In one of the largest Series B rounds to date for a Singapore-based financial technology company, the social payments specialist Fastacash raised $15 million in new funding. The investment was led by Rising Dragon Singapore, UVM 2 Venture Investments, and frequent Finovate sponsor Life.SREDA, along with additional unnamed existing investors.

The funding takes Fastacash’s total capital to more than $23 million and will help the company deepen its presence in Southeast Asia, the Middle East, and India, as well as Europe, the United States, and the United Kingdom.

“Our technology has made what was a cumbersome and often laborious process as easy as the swipe of a finger,” says Vince Tallent, fastacash CEO and Chairman. “We have an unwavering focus on simplifying the consumer payments experience.”

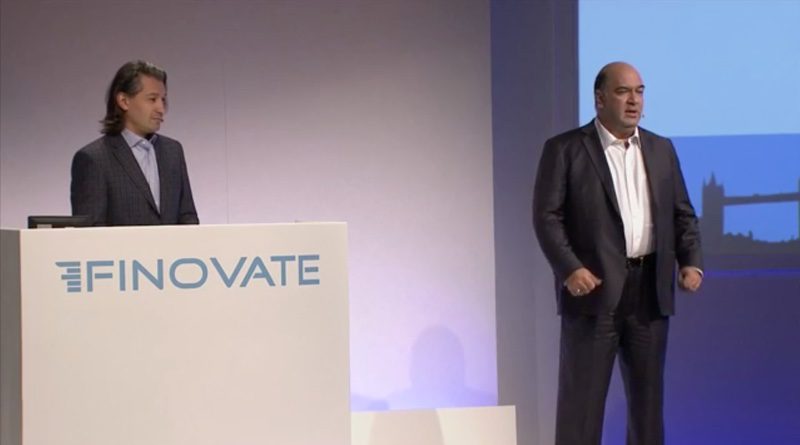

From left: Gilberto Arredondo, fastacash chief commercial officer, and Vince Tallent, chairman and CEO, at FinovateEurope 2014.

Fastacash is a global social platform that enables users to transfer value, such as cell phone airtime or money, as well as content, such as video, from one person to another securely using social media and messaging platforms. Fastacash partners with banks, PSPs, mobile operators, remittance companies, digital wallet providers and others to enable P2P and “person-to-merchant” value and content transfers.

Founded in April 2012 and headquartered in Singapore, Fastacash currently operates in India, Indonesia, Russia, Singapore, and Vietnam. Recent partnerships with India’s Axis Bank and Visa Europe have helped raise Fastacash’s profile among FIs looking to take advantage of the growth in the international money-transfer market valued at more than $685 billion.

Fastacash made its Finovate debut in London at FinovateEurope 2014.