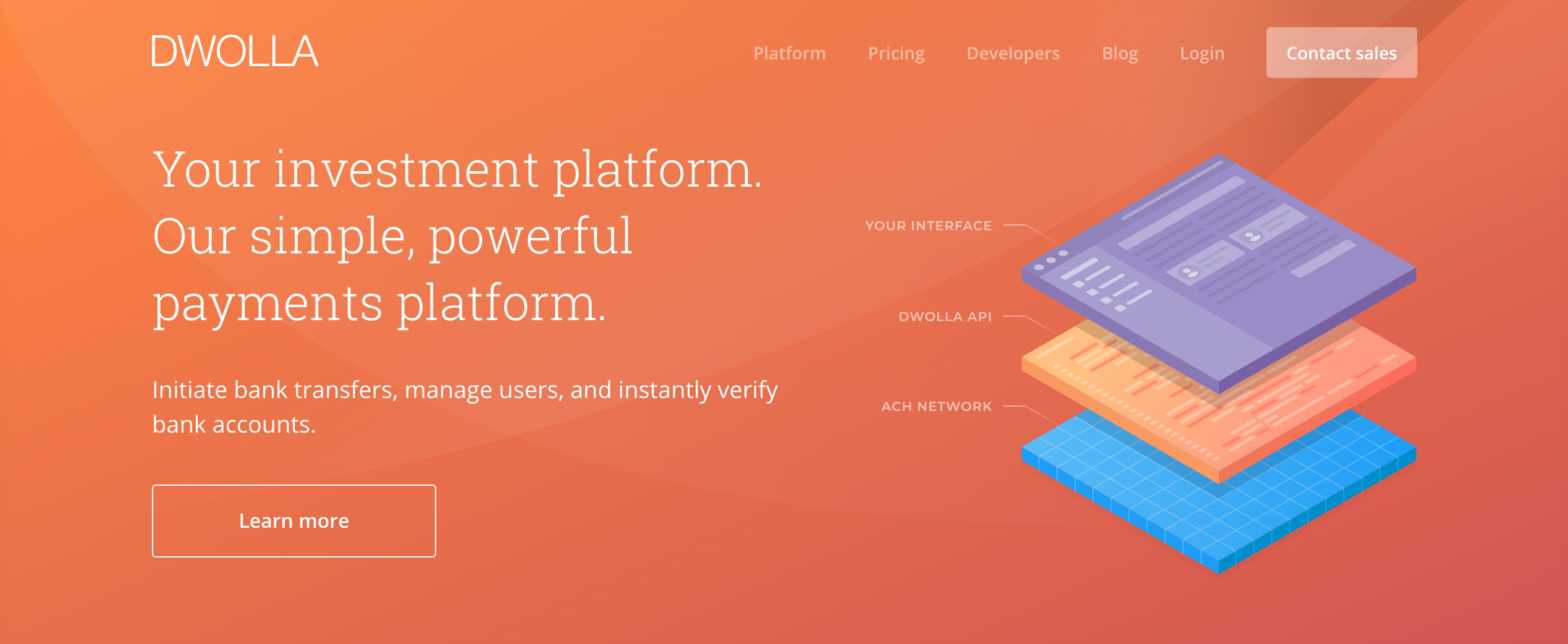

Status Money, the personal finance app that leverages peer comparisons and cash incentives to encourage users to make better financial decisions, announced a payments partnership with fellow Finovate alum, Dwolla, earlier this month. Status Money will leverage its new relationship with Dwolla to access the ACH network, so it can send earned cash rewards to members more efficiently.

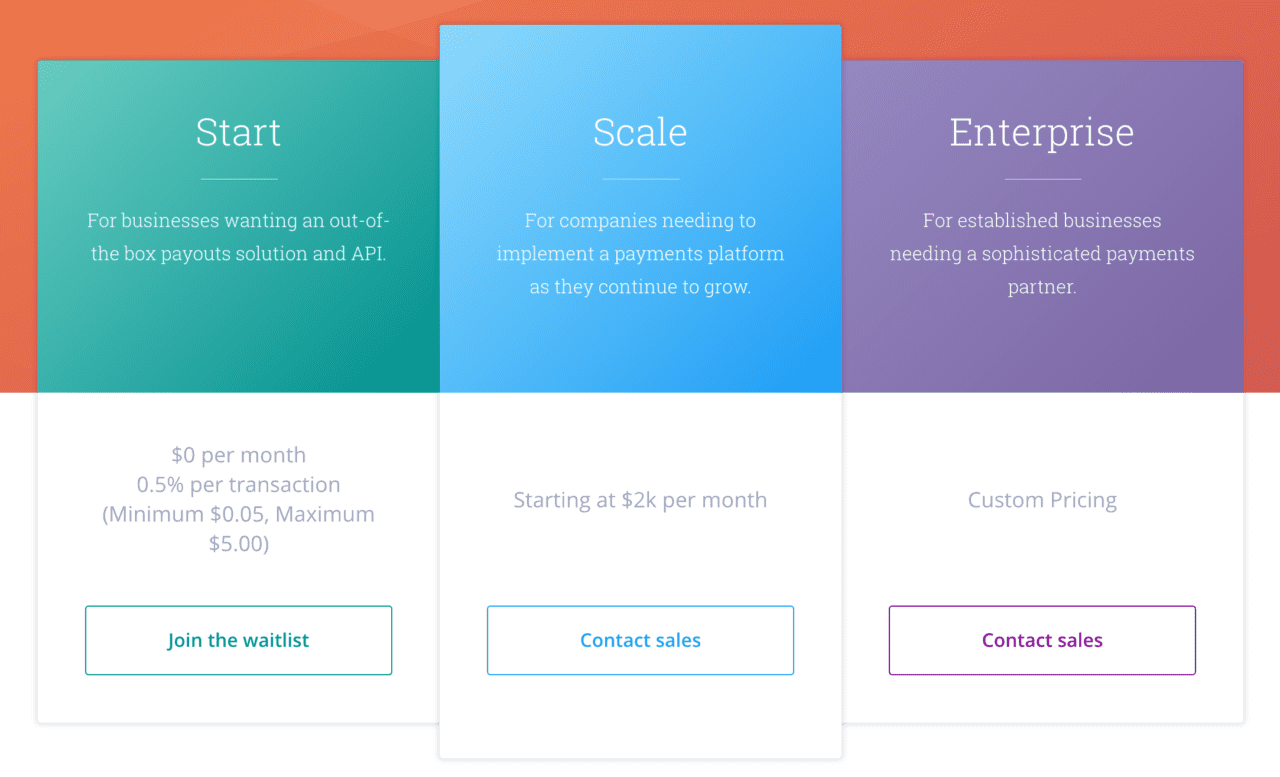

Dwolla will also be a major part of the company’s referral program, which offers cash rewards for referring non-members to the app. Status members earn $1 for each referral who signs up, with the new referred member earning a $7 reward. After a member accumulates $10 or more in total rewards, they can redeem them for cash by way of a Dwolla-enabled, free ACH bank transfer.

Status Money CEO and co-founder Majd Maksad praised cash rewards as a new way to incentivize savings in the PFM industry, and said that working with Dwolla would enable the company to get cash rewards to members quicker. Status offers users powerful financial insights based on peer comparisons, national averages, and more than one million custom groups. This data, combined with personal finance algorithms, helps users better manage spending, savings, debts, and investments, and connects them with partnering FIs that offer relevant financial services.

Status Money demonstrated its technology at FinovateSpring 2018. With more than 200,000 members, the company has raised $4 million in seed funding from Altpoint Ventures. Earlier this month, Status announced adding its first $100 reward. Founded in 2016, the company is headquartered in New York City.

Dwolla demonstrated its FiSync technology at FinovateSpring 2015. Earlier this year, the company announced that it was powering AutoInvest, a new automatic investing feature from OneGold. Late last year, Dwolla announced a pivot to focus on its white-label API, discontinuing its final branded solution, Transfer. The Des Moines, Iowa-based company was founded in 2008, and has raised more than $54 million in funding.