Bitcoin exchange Coinbase has a new president, Asiff Hirji, who will also serve in the newly-created position of chief operating officer. Formerly of Hewlett-Packard and Andreessen Horowitz, Hirji joins the company at a time of soaring interest in bitcoin and digital currencies, and will bring his expertise in managing large investment platforms and brokerage firms to Coinbase at a key moment in the company’s growth.

Writing at The Coinbase Blog this morning, co-founder and CEO Brian Armstrong said, “Coinbase is moving into an exciting phase of our journey. Asiff’s knowledge of traditional financial services, as well as his deep technical expertise, makes him the perfect person to guide our operations as we grow into new markets and products.”

“Asiff is an elite operator, with fantastic domain expertise from Ameritrade, and a deep technical background,” Andreessen Horowitz General Partner Ben Horowitz said, calling Coinbase’s new executive “the perfect fit.”

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.

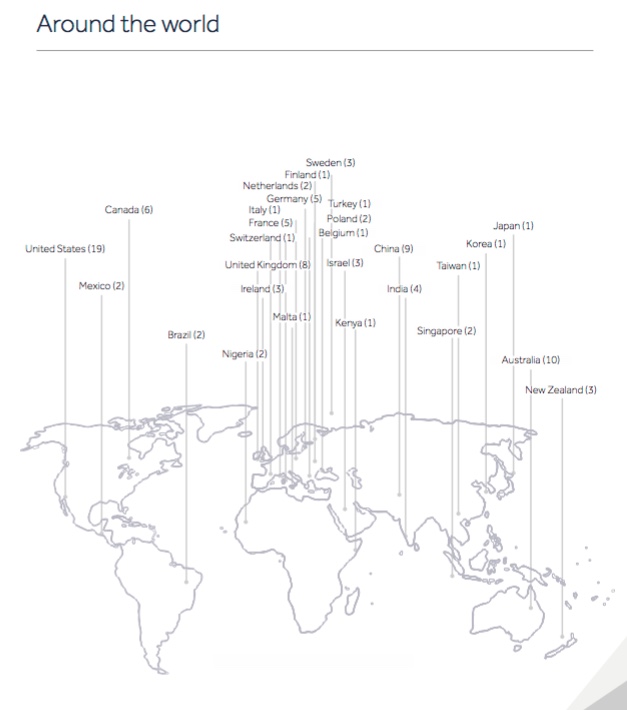

“Coinbase is uniquely positioned like no other company to capitalize on the burgeoning crypto-economy,” Hirji said. “Its breadth of offerings, global footprint, and unique capabilities mean that it will continue to be the first place that retail and institutional investors look when they invest in cryptocurrencies.”

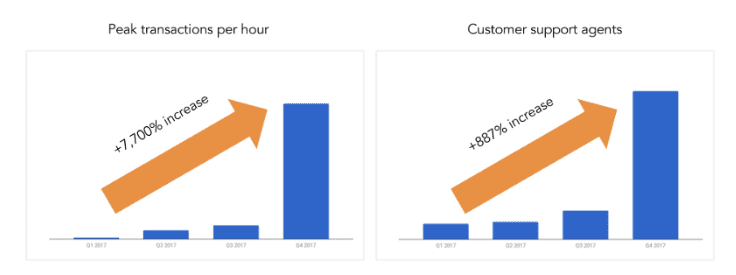

As such, Hirji told The Wall Street Journal that the challenge for Coinbase will “definitely” be growth. He said that both finding engineers that are well-versed in cryptocurrency technologies and dealing effectively the “patchwork of regulations around bitcoin” have been among the challenges to bitcoin businesses that “have yet to be resolved.”

With more than 10 million customers served, and more than $50 billion in digital currency exchanged, Coinbase demonstrated its Instant Exchange technology at FinovateSpring 2014. Earlier this month, the company introduced Coinbase Custody, a new solution to help institutional investors securely store digital assets. In August, Coinbase closed a $100 million Series D funding round led by IVP that took the company’s total capital to $217 million and an estimated valuation of $1.6 billion.

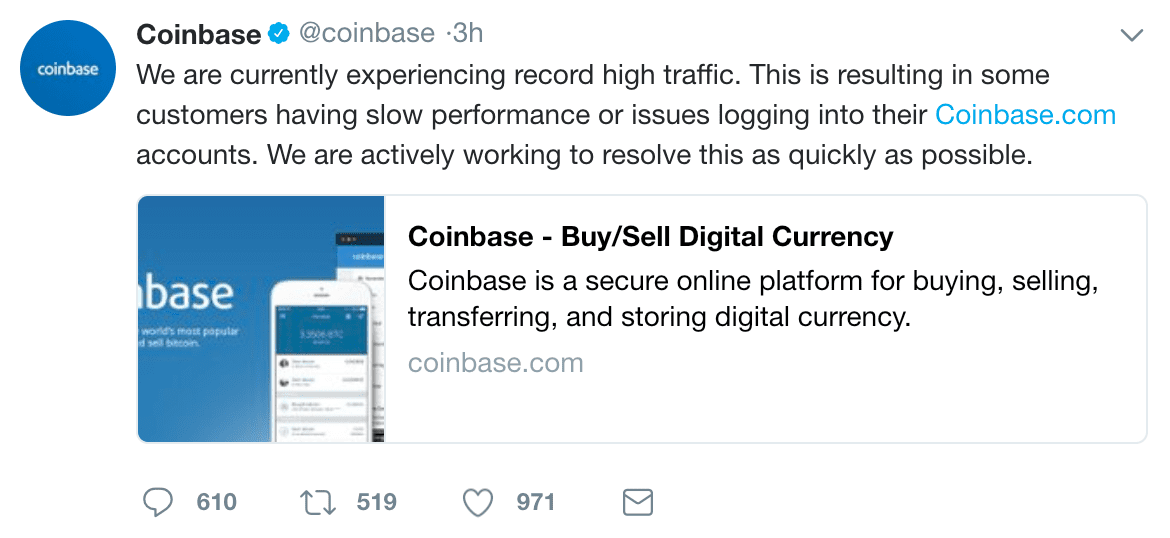

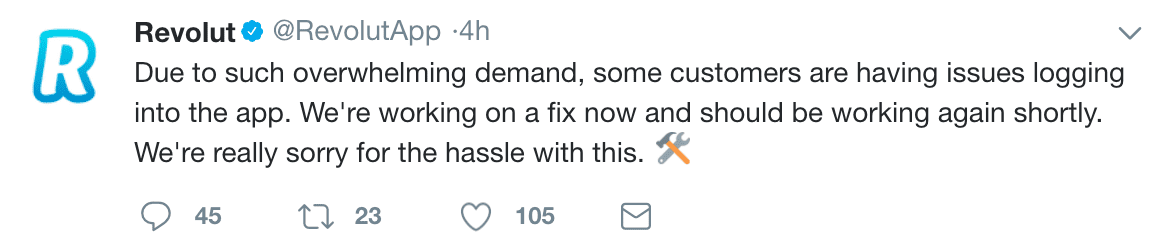

Last month we reported that digital currency wallet

Last month we reported that digital currency wallet

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.