“Insurtech” isn’t about providing financial assistance to distracted gamers who injure themselves playing Pokemon Go (though there is that). It’s a growing, thriving aspect of financial technology that is becoming a category of its own, apart from the world of payments, robo-advisers, and PFM that characterizes much of what we call “fintech.”

The new report just released from FT Partners (and available for free download) helps financial services execs better understand the rise of insurance technology. Prepare for the Insurtech Wave: Overview of Key Insurance Technology Trends is a 247-page research report that details trends in insurance distribution and administration, data and analytics; and sales, marketing, and engagement; and puts into context the opportunities from the “new technologies and transformative business models” that are “targeting all areas of the multi-trillion dollar global industry.”

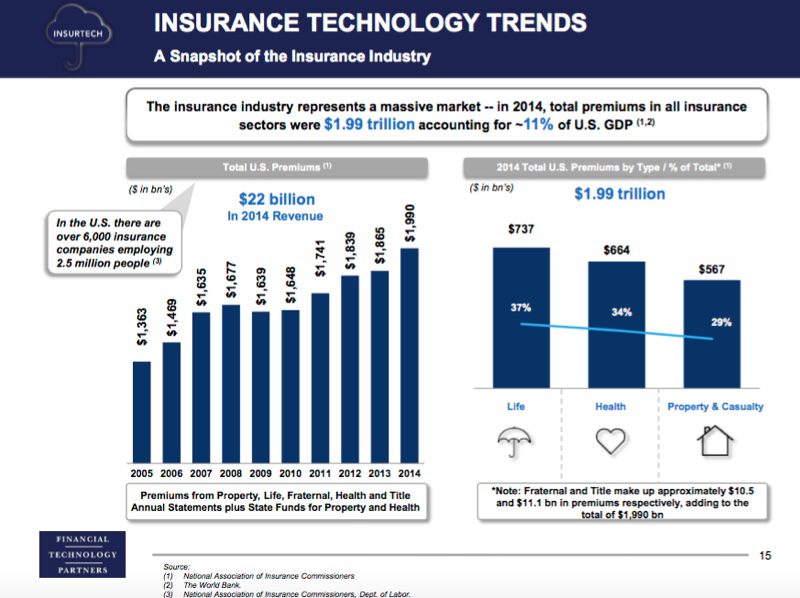

A few key metrics from the report:

- Total premiums for all insurance sectors in 2015: $2.0 trillion

- More than 6,000 insurance companies in the U.S. employ more than 2.5 million.

- Property and casualty (P&C) insurers generated $64 billion in net income in 2014. Life and health insurance companies generated $38 billion.

What makes insurtech especially interesting is where it sits at the nexus of the pace of technological innovation and the reality of an ever-evolving regulatory landscape. Prepare for the Insurtech Wave reveals an industry responding to this challenge in a variety of ways from starting ventures arms to teaming up with startups tackling key pain-points, as well as those best poised to take advantage of new technologies such as the internet of things. This, the report notes, has “huge implications across the insurance value chain.”

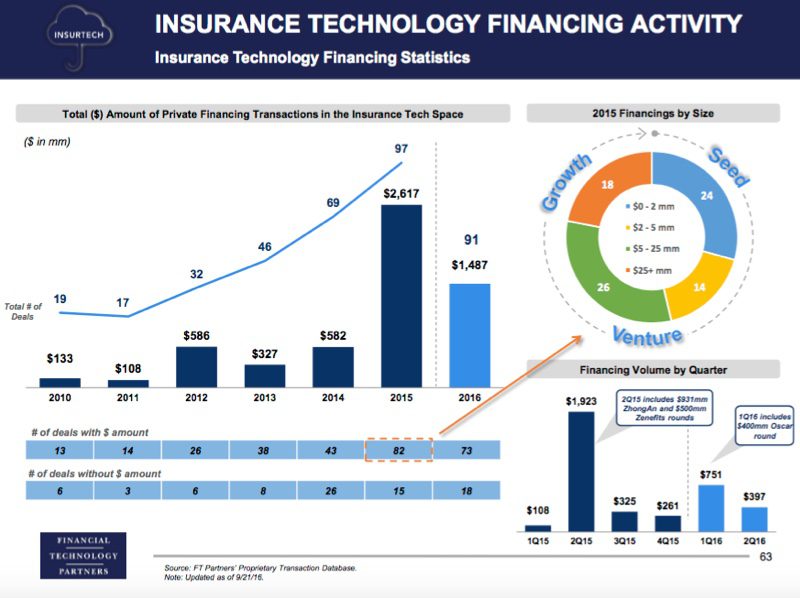

The report highlights the “disruptors” of insurtech, a group of 40 startups that includes Finovate alums CoverHound and Sureify, as well as what it calls “established tech-enabled companies” such as insurance-software developers Ebix and even 3D aerial measurement services and reports startup from Seattle, EagleView Technologies. Also listed are major recent insurtech M&A and financing transactions such as the $500 million raised by Zenefits and the $160 million to Clover.

Prepare for the Wave underscores the importance of convenience, speed, and transparency for the modern insurance consumer, encouraging the industry to embrace multi-channel engagement and new products like micro insurance. The report also looks at the role of the insurance agent, noting that a growing preference for insurance-shopping online—61% of consumers between the ages of 18 and 54 say they would purchase life insurance online in a recent PwC poll—is one of many factors likely to undermine one of the industry’s historically most relied-upon distribution channels. “At a time when life insurance ownership is plummeting,” the report reads, quoting the PwC poll, “life insurers are waking up to an inconvenient truth: Decades of relying on an agency-distribution system have left them woefully unprepared to survive in today’s consumer-driven economy.”

At the same time, the report notes that “the incumbents do not have their heads in the sand.” Note that:

- Among traditional insurers, 43% are planning to “acquire, or have already acquired, innovative startups to help expand digital capabilities.”

- More than half have “already invested” in social media, data mining, and predictive modeling

- Approximately 68% are embracing mobile technology.

Additionally, Ptolemus Consulting is cited for pointing out that insurance companies have “launched nearly 230 telematics programs worldwide, in twice as many countries as two years ago.” Telematics is the intersection of telecommunication and informatics, and is a part of the internet of things (IoT). Specifically, it refers to the collection and transformation of data via sensors in a “connected” vehicle or building for the purpose of risk-assessment. The report concludes with an extensive Selected Transactions section, detailing fundraising, mergers, acquisitions, and other relevant deals involving insurtech companies.

About FT partners

Founded in 2001 by Steve McLaughlin, CEO, Financial Technology Partners is the only investment banking firm dedicated exclusively to financial technology. FT Partners—named Investment Banking Firm of the Year in 2016 and Deal Maker of the Year in 2015—is a long-time sponsor of Finovate events and has offices in San Francisco and New York.