With FinovateAsia less than one week away, it’s worth noting that the history of our Asian conference is a short, but illustrative one. Consider this: of the twelve companies awarded Best of Show from our three FinovateAsia conferences in 2012, 2013, and 2016, more than half are multiple-time Best of Show winners, having impressed audiences in London, Silicon Valley, and New York City, as well as Singapore and Hong Kong. And three of the companies have also been the targets of major acquisitions: IND Group by Misys, EyeVerify by Ant Financial, and Yodlee by Envestnet.

So, other than winning multiple Best of Show awards and being acquired by major players in finance and technology, what have the Best of Show winners of FinovateAsia from last year been up to in the time since? See for yourself below.

FinovateAsia 2016 – Best of Show

The biggest news for Alpha Payments Cloud since winning Best of Show at FinovateAsia 2016 is likely the company’s comprehensive rebranding as Alpha Fintech in September. The move was designed to affirm the company’s status as “fintech’s first end-to-end middleware,” using a single API and UI to connect merchants and vendor suppliers across “the entire payments, risk, and commerce spectrum.”

Oliver Rajic, Alpha Fintech CEO added “Now with Alpha, (acquirers and gateways) can evolve to enable the right vendor combination for each unique requirement … thereby extending and enhancing their core solution subset.” Alpha Fintech has already made its first agreement under the new rebrand, teaming up with Payture, a major payment gateway in the CIS region. “Among the early adopters of the Alpha Fintech /Payture integration are businesses in Russia’s e-travel consumer market, which the company says is one of the largest segments of Russia’s e-commerce market.

Multiple-time Best of Show winner Dynamics announced a partnership with LG Electronics earlier this year. The agreement would put Dynamic’s Wireless Magnetic Communication (WMC) technology in LG Pay. The integration will enable LG mobile phones to transmit traditional magnetic stripe information wirelessly to traditional magnetic stripe readers.

“Dynamics has been building wireless magnetic communication solutions for nearly a decade and is widely considered the founder of the programmable magnetic stripe industry,” Dynamics CEO Jeff Mullen said. “Dynamics’ best-in-breed technology will help LG Pay reach hundreds of millions of new payment environments.”

Acquired by Ant Financial Services Group just months before making its Best of Show-winning demonstration at FinovateAsia 2016, EyeVerify has hardly rested on its laurels. This summer, for example, the company partnered with fellow Finovate alum Daon, adding Eyeprint ID to Daon’s IdentityX platform. But the biggest headlines from this multiple Best of Show winning company have to do with their rebrand as ZOLOZ back in August.

“When I announced almost a year ago that Ant Financial acquired EyeVerify, I said we want to do more,” company founder and CEO Toby Rush wrote at the company blog. “Today we publicly commit to providing a hosted identity platform that helps people manage their digital lives.” Rush described an initiative to bring identity services to the underserved and underbanked consumers of Asia, with plans to ultimately bring hosted identity solutions to markets in North America and Europe.

With two Best of Show awards in two Finovate appearances, intelligent banking assistant developer Finn.ai must be doing something right. Finn.ai earned a spot in Payment Canada’s pitch competition, Dragon’s Den, and was recognized over the summer by Capegemini’s global InnovatorsRace and at the VivaTech conference in Paris, France. Finn. ai also announced a few days ago that ATB Financial would use Finn.ai’s technology to offer its 700,000 customers the first, fully-featured, AI-powered virtual banking assistant on Facebook Messenger.

But in addition to making friends and influencing people, Finn.ai is raising capital, as well. The company raked in $3 million in new funding in October, and plans to use the financing to help add technical talent to its team, as well as support the company’s expansion in the U.S. and around the world. Banking industry veteran, Carrie Russell, who will join Finn.ai as Strategic Executive Adviser, noted the importance in helping banks “move beyond transactional banking to build deeper, more personal relationships with customers.” Russell added “I believe Finn.ai is the right partner to do this, acting as a proactive virtual assistant to help customers understand, plan and take action to improve their financial lives.”

The rest of our FinovateAsia Best of Show winners are listed below:

FinovateAsia 2013 – Best of Show

FinovateAsia 2012 – Best of Show

- CurrencyFair (demo)

- Finantix (demo)

- SocietyOne (demo)

- UBank (demo)

Envestnet | Yodlee

Envestnet | Yodlee Finn.ai

Finn.ai Jiffee

Jiffee

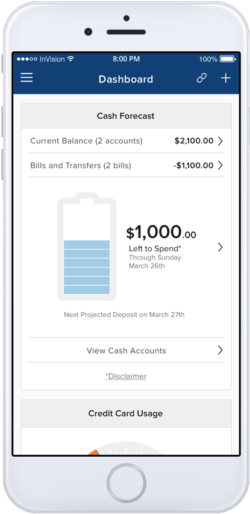

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

Dr. Jason Mars, Founder and CEO, Clinc

Dr. Jason Mars, Founder and CEO, Clinc Jeff Cain, Director, Envestnet | Yodlee Incubator

Jeff Cain, Director, Envestnet | Yodlee Incubator