The only thing keeping pace with the investment interest in alternative lenders from Prosper to Kabbage may be the growing partnership interest from banks.

Earlier this week we reported on the deal between Lending Club and Union Bank. Today we learn that BBVA Compass will be working with OnDeck to develop better ways to provide loans to its small business clients.

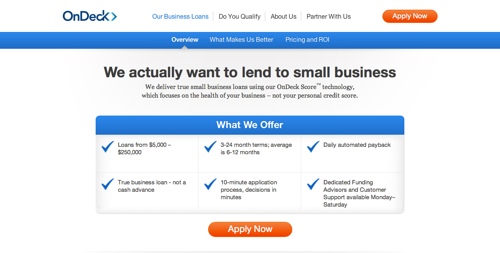

Specifically, BBVA Compass will be relying on OnDeck’s OnDeck Score. This technology allows banks and financial institutions to review thousands of relevant data points, including social data points, to help determine a would-be borrower’s suitability for a given loan.

This new initiative is a big deal for OnDeck, and represents the first such collaboration with a bank the size of BBVA Compass. Founded in 2007 and led by CEO Noah Breslow, OnDeck made headlines a month ago when it announced a $77 million funding round led by Tiger Capital. The company specializes in combining loan underwriting analysis with the merchant’s own business data to determine a potential borrower’s creditworthiness faster than traditional lenders.

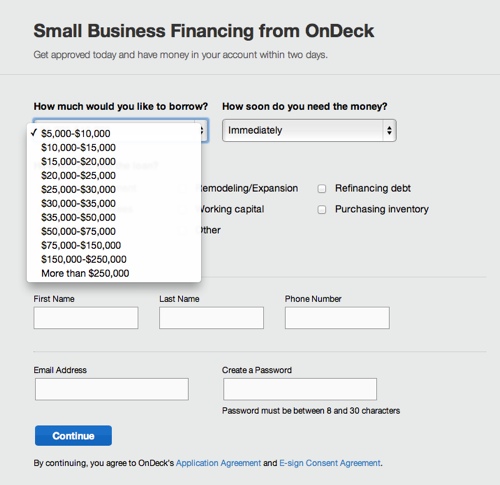

The average loan from OnDeck is $40,000, and loans can run as high as $250,000. Terms range from as little as three months to two years. The company demoed its technology at

FinovateSpring 2012.

Heckyl to provide real-time news and data analytics courtesy of new partnership with Marketware International.

Heckyl to provide real-time news and data analytics courtesy of new partnership with Marketware International.

Top Image Systems

Top Image Systems