Gro Solutions, a subsidiary of Mobile Strategy Partners that offers digital banking services for financial institutions, launched a new addition to its mobile account opening solution at FinovateFall earlier this year.

Company facts:

- Headquarters: Atlanta, Georgia

- Founded: 2015

- 30 full-time employees

Since Gro’s founders have all worked in traditional banks, they understand the need for an easy onboarding process. With its new carrier data integration, Gro Account Opening goes beyond typical driver’s license-capture with an alternative for customers who may be uncomfortable or unable to upload their license.

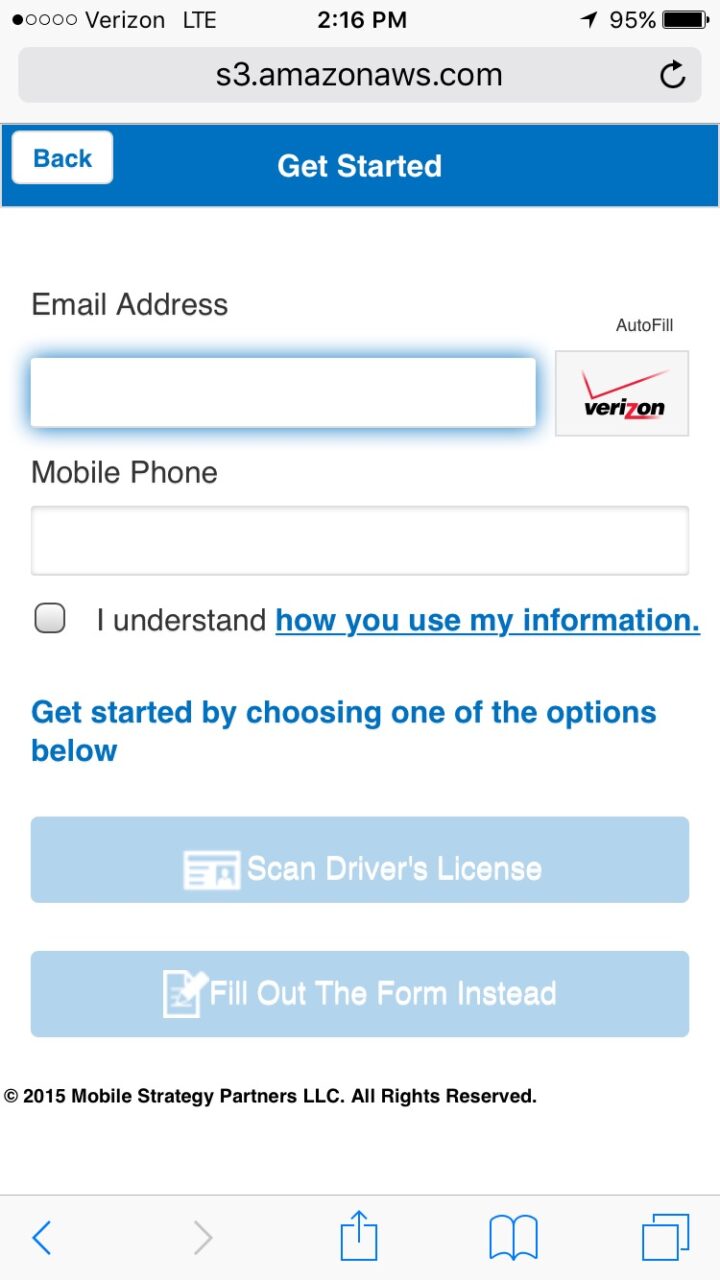

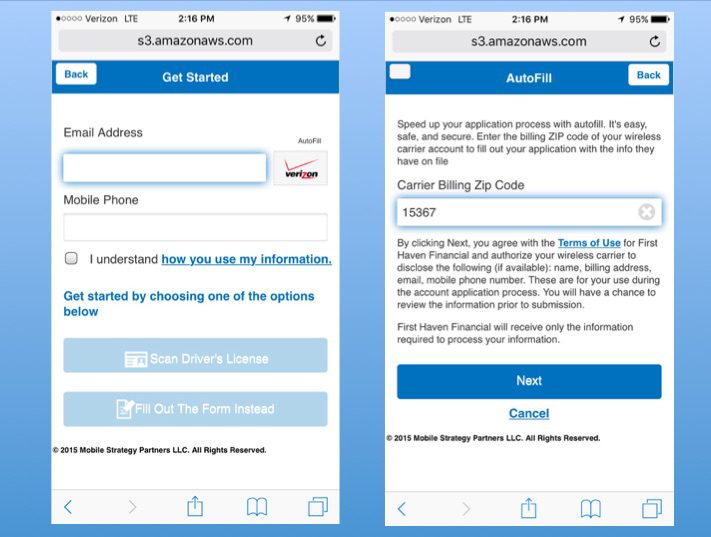

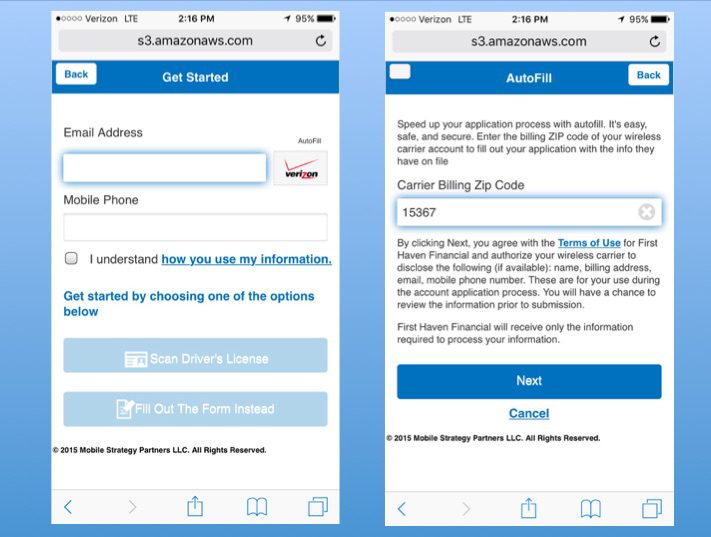

Instead of pulling data from a photo ID, Gro uses cell phone carrier data to verify identity and meet KYC and AML requirements. Here’s how it works: When the user applies for an account, GRO detects their mobile carrier; in this case, Verizon (screenshot left). When they click on the Verizon logo, GRO shows a disclosure and requests their ZIP code to verify the account (screenshot right).

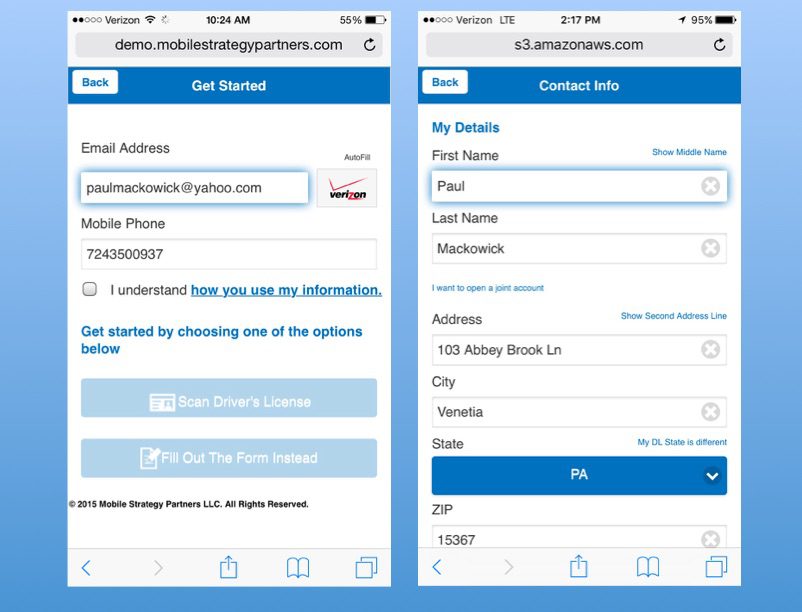

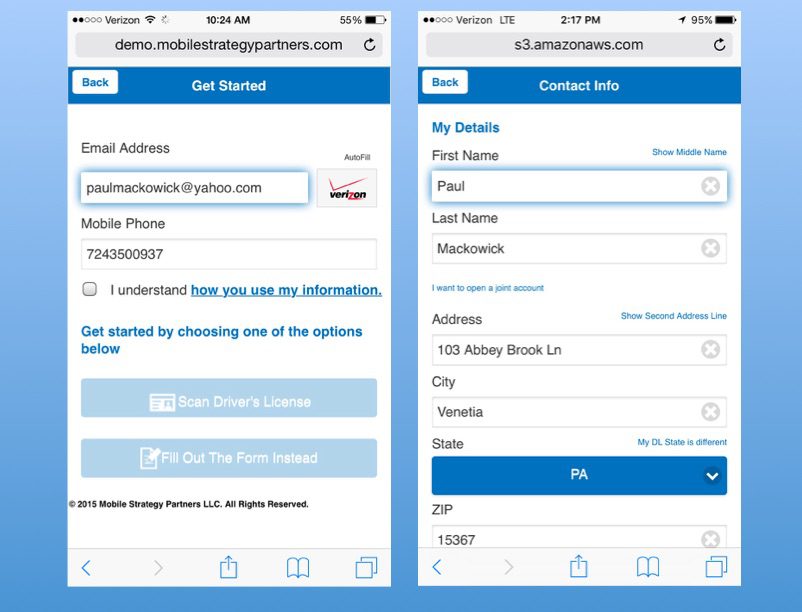

Pulling data from their Verizon account, GRO automatically populates the form.

After verifying the Verizon information, customers manually enter sensitive information such as Social Security Number, date of birth, and mother’s maiden name. Next, GRO validates their email address and sends disclosures and legal documents.

After accepting the terms and conditions and signing the agreement, the customer answers out-of-wallet questions from Experian, TransUnion, or LexisNexis, and the process is complete.

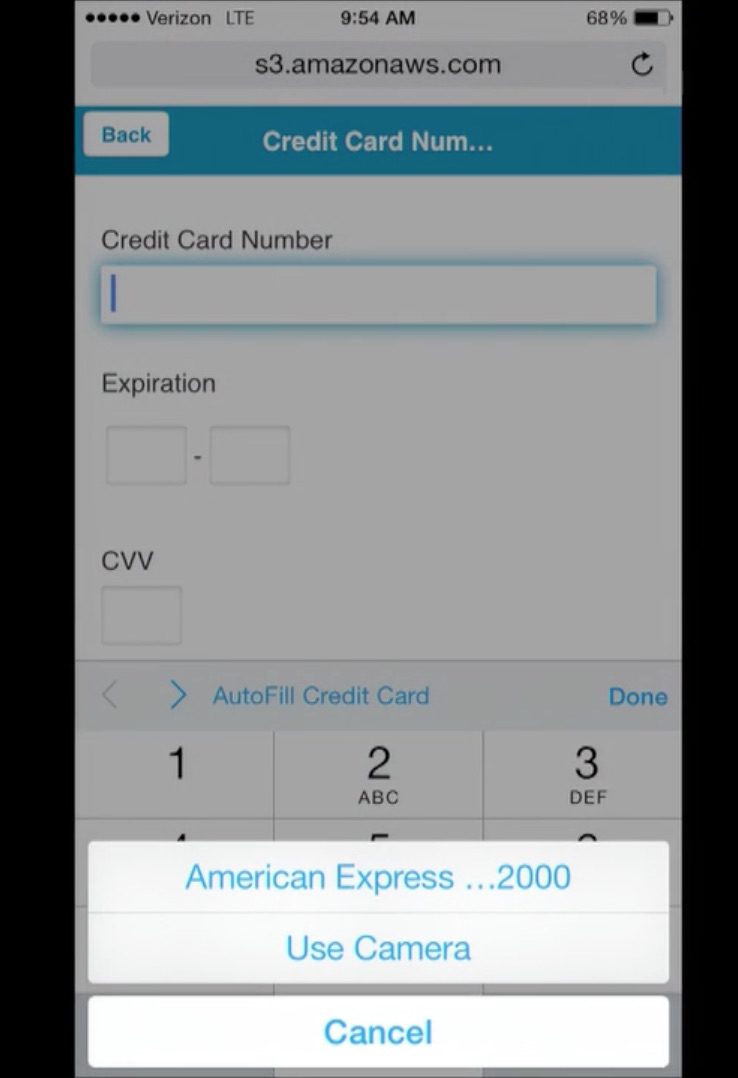

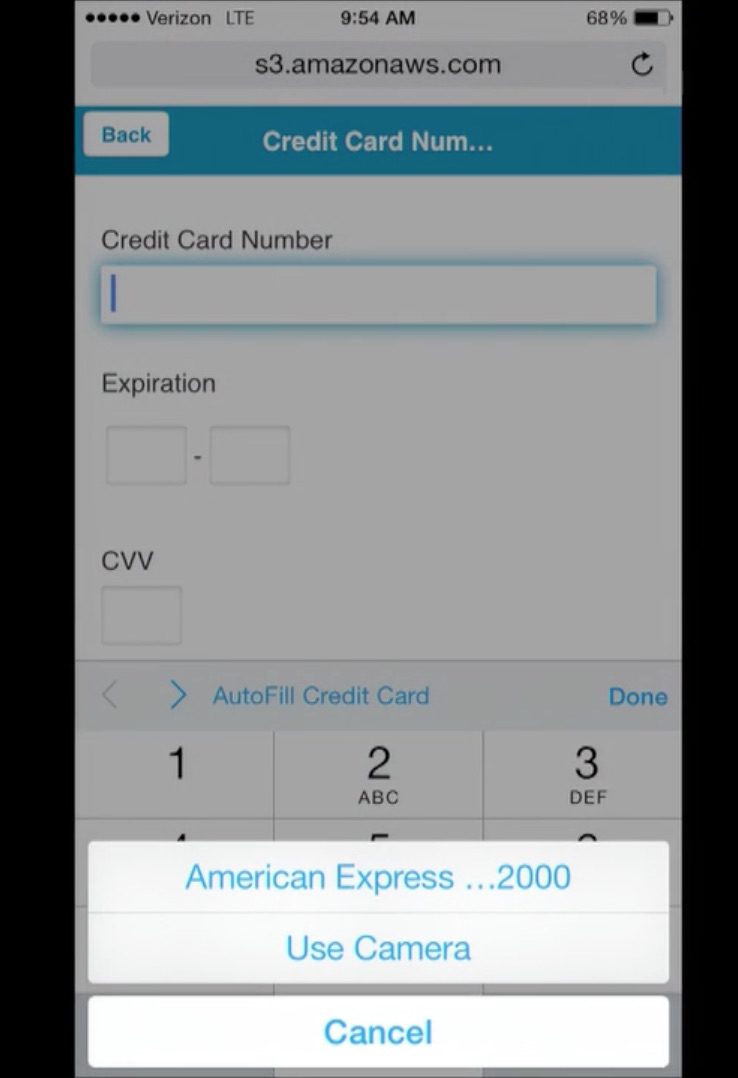

To fund their new account, the user snaps a photo of their credit card using their mobile camera (see below) and signs their screen.

Gro also creates additional layers of security by integrating geolocation and parsing out email addresses to match the applicant’s name and/or company name.

What’s next?

The company is working on using data from LinkedIn to authenticate users with questions such as, “Where did you work 10 years ago?”

This fall, Gro was recognized by American Banker and BAI as a “fintech company to watch” as part of the 2015 FinTech Forward rankings.

Gro Solutions CEO David Eads and CRO Paul Mackowick demoed Gro Account Opening at FinovateFall 2015 in New York City, as seen here: