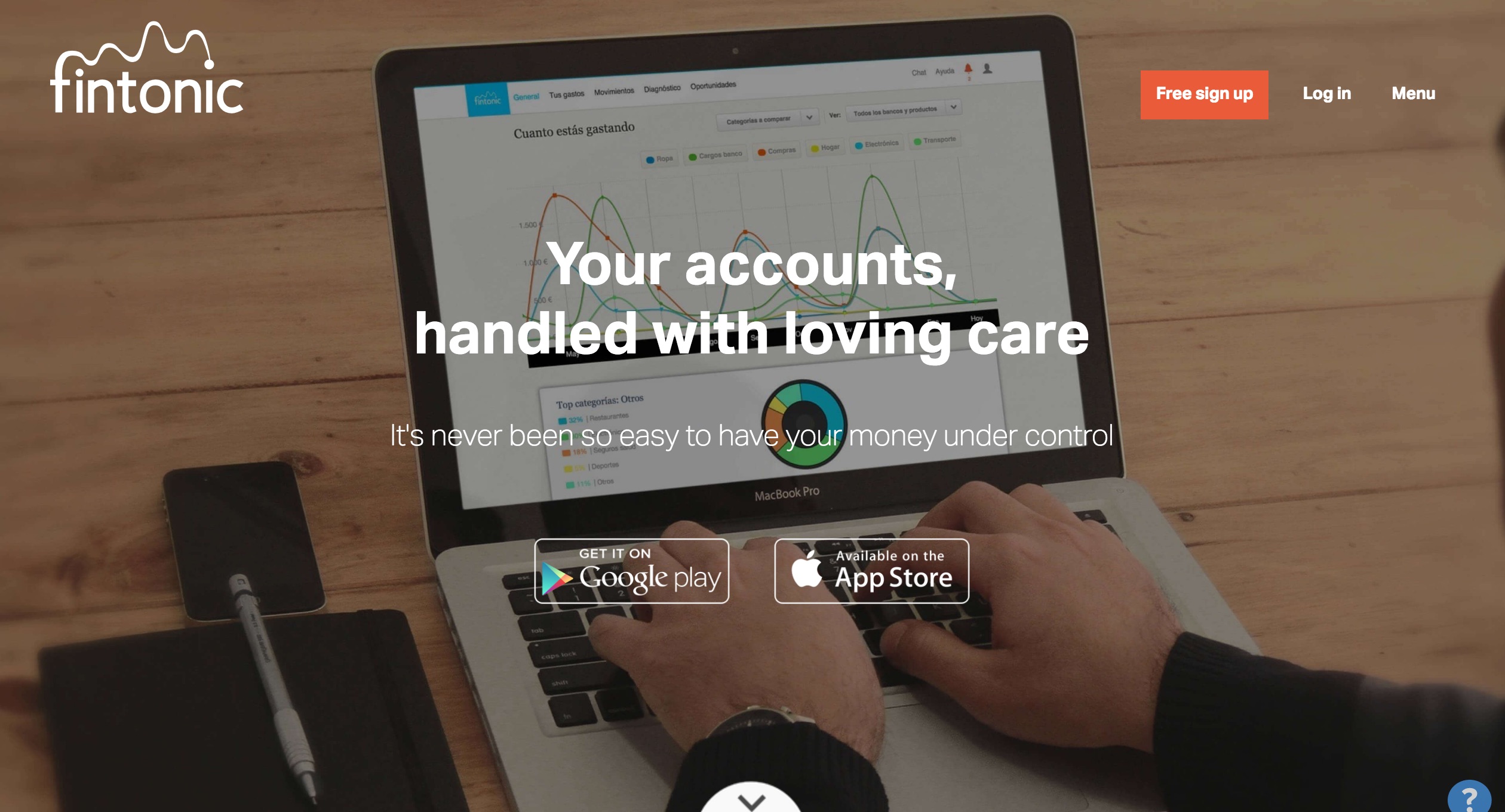

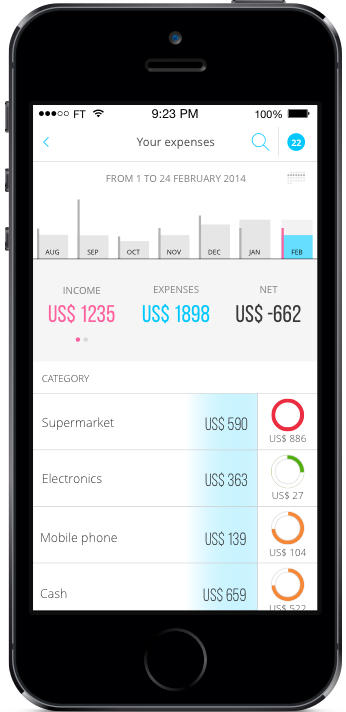

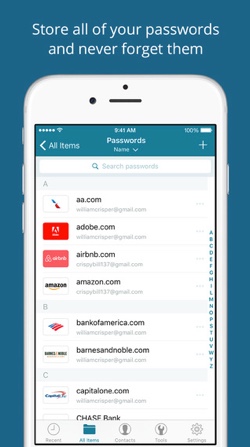

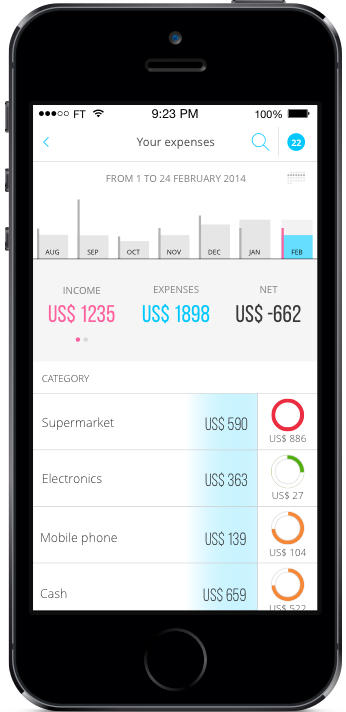

Fintonic’s mobile PFM app not only looks good, but also serves as an advocate to help consumers manage their financial health. The app combines big data and machine learning to provide a personalized experience and relevant offers for loan and insurance products.

Fintonic’s mobile PFM app not only looks good, but also serves as an advocate to help consumers manage their financial health. The app combines big data and machine learning to provide a personalized experience and relevant offers for loan and insurance products.

At FinovateSpring 2016, Fintonic introduced an alert and inbox system that delivers recommendations, product suggestions, and notifications about financial health. The company also showed its simple loan and insurance underwriting process that enables users to set up a contract in just a single click.

Fintonic was founded in the midst of the recent recession in Spain where consumer confidence in banks has dropped significantly. Therefore, Fintonic launched with a goal to be transparent and unbiased.

The app currently offers only loans, but insurance products will also be available soon; Fintonic already provides access to 50 insurance companies. The app has launched in Spain and is being tested in Chile with plans to launch in the U.K. and the U.S. in the future.

Company facts:

- Around 400,000 users

- Founded in 2012

- Based in Madrid, Spain

CEO Sergio Chalbaud demoing Fintonic at FinovateSpring 2016 in San Jose

CEO Sergio Chalbaud demoing Fintonic at FinovateSpring 2016 in San Jose

We interviewed CEO Sergio Chalbaud for more insight into the Madrid-based company. Chalbaud, who speaks three languages, has served as CEO of Fintonic since it launched in 2012. Prior to starting Fintonic, he was founder of Ideon (FinovateSpring 2011 alum), which launched in 2002, and also worked as VP of Chase Manhattan Bank.

We interviewed CEO Sergio Chalbaud for more insight into the Madrid-based company. Chalbaud, who speaks three languages, has served as CEO of Fintonic since it launched in 2012. Prior to starting Fintonic, he was founder of Ideon (FinovateSpring 2011 alum), which launched in 2002, and also worked as VP of Chase Manhattan Bank.

Finovate: What problem does Fintonic solve?

Chalbaud: The traditional banking model is not suited to solve the financial needs of today’s digital generations. They demand a customized experience, a relationship based on trust, and a fully mobile platform.

- Trust: Millenials and Gen-Xers don’t trust banks and would rather go to the dentist than listen to what banks have to say. Fintonic provides these generations with a trustworthy app that gives them unbiased advice and timely alerts.

- Full mobile experience: Fintonic offers a fully mobile experience, and the best example of this is with Fintonic’s loan process. Fintonic customers can contract a loan without paperwork, without a FICO score and with immediate approval. Funding of the loan takes less than 24 hours.

- Competitive products: Fintonic’s algorithm determines the best moment in time when a user may be in the market for particular services (e.g., loans, insurance renewals) and offers easy comparison to cheaper/better coverage options that would benefit the user more than blindly renewing their policy.

- Convenience: It’s important to know what the customer wants before they do. Fintonic uses more than 1,000 data points per user to understand the specific needs of each customer and their inclination to contract any financial product at a given period in time, providing a very customized experience. The customer can relax and Fintonic will anticipate its needs and provide a solution.

Finovate: Who are your primary customers?

Chalbaud: Millennials and Gen-Xers.

Finovate: Tell us about your favorite implementation of your solution.

Chalbaud: I really love Fintonic’s loan-contracting process, as it removes all the hurdles that typically exist when applying for a loan:

- From the beginning of the process, you know how much money you will be able to borrow. The process is also very straightforward and transparent for the customer.

- Fintonic solves KYC with a simple ID picture, which is validated again with information in their bank accounts.

Finovate: What in your background gave you the confidence to tackle this challenge?

Chalbaud: With more than 15 years of experience in banking, I have always been very technical about the banking experience in general. As a certified CFA and FRM, I graduated with an MBA from Chicago Booth School of Business.

One day I realized that banking was not just about numbers and instead, it’s about relationships and anticipating how fast the banking industry is changing and getting ahead of those changes. The banking sector has been slow to adapt, so together with my co-founders I decided to take action and create Fintonic. We knew we were well prepared with the skills to make it happen, but it was just a matter of pulling everything together to make it a reality.

Finovate: What are some upcoming initiatives from Fintonic that we can look forward to over the next few months?

Chalbaud: Fintonic’s platform is providing customers with a more efficient and friendlier way to take care of their money and solve their financial needs. Most recently, we implemented the loan process into Fintonic’s app, which streamlines the process for customers to apply and get accepted for loans. This was our most recent addition, but we are always looking for new and improved ways to help our customers better understand the impact of their financial behaviors.

Finovate: Where do you see Fintonic a year or two from now?

Chalbaud: In two years, we hope to prove that Fintonic is one of the most efficient banking models out there and one that gives the highest satisfaction to customers. We hope to become the preferred banking platform for people all over the world.

Sergio Chalbaud presenting Fintonic at FinovateSpring 2016 in San Jose:

“The app combines the same convenience and functionality of the previous version,”

“The app combines the same convenience and functionality of the previous version,”

Fintonic’s

Fintonic’s CEO Sergio Chalbaud demoing Fintonic at FinovateSpring 2016 in San Jose

CEO Sergio Chalbaud demoing Fintonic at FinovateSpring 2016 in San Jose We interviewed CEO Sergio Chalbaud for more insight into the Madrid-based company. Chalbaud, who speaks three languages, has served as CEO of Fintonic since it launched in 2012. Prior to starting Fintonic, he was founder of

We interviewed CEO Sergio Chalbaud for more insight into the Madrid-based company. Chalbaud, who speaks three languages, has served as CEO of Fintonic since it launched in 2012. Prior to starting Fintonic, he was founder of