Private equity firm Motive Partners will become a majority shareholder in Finantix, a provider of digital services for the private banking, insurance and wealthtech sectors, reports Antony Peyton of Fintech Futures (Finovate’s sister publication).

Financial details were not disclosed. Both firms are a bit vague but Motive will support the company and the founders (Ralf Emmerich and Alessandro Tonchia) in “extending the functional footprint of the product and in accelerating geographic expansion”. The latter means Europe, Asia and to enter the U.S. market.

Scott Kauffman, partner at Motive Partners, said Finantix has demonstrated its ability to create a “compelling product, bringing a leading technology platform to an ever-increasing set of blue chip clients”.

Finantix’s founders and the management team will continue to lead the company.

The company has over 250 staff in seven cities and a customer base in more than 45 countries. Some of its clients include Rothschild Bank, Crossbridge Capital, and DBS.

Motive Labs, the operational and technology team of Motive, will also work with Finantix.

Back in March, Finantix acquired Singapore-based Smartfolios, a creator of quant-enabled investment tools. No financial details in that deal as well.

As reported last year, Motive powered up and revealed its plans to invest in fintech firms in the U.K. and U.S.

According to its Form D filed with the Securities and Exchange Commission (SEC) in the U.S, Motive was looking to raise $150 million.

“Our mission is to back and build the next generation of financial technology businesses to transform markets, models and society,” the company said on its website.

Based in Venice, Italy, and founded in 1994, Finantix demonstrated its Banking Assistant solution at FinovateEurope 2013.

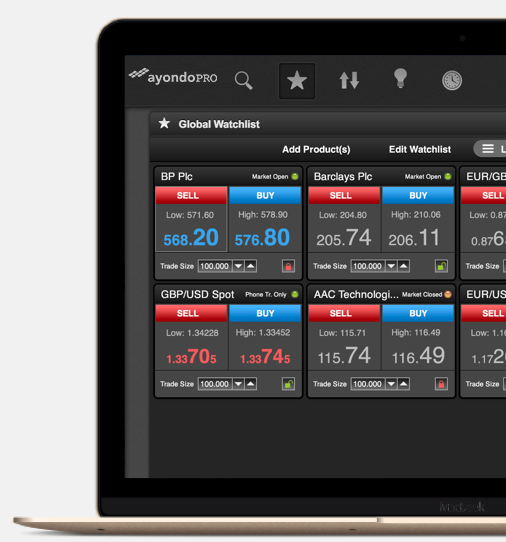

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.