On Finovate.com

- Yodlee Brings “Sense” to Forward-Looking Bank Balances

- BancVue’s Kasasa Spreads to 1,800+ Client Branch Locations Across 46 U.S. States.

Around the web

- NerdWallet lists Lendio as 1 of 7 great small-business loan options for women-owned businesses.

- Credit Sesame wins Gold Stevie Award in 2015’s American Business Awards.

- PayPal and Uber extend their partnership to additional 9 countries, now in 19 total.

- Backbase adds Geezeo’s PFM to its Open Banking Marketplace.

- Equities Lab integrates with Tradier Brokerage.

- FIS to provide and manage banking and payments platform for U.K. start-up bank, Atom.

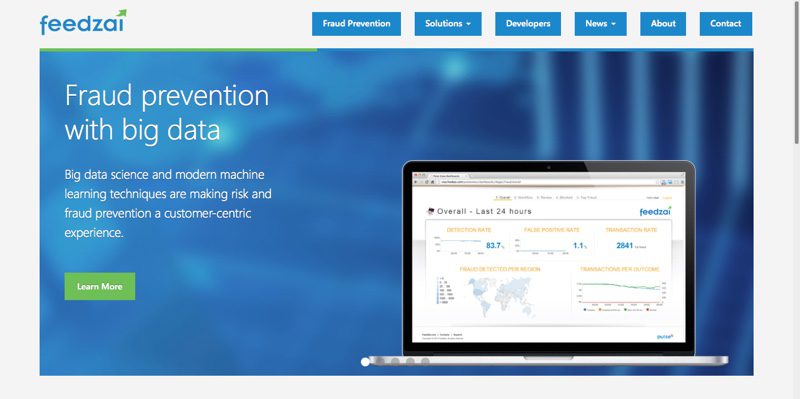

- Partnership between Feedzai and Azul Systems yields first deployment with “leading payment technology provider.”

- Insuritas wins NAFCU 2015 Services Innovation Award.

- DriveWealth helps trading software technology company, KnowVera, develop video course on pattern recognition.

- e-SignLive by Silanis to develop joint, cloud-based solution for digital transactions in new partnership with Australia’s Nuvola.

- Jim Cramer of CNBC’s Mad Money interviews SeedInvest CEO Ryan Feit.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Oberthur and SecureKey

Oberthur and SecureKey