On Finovate.com

- “Finovate Debuts: Bluescape Helps Banks Create Products from Napkin Sketches”

- “Tradeshift Earns Undisclosed Investment from Santander”

Around the web

- Fenergo rises 25 places in global Chartis Research’s RiskTech100 rankings.

- Blackhawk Network partners with Apple to offer ApplePay rewards.

- The Australian reports: OurCrowd goes on start-up funds-drive.

- SafetyPay and VTEX sign a global agreement for electronic commerce.

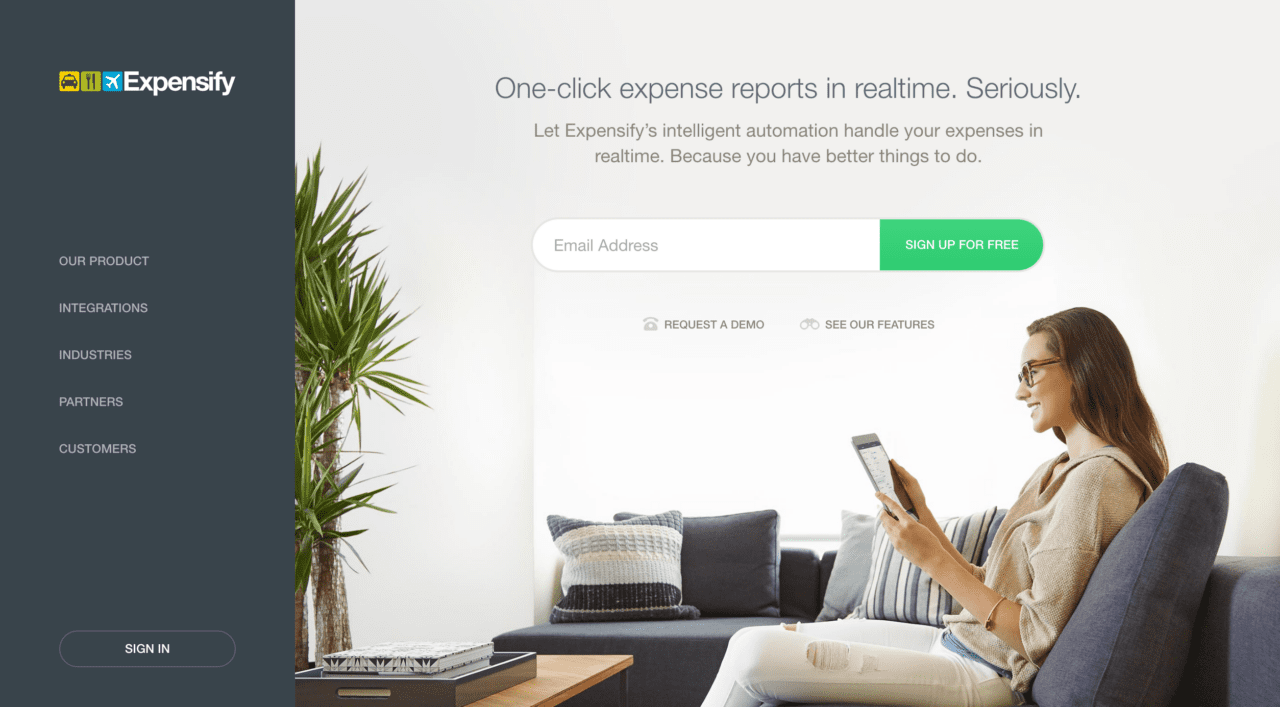

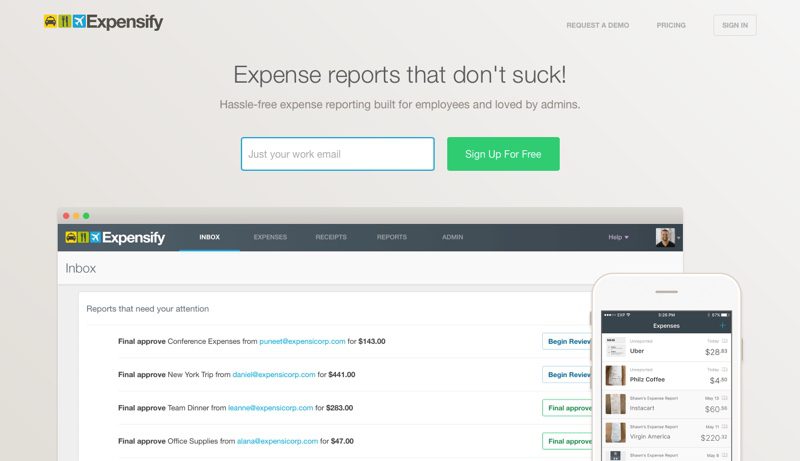

- Expensify selected as preferred expense-management solution by the AICPA and CPA.com.

- Mint introduces bill pay.

- Zopa launches a fresh new look.

- Professional Planner quotes SuiteBox CEO Ian Dunbar in discussion on technology and millennials.

- Top Egyptian retail FI, housing and development bank goes live with Temenos core banking solution.

- Avanzia Bank and TSYS renew card-processing partnership.

This post will be updated throughout the day as news and developments emerge. Follow our alumni news headlines on the Finovate Twitter account.