Large swaths of cash flowed into the global fintech sector last week. All told, 26 companies brought in $1.06 billion. A quarter of the total was Square’s IPO ($243 million), another $330 million was debt, with the remaining $479 million being VC/angel funding.

Large swaths of cash flowed into the global fintech sector last week. All told, 26 companies brought in $1.06 billion. A quarter of the total was Square’s IPO ($243 million), another $330 million was debt, with the remaining $479 million being VC/angel funding.

In addition to Square, two companies topped $100 million: student and personal loan startup Earnest ($75 million equity; $200 million debt) and Australia’s ZipMoney ($1 million equity; $100 million debt).

Two Finovate alums landed new rounds: $5 million to Tuition.io which enables employers to help pay down employee student loan debt and Nous, a crowdsourced investment-information platform, which raised $290,000.

Year-to-date, the total raised is $17.7 billion, or about $24 billion counting the payments-company IPOs (Worldpay, First Data, Square).

Here are the fundings by size from 14 Nov to 20 Nov 2015:

Earnest

Alt-personal and student lender

Latest round: $275 million ($75 million equity; $200 million debt)

Total raised: $299.1 million ($99.1 million equity; $200 million debt)

HQ: San Francisco, California

Tags: Consumer, credit, lending, underwriting, loans, student loan refinancing

Source: Crunchbase

Square

Payment processor and small-business lender

Latest round: $243 million (IPO)

Total raised: $833 million

HQ: San Francisco, California

Tags: Consumer, SMB, payments, point-of-sale, mPOS, acquiring, merchant, credit/debit cards

Source: LA Times, Crunchbase

ZipMoney

Financing online consumer purchases

Latest round: $101 million ($1 million equity; $100 million debt)

Total raised: $101 million (includes $100 million debt)

HQ: Sydney, Australia

Tags: Consumer, SMB, B2B2C, financing, lending, underwriting, ecommerce, payments

Source: Crunchbase

Ebury

Global funds-transfer service for businesses

Latest round: $83 million

Total raised: $119 million

HQ: London, England, United Kingdom

Tags: Enterprise, SMB, accounts payables, payments, FX, trade finance

Source: Crunchbase

LQD Business Finance

Online small-business financing

Latest round: $30 million Debt

Total raised: $30 million Debt

HQ: Chicago, Illinois

Tags: SMB, commercial lending, credit, loans

Source: Crunchbase

Openhouse

Real estate discovery app

Latest round: $13.5 million

Total raised: $19.5 million

HQ: Santa Monica, California

Tags: Consumer, real estate, home buying, mortgage

Source: Crunchbase

Align Commerce

Payment service provider for global commerce

Latest round: $12.5 million

Total raised: $12.5 million

HQ: San Francisco, California

Tags: Enterprise, SMB, payments, bitcoin, FX, trade finance

Source: Crunchbase

Sensible Lender

P2P property lender

Latest round: $10.6 million

Total raised: $10.6 million

HQ: Kent, England, United Kingdom

Tags: P2P lending, investing, mortgage, underwriting, crowdfunding

Source: FT Partners

Hanweck Associates

Real-time risk analytics for financial institutions

Latest round: $10 million

Total raised: $10 million

HQ: New York City, New York

Tags: Security, risk management

Source: FT Partners

Card.com

Prepaid card platform

Latest round: $9 million

Total raised: $12 million

HQ: Santa Monica, California

Tags: Consumer, debit card, gift card, payments, card management

Source: Crunchbase

Intersections

Identity-protection services

Latest round: $7.5 million Post-IPO equity*

Total raised: Unknown

HQ: Chantilly, Virginia

Tags: Consumers, enterprise, security, credit report monitoring

Source: Crunchbase, BusinessWire

SalaryFinance

Payroll-based lender

Latest round: $6.1 million

Total raised: $6.1 million

HQ: London, England, United Kingdom

Tags: Enterprise, SMB, B2B2C, consumer credit, lending, underwriting, employee benefits

Source: Crunchbase

Tution.io

Student loan repayment service for employers

Latest round: $5 million

Total raised: $8.15 million

HQ: Santa Monica, California

Tags: Student lending, employee benefit, SMB, enterprise, Finovate alum

Source: Finovate

Prepaid Financial Services

Prepaid card services

Latest round: $3.8 million (at $75 million valuation)

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Consumer, SMB, prepaid cards, debit cards

Source: FT Partners

Vanare

Wealth management system for advisors

Latest round: $3.35 million

Total raised: $3.35 million

HQ: New York City, New York

Tags: Advisers, investing, asset management, robo-adviser

Source: Crunchbase

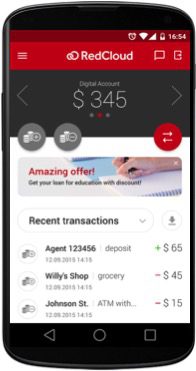

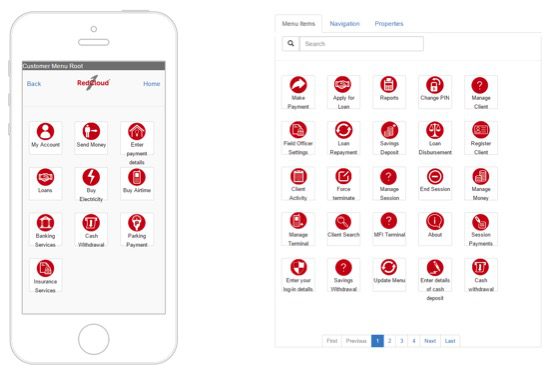

Peppermint Innovation

Mobile banking and payments platform

Latest round: $2.7 million

Total raised: $2.7 million

HQ: Australia

Tags: Payments, mobile, remittances, banking, Indonesia (market)

Source: FT Partners

GoodBox

Mobile ecommerce and payments platform

Latest round: $2.5 million

Total raised: $2.7 million

HQ: Bangalaru, India

Tags: SMB, payments

Source: FT Partners

ietty

Home discovery platform

Latest round: $1.6 million

Total raised: $4.0 million

HQ: Tokyo, Japan

Tags: Consumer, real estate, home buying, mortgage

Source: Crunchbase

iBox

Mobile point-of-sale solution

Latest round: $1.3 million Seed

Total raised: $4.8 million

HQ: Hong Kong, China

Tags: SMB, payments, mPOS, merchants, acquiring, hardware, credit/debit cards

Source: Crunchbase

Health Solutions One

Online health insurance broker

Latest round: $1 million Seed

Total raised: $2 million

HQ: Roswell, Georgia

Tags: Consumer, insurance, price comparison, lead gen

Source: Crunchbase

Bitwage

Bitcoin-based international payroll

Latest round: $750,000

Total raised: $750,000

HQ: Sunnyvale, California

Tags: SMB, enterprise, payments, human resources, cryptocurrency, payroll

Source: Crunchbase

Stampery

Proof of ownership via the blockchain

Latest round: $600,000

Total raised: $600,000

HQ: San Francisco, California

Tags: SMB, consumer, blockchain, security, contracts, security

Source: Crunchbase

Fintec Labs

Banking and insurance incubator

Latest round: $350,000 ($2.3 million valuation)

Total raised: $745,000

HQ: South Africa

Tags: Insurance, SMB, startups

Source: Crunchbase

Nous Global Markets

Crowdsourcing financial market predictions

Latest round: $460,000

Total raised: $1.6 million

HQ: London, England, United Kingdom

Tags: Consumer, trading, investing, gamification Finovate alum

Source: Finovate

POM

Secure invoice payment

Latest round: $200,000

Total raised: $200,000

HQ: Viaams-Brabant, Belgium

Tags: SMB, payments, accounting, accounts receivables

Source: FT Partners

ScramCard

Ultra-secure consumer payments device

Latest round: Undisclosed

Total raised: Unknown

HQ: Hong Kong, China

Tags: Consumer, B2B2C, credit/debit card, payments, security, token, hardware

Source: Crunchbase

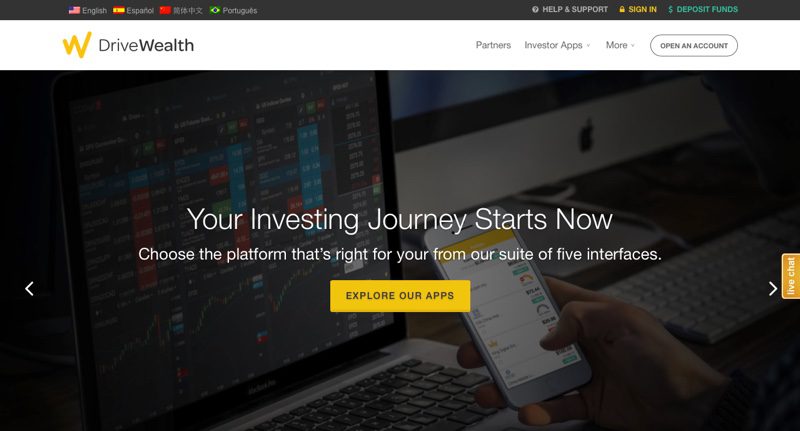

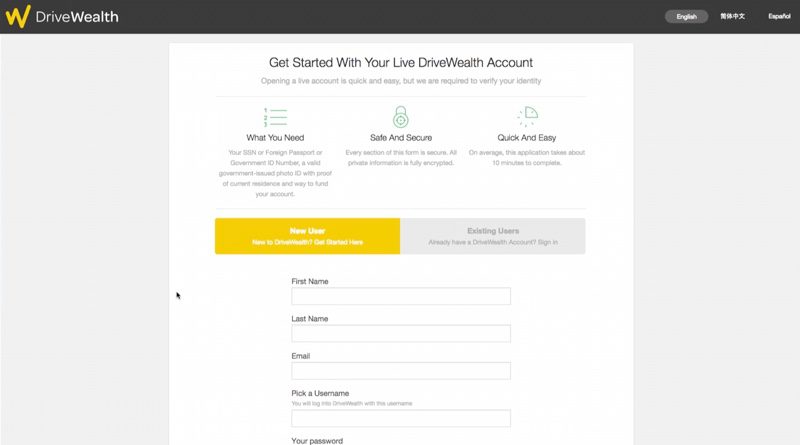

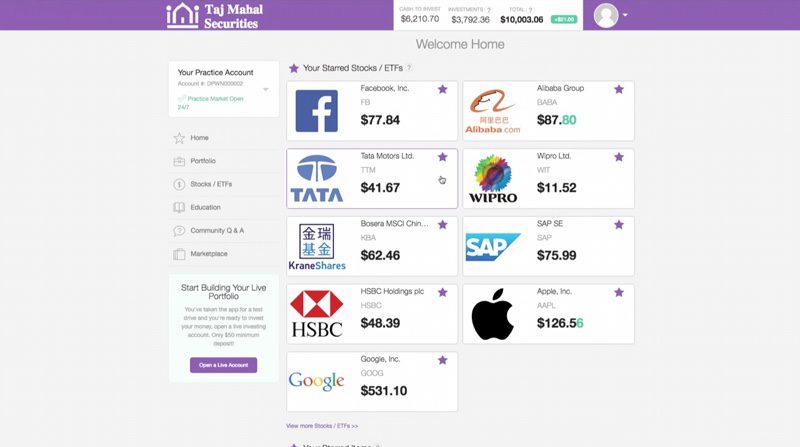

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”