On Finovate.com

- AnchorID Adds Apple, SolarCity Vet Mark Roe to Board of Directors.

- Equifax Shakes Up Mortgage Tech with Castlight Partnership

- Payfone Lands $23.5 Million in Funding

- Check out our latest round of FinovateEurope 2017 Sneak Peeks featuring

Around the web

- Pakistan’s Samba Bank to deploy new core banking technology from Temenos.

- Infosys’s core banking software Finacle goes live at Nepal’s Sunrise Bank.

- ACI Worldwide to provide fraud protection for Kuwait’s Shared Electronic Banking Services Company (KNET).

- Mitek partners with the American Cancer Society, supporting mobile fundraising with its mobile deposit and MiSnap technology.

- Check Point Software partners with Attivo Networks to improve fraud detection.

- Fintech News interviews the founder of Bambu.

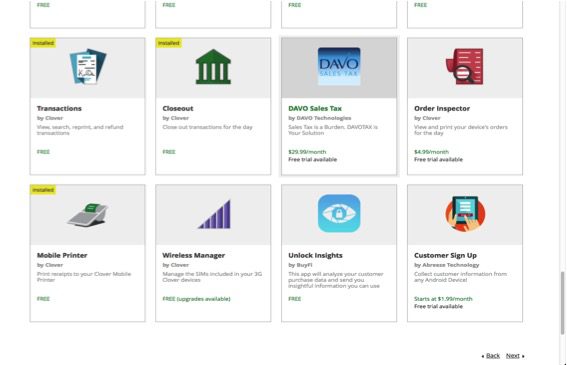

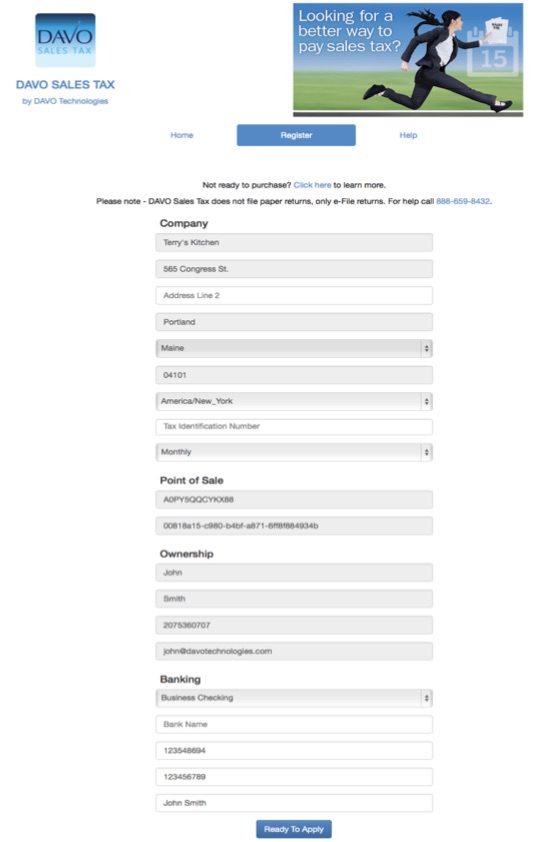

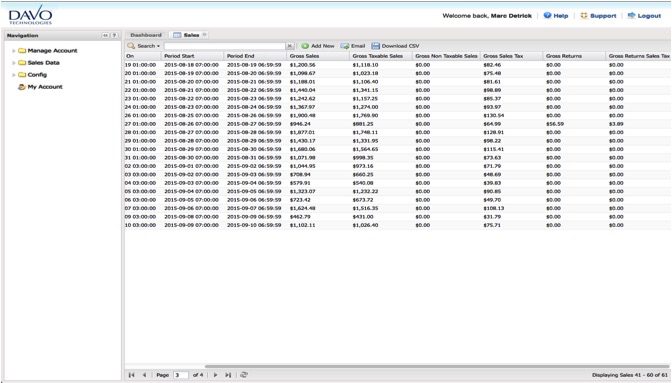

- DAVO Technologies has just been approved as a Certified Electronic Return Originator (ERO) with the California State Board of Equalization.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.