H2 Ventures and KPMG have released their Fintech 100 roster for 2016. Divided equally between 50 “industry leaders” and 50 “emerging stars,” the roster features 17 Finovate/FinDEVr alums in the first category, and 10 in the second. Calling its roster a “celebration” of the most compelling innovators in this “bold new space,” the H2 Ventures/KPMG 2016 Fintech 100 covers a variety of different shades of fintech:

- Lending (32 companies)

- Payments (18 companies)

- Insurance (12 companies)

- RegTech (9 companies)

- Data & analytics (7 companies)

- Wealth management (6 companies)

- Blockchain (5 companies)

- Digital currency (5 companies)

- Capital markets (3 companies)

- Crowdfunding (2 companies)

- Accounting (1 company)

And here is a look at how Finovate/FinDEVr alums fared. Earning recognition among the companies in the Leading 50 group are:

- Kreditech (FS14)

- Klarna (FS12)

- Xero (FS11)

- Nubank (FD16)

- Kabbage (FS15)

- Wealthfront (FS09 – as KaChing)

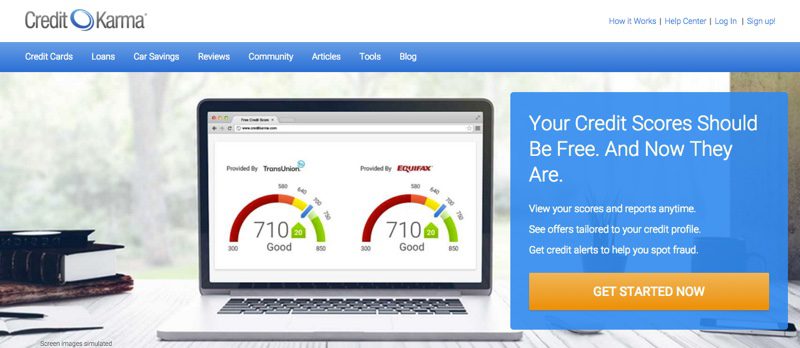

- Credit Karma (FS09)

- Lending Club (FS09)

- Prosper (FS09)

- OnDeck (FS12)

- LendUp (FS14)

- Motif Investing (FS14)

- SecureKey Technologies (FF12)

- itBit (FS15)

- Coinbase (FS14)

- Payoneer (FA13)

- SocietyOne (FA12)

Also noteworthy in the Leading 50 are Ant Financial, which acquired Best of Show-winning EyeVerify in September 2016, and Avant, which acquired Finovate alum ReadyForZero in the spring of 2015.

Additionally, Finovate/FinDEVr alums earning spots in the Fintech 100’s 50 Emerging Stars roster were:

- Azimo (FE13)

- Feedzai (FE14)

- Finova Financial (FS16)

- Identitii (FF16)

- North Side (FE16)

- Overbond (FF16)

- Rippleshot (FF14)

- Tink (FE14)

- TipRanks (FF13)

- Zooz (FF13)

The H2 Ventures/KPMG report includes a geographic breakdown of the 2016 Fintech 100, as well as a set of key takeaways such as increased geographic diversification, the return of lending, the continued ascent of Insurtech, and the appearance of RegTech. The report also notes that China now has four out of the top five companies in the report’s top 10, and eight companies in the top 50. The report says funding for fintech “continues to rise,” and its authors cite more than $14 billion in capital was raised by the Fintech 100 in the past year.

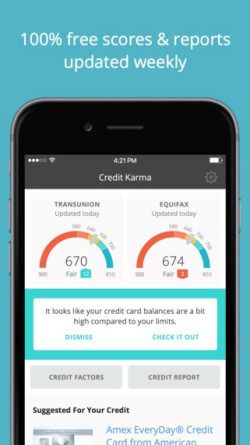

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said.

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said. Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the

Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the