This post is part of our live coverage of FinovateFall 2015.

Our first presenter of day two at Finovate is Bizfi, demonstrating how it helps with lead monetization in business financing:

Our first presenter of day two at Finovate is Bizfi, demonstrating how it helps with lead monetization in business financing:

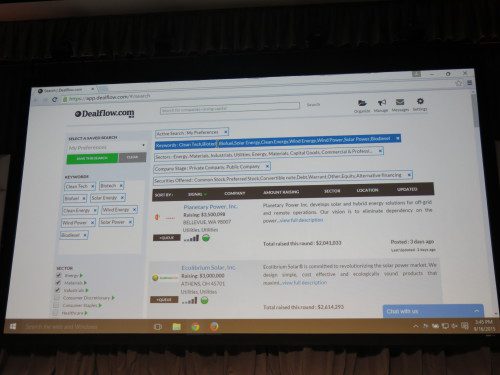

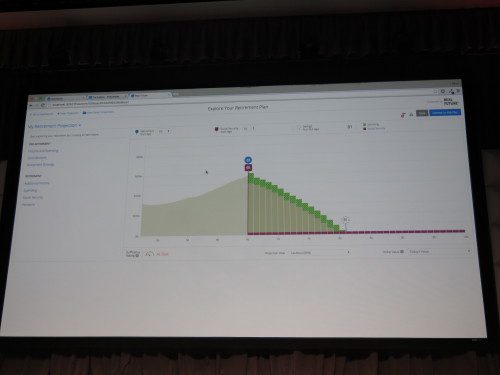

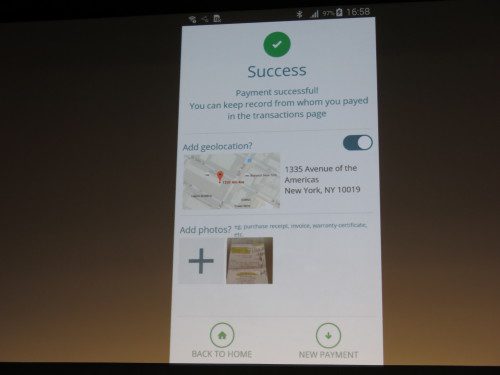

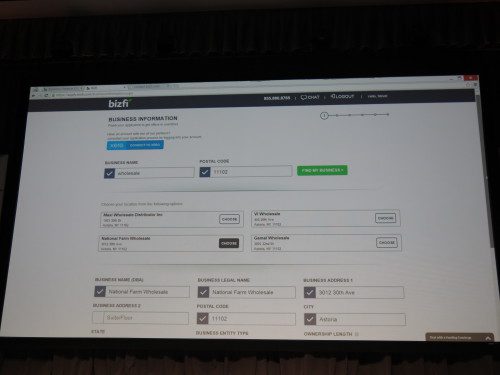

At FinovateFall, Bizfi will be highlighting its aggregation silo, which the company is now making available to partners as a white-label or co-branded solution. Bizfi’s aggregation platform enables sales offices and/or partners to maximize lead monetization, while taking advantage of economies of scale and scope, powered by data science and technology. The proprietary technology behind the aggregation silo is further supported by strategic relationships with more than 35 funding partners. For potential customers, the presence of the aggregation silo translates into greater choice, efficiency, and convenience.

Presenters: Stephen Sheinbaum, founder, and Walt Levengood, chief strategy officer

Product launch: April 2015

Metrics: $15 million raised in equity in 2006 from a handful of angels; currently raising its first round of institutional equity; ~$100 million of debt (senior, mezzanine, and subordinated); LTM revenues $69.2 million; LTM EBITDA $15.3 million; YTD production ~$257 million; $1.3 billion+ provided to ~26,000 customers; 175 employees.

Product distribution strategy: Direct to business (B2B), through financial institutions, through other fintech companies and platforms

HQ: New York City, New York

Founded: May 2005

Website: bizfi.com

Twitter: @bizfinyc