If there was ever a question if Venmo has achieved mainstream status, today’s news has the answer: The startup – owned by online payments processing company Braintree, which PayPal purchased for $800 million in 2013 – just exceeded $1 billion in payments processed in the month of January, the highest volume in a single month.

This is more than 2.5x the volume Venmo processed in January 2015 and more than 10x the amount processed in 2014.

Venmo’s short blog-post announcing the news doesn’t comment much on the achievement, other than to say, “We thought this was a pretty big milestone, so we wanted to share it with you.”

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.

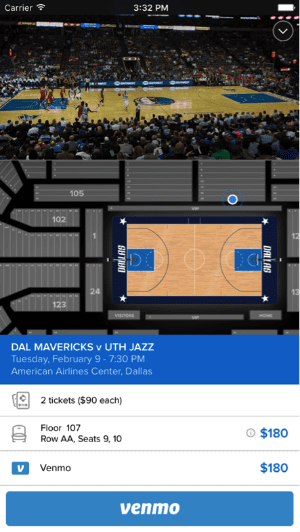

This week’s announcement comes on the heels of Venmo’s report that it plans to start monetizing its service by opening Braintree’s iOS v4 SDK and Android v2 SDK to U.S. merchants. Payments will be free for end users, and merchants will be charged 2.9% plus $0.30 for each transaction. Food delivery service Munchery and event ticket seller Gametime (pictured right) are piloting the program with a limited number of beta users.

Braintree debuted Venmo Touch at FinovateSpring 2013. More recently, at FinDEVr San Francisco 2015, PayPal’s Justin Woo discussed how developers can increase checkout conversion.

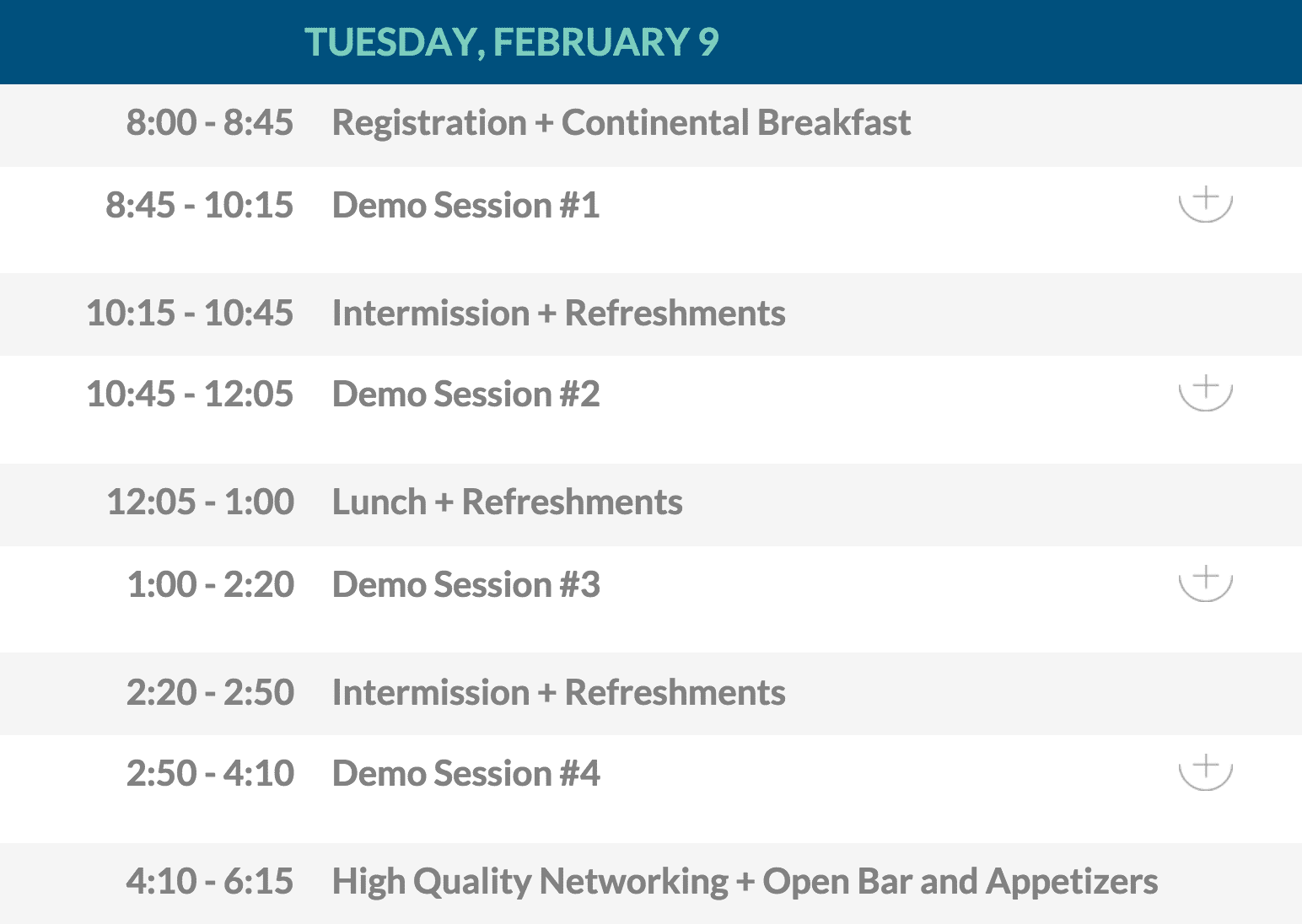

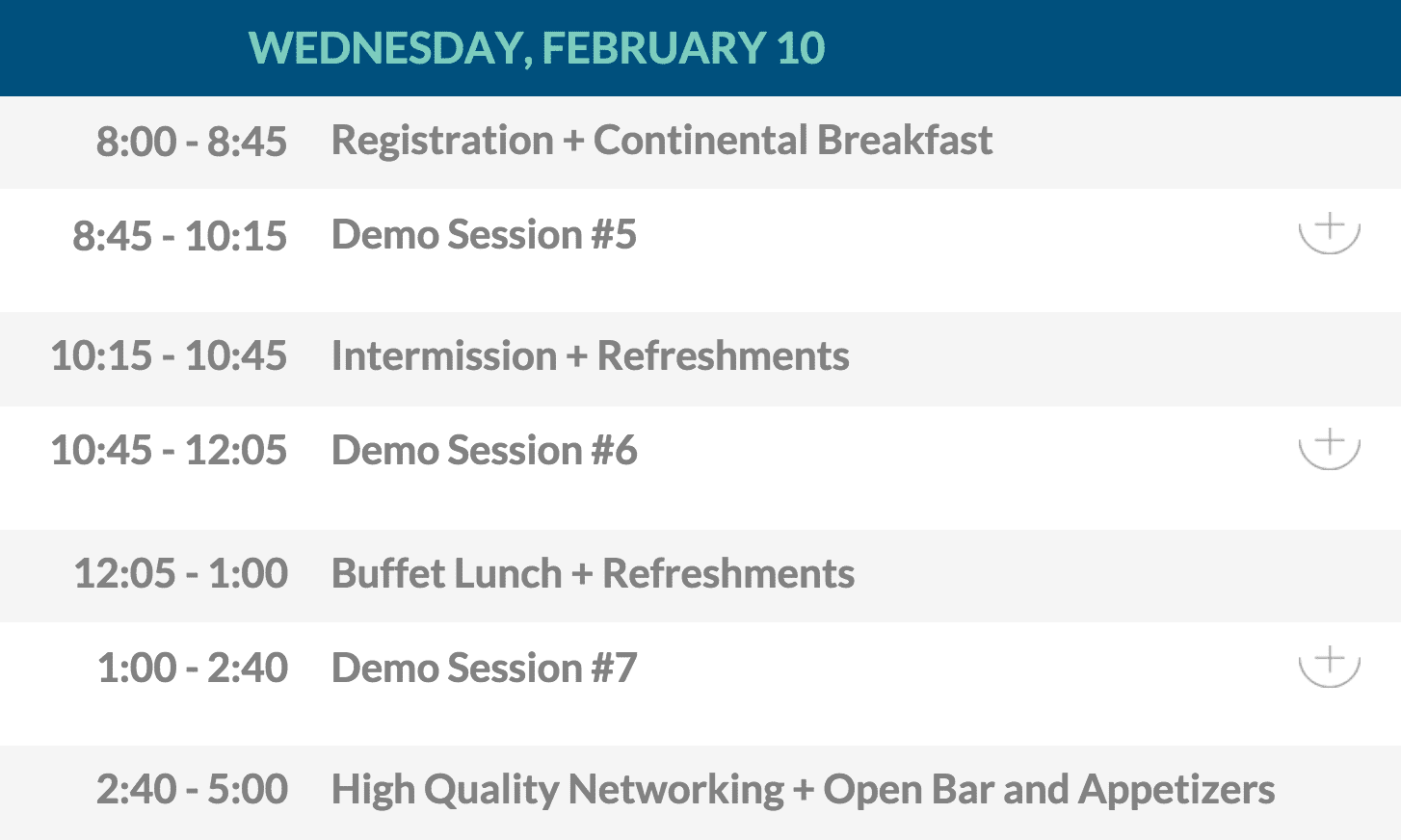

You can catch Braintree’s latest presentation to developers at FinDEVr New York 2016 next month. Register now to save your seat or send your developer.

We’re

We’re