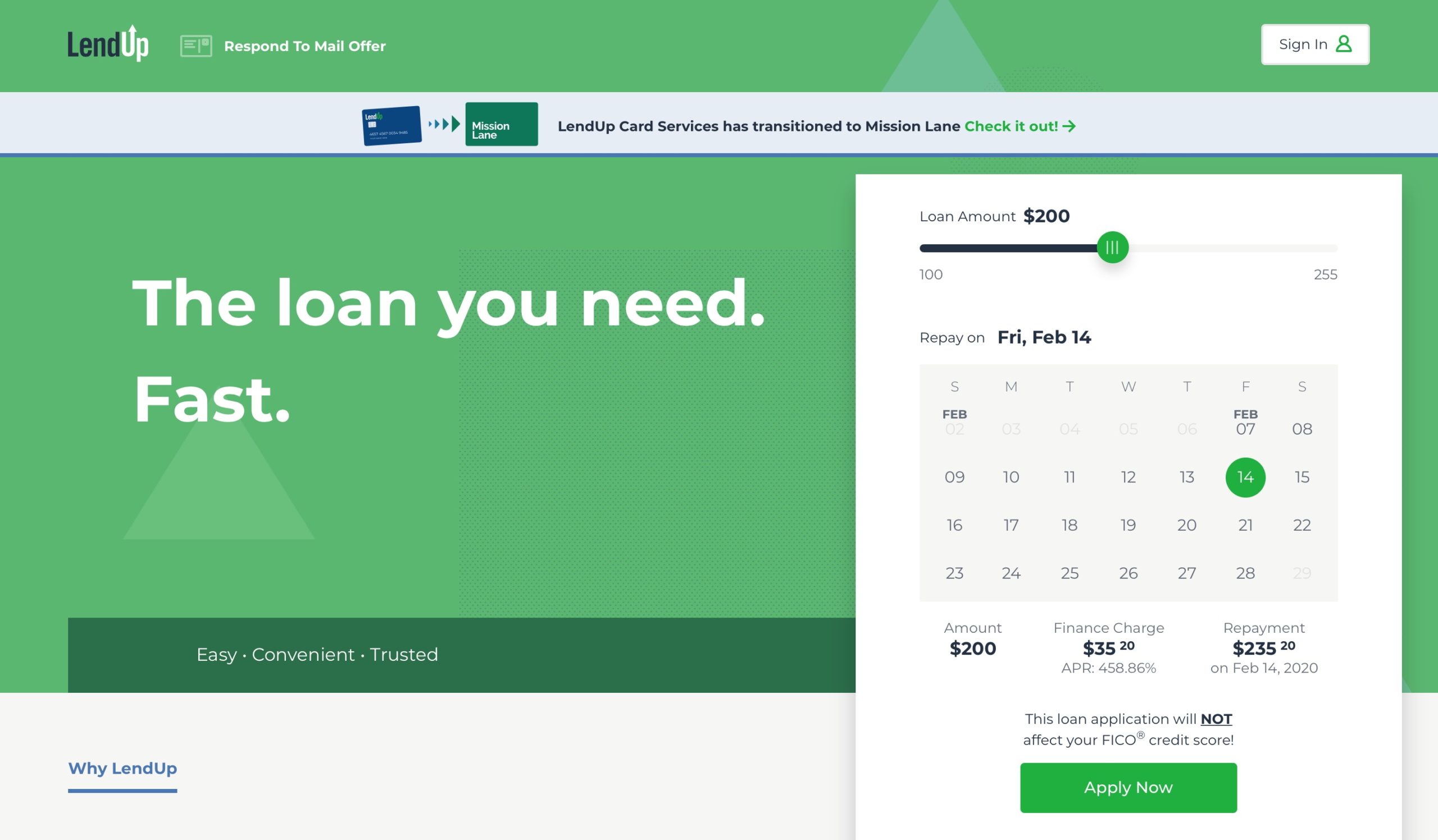

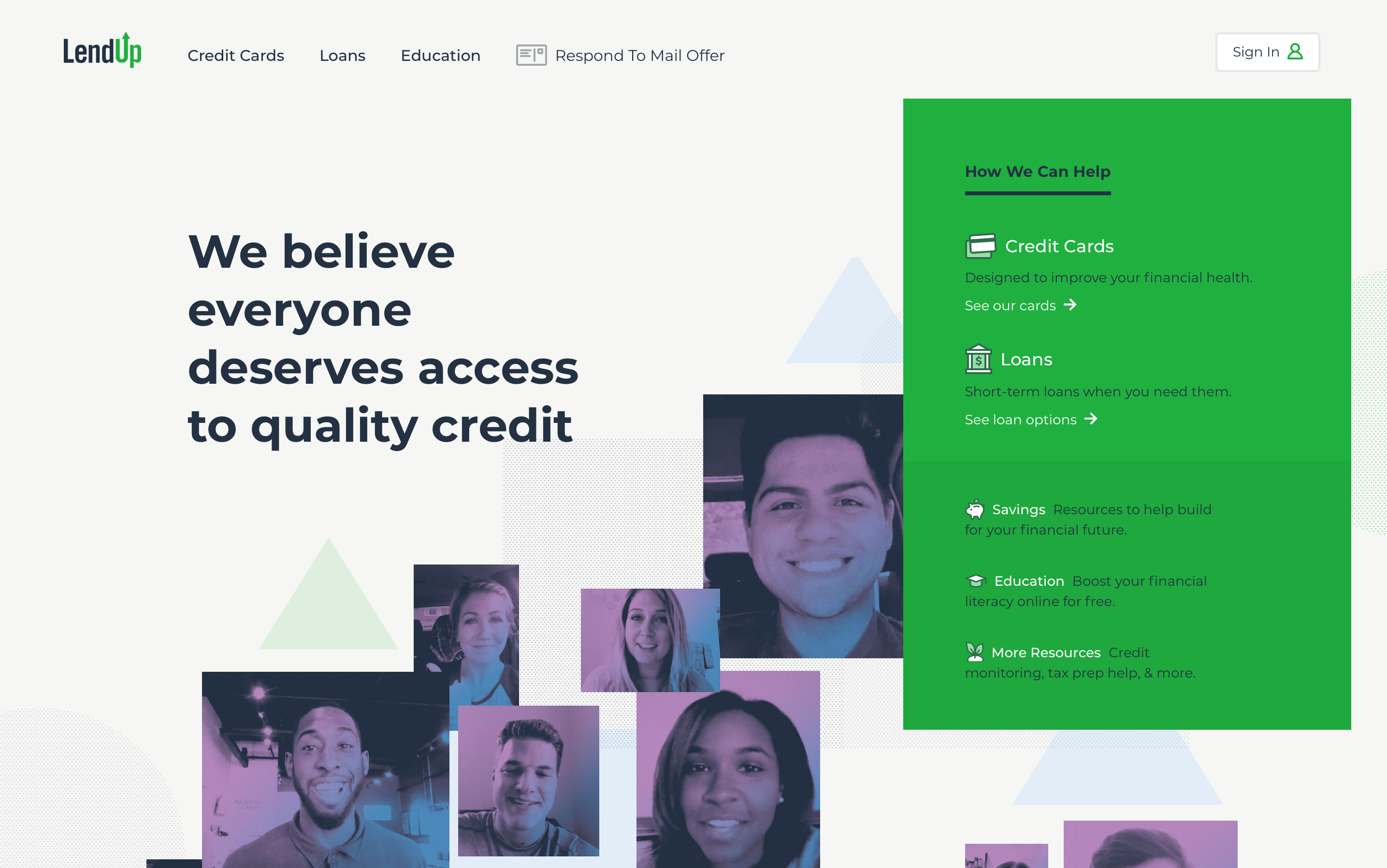

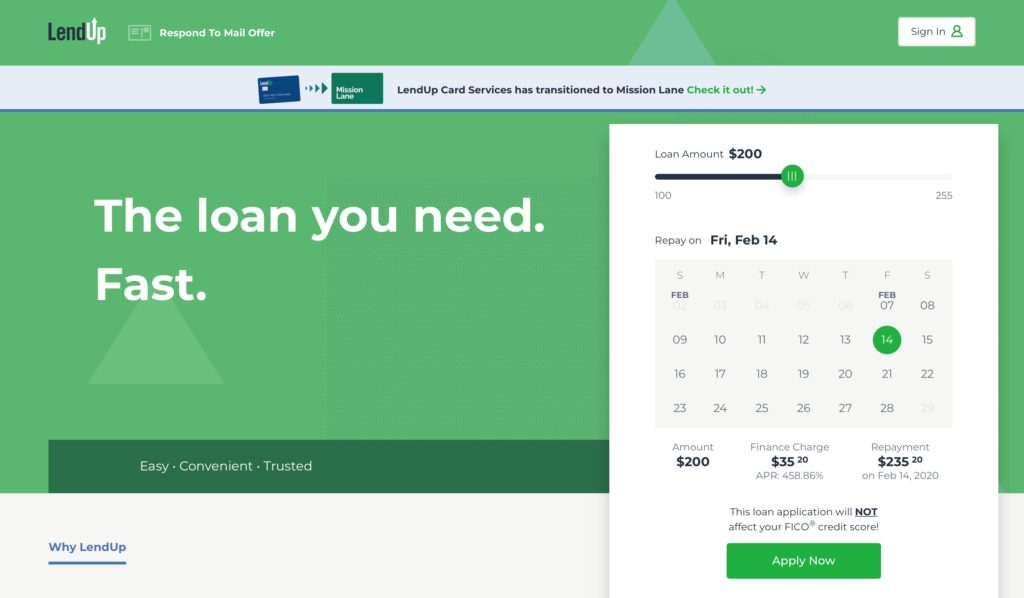

One of the fintechs to embrace early the concept of financial wellness, LendUp combines access to financing via its short-term installment loans. The company offers financial education and a specific-but-personalized strategy to help consumers improve their credit, the LendUp Ladder. This resource uses gamification, education, and good borrower behavior to enable borrowers to earn points that allow them to apply for larger loan amounts at better rates. The company notes that its customers have taken more than two million financial education courses via its platform.

“Through our lending, education, and savings programs, we’ve helped customers raise their credit profiles by hundreds of thousands of points cumulatively and saved them hundreds of millions of dollars in interest and fees from much higher cost products,” Shultes explained. She added that the $2 billion mark was a “real testament to the impact that financial service providers like LendUp can and should have on the market.”

It’s worth noting that this week’s announcement comes on the one-year anniversary of Shultes’ appointment as CEO; Shultes took over the company last January from co-founder Sasha Orloff. Shultes was formerly LendUp’s GM and has been credited for helping grow the company’s loan originations to more than 5.5 million.

LendUp demonstrated its financing platform at FinovateSpring 2014. The San Francisco, California-based company has raised more than $360 million in funding from investors including PayPal Ventures and Victory Park Capital. The company spun-off its credit card business, Mission Lane, as a stand-alone entity a year ago, which has allowed LendUp to focus on its lending and financial wellness businesses.