PayPal EVP and COO Bill Ready recently reminisced how, in 1998, the company launched its first product, one that allowed users to beam money from one Palm Pilot to another. While the hardware has changed, the “beaming money” idea remains the same. In this race to real-time payments, the San Jose-based company announced this week that it has leveraged the partnerships it formed last year with Visa and Mastercard to offer users faster payments.

The new service will allow PayPal and Venmo users to send funds in minutes instead of the two-to-three day timeframe that is typical with most ACH transfers. Expediting funds will come at a cost, however. Users can expect to pay $0.25 per transaction if they want to send funds in real-time (or up to 30 minutes in some cases). The functionality is already available for select PayPal users and will be available for all U.S. PayPal users with eligible Visa and Mastercard debit cards “over the coming weeks and months” and available to Venmo users later this summer.

Zelle

When compared to Zelle, which runs on its former namesake, the clearXchange network, PayPal’s instant payment option is certainly more expensive than Zelle’s free option. PayPal’s advantage over Zelle is that it offers a standalone mobile and web app, while Zelle– as a bank-owned payments app– is more confined. While there are rumors Zelle plans to launch a standalone app, for now it must be hosted within a bank’s website or mobile app. It is worth noting, however, that PayPal’s model isn’t the same as Zelle’s, which is strictly a payment rails network among a group of banks.

Square Cash

Because of this, it is more fitting to compare PayPal’s offering to Square cash, which offers P2P money transfers and holds a user’s balance until they “cash out” or transfer it back into their checking account. Square also offers an instant money transfer feature, for which it charges a one percent fee.

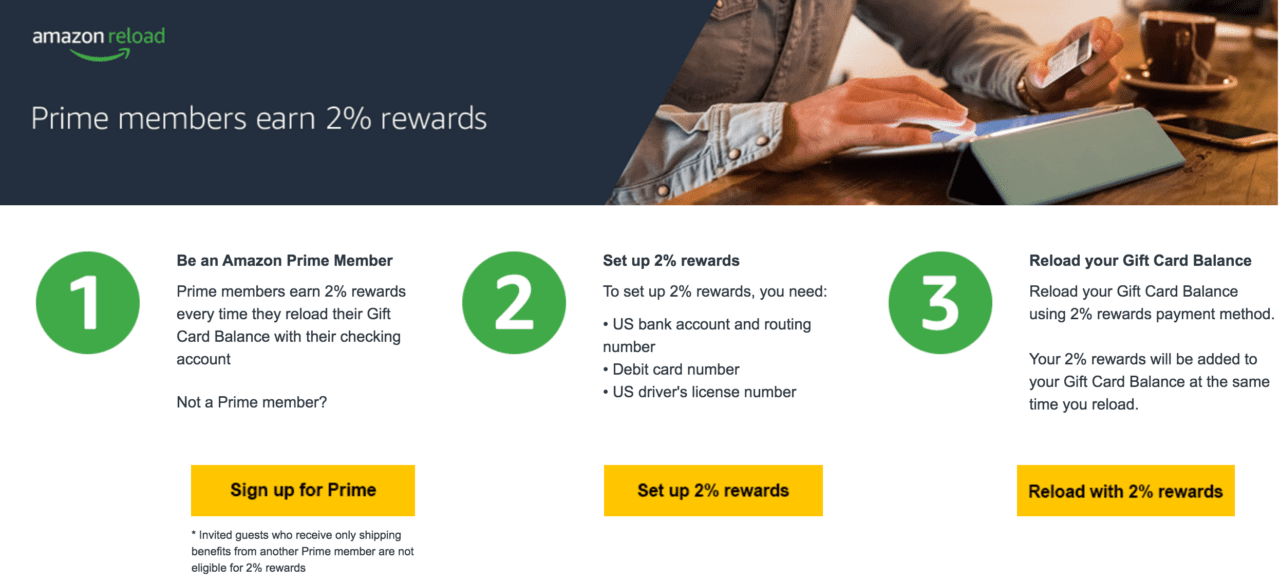

Amazon

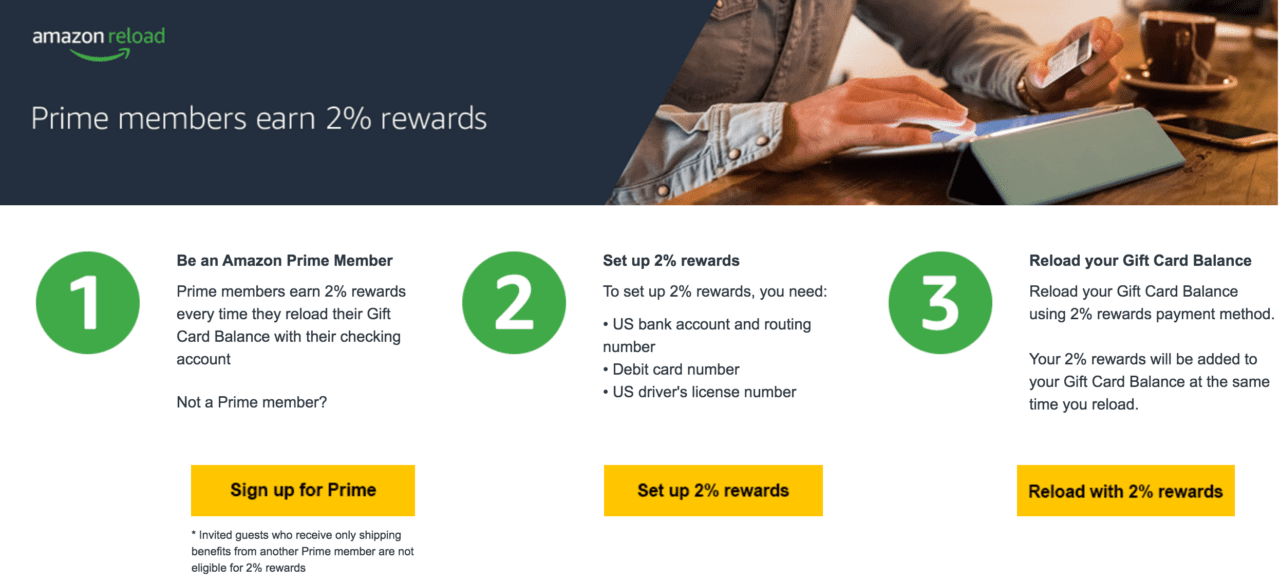

It is also worth watching Amazon in this space. The online retail giant made a move earlier this month to encourage its Prime members to hold a balance in their prepaid Amazon account by offering 2 percent cash back on purchases using their Amazon account balance. Similar to PayPal and Square Cash, Amazon does not pay interest on users’ balances, and thus stands to profit from the cash (which, by the way, cannot be transferred back to a user’s account– it must be used on an Amazon purchase). Of course, Amazon’s balance option is just a glorified gift card (for now). However, if enough users are compelled by the 2% cash back offer, we can expect to see the online retailer debut more banking features, stepping on banks’ toes and into territory PayPal has held for almost 20 years.

PayPal’s Braintree recently presented at FinDEVr New York 2016. The company also showcased its Instant Account Creation feature at FinovateFall 2012. Mastercard and Visa both presented at the first FinDEVr, held in San Francisco in 2014, where Mastercard showed off its Developer Zone and Visa demonstrated its API-less web integration and SDK web integration.

Presenters

Presenters Greg Barrett, VP, Product Development & Innovation for Global Credit and Debit

Greg Barrett, VP, Product Development & Innovation for Global Credit and Debit