As parts of the world inch toward a new normal in the face of the COVID-19 pandemic, fintech companies – including our Finovate alums – are increasingly finding their footing in an environment of health and financial insecurity. Companies are developing solutions to make it easier for small businesses, for example, to access relief funding. Others are helping consumers secure health care benefits and rewards, or giving SMEs and micro-entrepreneurs no-fee access to their services and solutions.

And while some fear that this global public health crisis heralds the end of globalization, alums like TransferWise and SoFi are busy setting up shop in places like the UAE, and making acquisitions that enable them to launch new solutions in markets like Hong Kong. Other Finovate alums are busy making friends and influencing innovation by combining data extraction technology with mortgage servicing, or leveraging digital identity technology to support eKYC for e-commerce and gaming.

COVID-19 remains a serious threat. As the number of cases worldwide nears three million and the number of deaths rise above 207,000 (985,000 cases and 55,000+ deaths in the U.S. alone), we are still likely closer to the beginning of this challenge than we are to its conclusion. But as Forrester Research analyst Alyson Clarke suggested in a recent Finovate podcast, the time to prepare for life after the crisis – as odd and uncomfortable as it may be – is often when the crisis seems at its worst.

Fintech in Extraordinary Times: Codes of Trust in the Age of Crisis

Finovate podcast host Greg Palmer sat down with Dr. Louise Beaumont to discuss in the impact of the global COVID-19 pandemic on the economy and the fintech ecosystem. Co-Chair of the Chair Open Banking & Payments Working Group at Tech UK, Beaumont works with lawmakers and regulators to drive positive disruption: helping corporates cope with it and enabling startups to exploit it.

A frequent speaker and lecturer, Beaumont has delivered keynote addresses to Finovate audiences on topics ranging from platformification in banking to the role of emerging codes of trust in financial services.

Finovate Newsletter Goes Bi-Weekly

Coming soon to an inbox near you, our Finovate newsletter soon will switch from a daily offering to a new, twice-weekly delivery. Whether you read us for the latest news on our Finovate alums or for a look at top trends in fintech, stay tuned as our new format helps you keep track of your favorite fintech upstarts, as well as gain new insights from some of our industry’s most perceptive analysts and observers.

Here is our weekly roundup of news from our Finovate alums.

- Lending-as-a-Service innovator ezbob introduces CBILS (Coronavirus Business Interruption Loan Scheme) eligibility and credit assessment engine.

- Fenergo launches cloud-based, digital remote account opening solution to help SMEs in the U.S. secure PPP (Paycheck Protection Program) funding faster.

- TransferWise goes live in the UAE.

- The Logic looks at Cinchy’s plan to develop a “data collaboration command center” to help Canadian health organizations manage the COVID crisis.

- Ocrolus brings its data extraction and analysis technology to mortgage servicing platform Brace.

- Voleo announces pilot project to optimize data for tax reporting for independent broker dealer Haywood Securities.

- StrategyCorps launches In This Together campaign to extend health-related benefit to the customers and members of banks and credit unions free of charge.

- Fenergo inks OEM agreement with IBM to combat financial crime.

- SoFi acquires parent of Hong Kong-based online brokerage firm 8 Securities, bringing SoFi Invest to the Hong Kong market.

- Diamond Credit Union partners with financial literacy specialist Zogo Finance.

- Blackhawk Network teams up with Rybbon to provide digital prepaid rewards.

- CRIF Realtime launches COVID-19 Credit Passport to help SMEs present an accurate portrait of their finances to potential lenders.

- Ocrolus to support income verification for credit decisioning services provider FormFree.

- U.K. online investment manager Nutmeg integrates with Yolt in an embrace of open banking.

- Trustly teams up with Swedish insurance firm Folksam to make it easier for students to make insurance payments and get their insurance claim payouts.

- Digital asset security platform Curv Air debuts its Curv Air Gap signing solution with eToro.

- Currencycloud launches pilot program to provide SWIFT gpi tracking capabilities to clients via API.

- ETRONIKA’s BANKTRON to power digital banking for Baltic International Bank.

- Jumio teams up with Playtech to provide remote onboarding and eKYC for gaming operators.

- Kofax and ImageTech Systems collaborate on loan processing solution to help financial institutions process COVID-19 related assistance faster.

- Fiserv teams up with Deluxe to bring merchant services – such as access to the CloverPOS platform – to SMEs.

- Experian and Funding Xchange team up to offer eligibility portal for borrowers seeking to access COVID-19 related relief funds.

- Bankjoy partners with a trio of credit unions – Estacado FCU, Prospectors CU, and Discovery CU – with a combined $293 million in assets and 22,000 members.

- Insuritas announces strategic partnership with Salesforce and Veruna as it unveils its iInsure insurance agency management ecosystem.

Finovate Alumni Features and Profiles

Empyr Acquired by Augeo, Becomes Figg – Under the agreement, Empyr will rebrand as Figg, combining Augeo’s card-linking technology with Empyr’s publisher experience. Figg will benefit from Augeo’s existing 60 million users and $300 billion in transaction volume for loyalty offers.

TransferWise Brings its Money Transfer Innovations for Banks to Mambu – Mambu will leverage TransferWise’s TransferWise for Banks solution via API, giving its clients an out-of-the-box solution that allows them to focus on building a quality user experience and expanding their offerings.

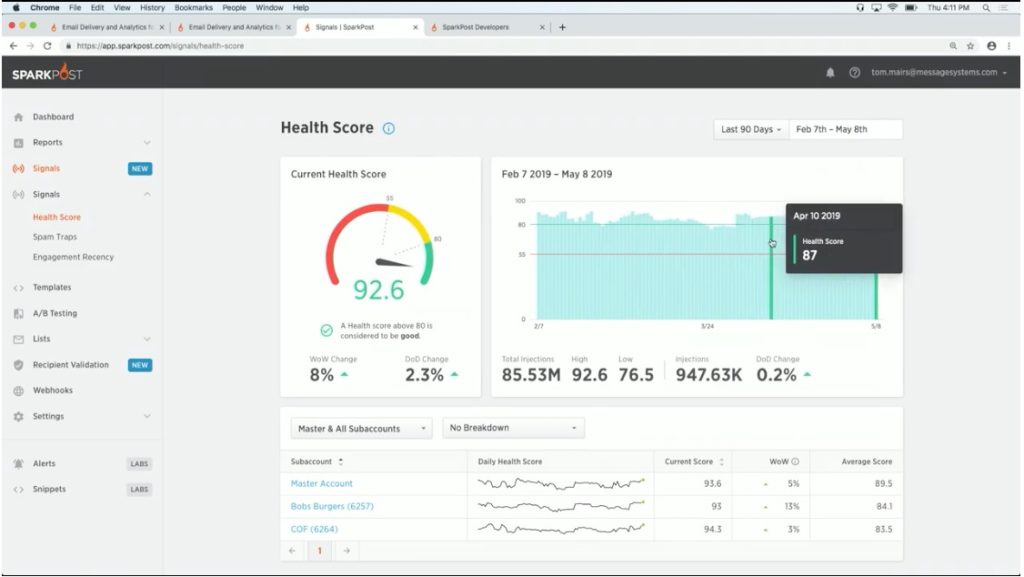

Email Specialist SparkPost Celebrates Fifth Anniversary – SparkPost, which celebrated the fifth anniversary of the launch of its cloud-based solution earlier this month, is one of the companies innovating in the email delivery and analytics space.

CuneXus Strikes Strategic Partnership with TransUnion – The collaboration matches CuneXus’ Perpetual Loan Approval platform with TransUnion’s vast data assets to deliver relevant brand experiences to consumers quickly, securely, and via the digital channels they increasingly prefer.

Varo Gets Moven: Transition to Enterprise Sends Customers to Digital Banking Upstart – Moven will transition its customers to San Francisco, California-based Varo Money, which is in the process of securing its status as a challenger bank in the U.S.

How the West Was Won: A Salute to the Innovators of FinovateSpring – What have the companies that demonstrated their latest technologies at our west coast fintech conference last spring been up to in the months since then?