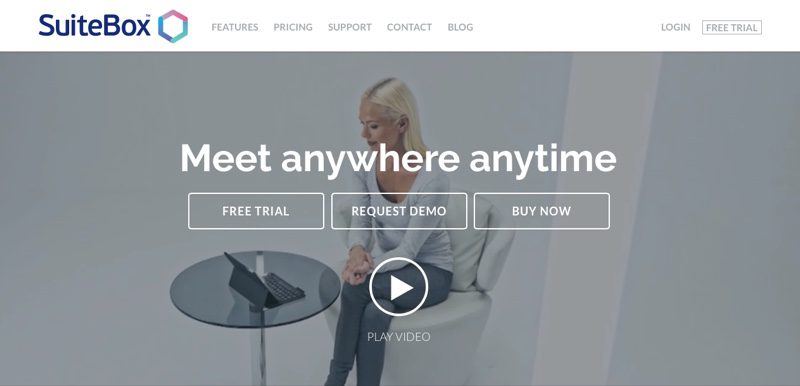

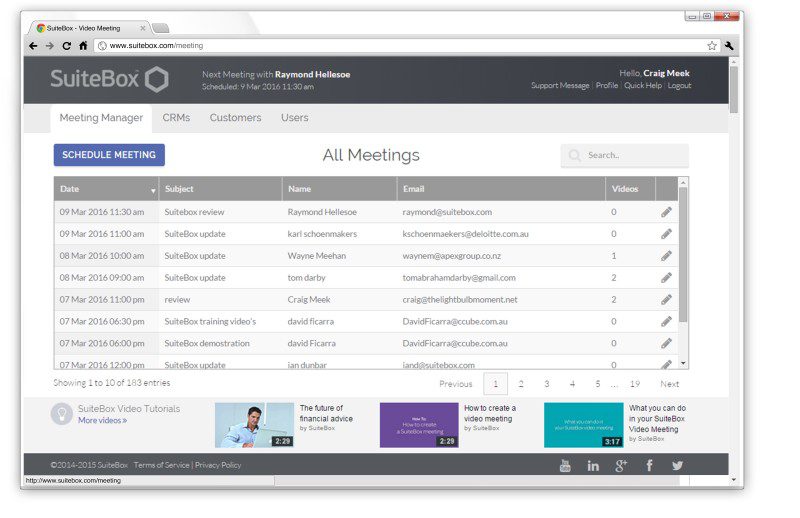

SuiteBox provides professionals in financial services and other fields with the kind of multi-channel, interactive experience we’ve always wanted from the internet. With just a smartphone, tablet, or laptop, professionals can build and manage secure, virtual meeting rooms and use these private, virtual spaces for conference calls, document collaboration, screen sharing, embedded web forms, e-signatures and more. Everything in the session can be recorded in full or in part for future reference. The technology is available as both a standalone solution or via a fully integrated white-label API.

“SuiteBox does everything that you can do in a physical meeting and more,” said Ian Dunbar, country manager for SuiteBox Australia.

Company facts:

- Founded in March 2013

- Headquartered in Auckland, New Zealand

- Richard Mannell is CEO

SuiteBox Australia Country Manager Ian Dunbar demonstrated his company’s technology at FinovateEurope 2016 in London.

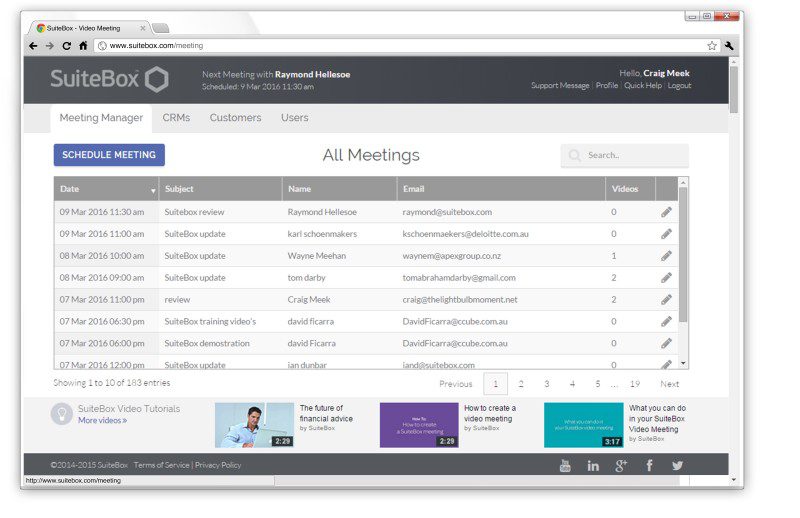

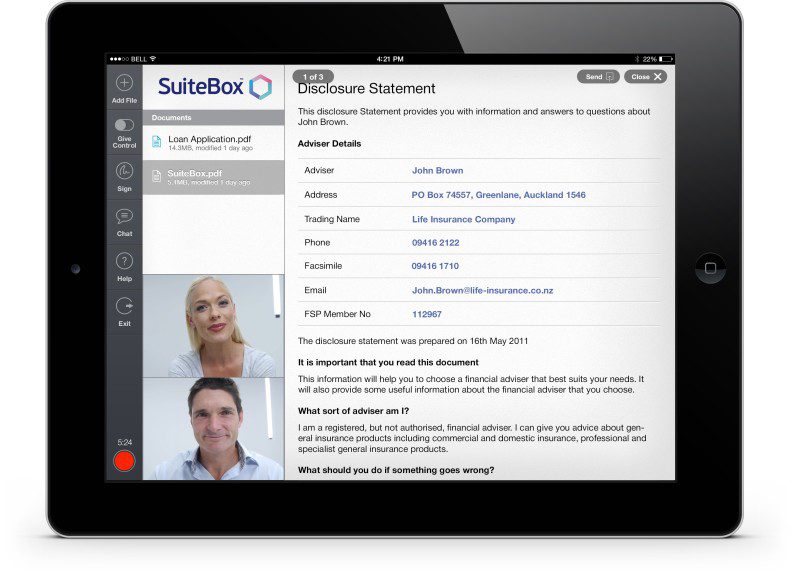

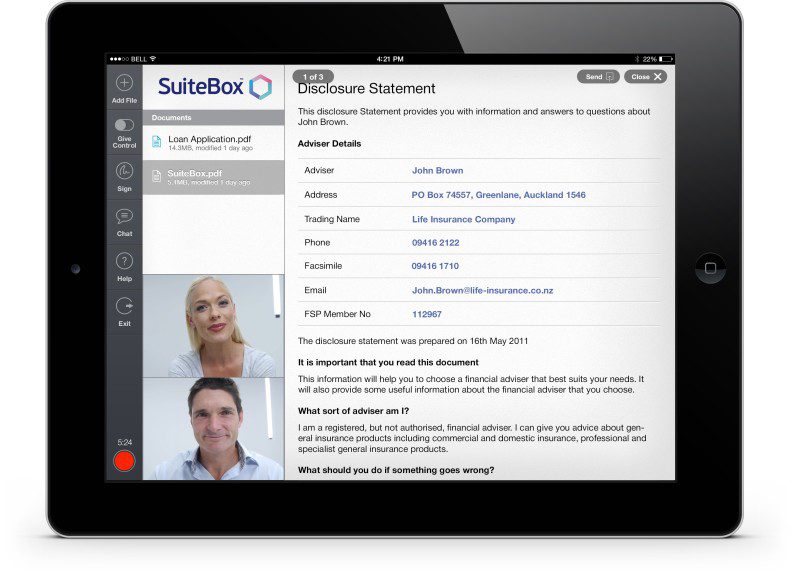

In his demonstration at FinovateEurope, Dunbar and his team showed a fully white-labeled virtual meeting space. He demonstrated a sample insurance transaction showing off the platform’s mutually accessible web forms, video conferencing, session recording, and e-signatures. “Importantly,” Dunbar added, “this virtual meeting room is now open and available to be used at any time. They can come back in. They can have a meeting. They could drop documents off for each other to have a look at. They could even leave a video message or a chat message.”

“Effectively that gives you a meeting space that can be used on an ongoing basis,” Dunbar explained. “You don’t have to be back actually having a physical meeting.”

We spoke with Ian Dunbar (circle photo), country manager, Australia, during rehearsal day at FinovateEurope. We followed up with a few questions about SuiteBox and how entrepreneurs and businesses can take advantage of the technology.

We spoke with Ian Dunbar (circle photo), country manager, Australia, during rehearsal day at FinovateEurope. We followed up with a few questions about SuiteBox and how entrepreneurs and businesses can take advantage of the technology.

Finovate: What problem does SuiteBox solve?

Ian Dunbar: SuiteBox is solving one of the biggest challenges of professional services globally. How do you maintain and grow your client relationships, manage and close business and increase efficiency and profitability into your business. All when we are faced with time-poor clients, congested cities, and the need manage paper, post, scanning and signing of documents.

SuiteBox solves all of this by delivering everything you can do in a physical meeting and more, including video meetings, document sharing and collaboration, electronic signing and selective recording.

This is all delivered through the SuiteBox MeetingSpace, a secure private collaboration space that remains permanently open and accessible throughout the relationship life of the professional and their client.

Finovate: Who are your primary customers?

Dunbar: Financial advisers, insurance providers, banks, mortgage brokers, stock brokers, educators; legal, pension fund, and real estate professionals.

Finovate: How does SuiteBox solve the problem better?

Dunbar: SuiteBox is the only tool globally that combines all the tools to close business and get the job done. SuiteBox eliminates the need to juggle video tools, e-signature tools and emails. SuiteBox is also the only tool that delivers a permanently open MeetingSpace, that allows the participants to enter and leave the space at their convenience, share and transact documents, and only meet via video when needed.

Finovate: Tell us about your favorite implementation of SuiteBox.

Dunbar: SuiteBox has launched a highly integrated solution with Midwinter Financial Services’s AdviceOS adviser desktop in Australia. In this implementation, the Adviser has a seamless experience that allows:

- the Adviser to schedule virtual meetings and launch SuiteBox from the AdviceOS desktop

- the Adviser to white label SuiteBox to their own branded MeetingSpace

- documents to be sourced from AdviceOS and saved directly back to the client record in AdviceOS

- video records to be stored for future reference, and be easily accessible from the client record within AdviceOS.

Finovate: What in your background gave you the confidence to tackle this challenge?

Dunbar: SuiteBox’s founder and creative director is a world leader in data visualization and founder of several successful interactive media businesses including Terabyte Interactive, now recognized as the oldest multimedia company in the world.

Craig is expert at developing technology strategies to address opportunities. He pioneered the first online real-time 3D graphics for the America’s Cup as co-founder of Virtual Spectator. More recently, Craig established Futuretech that gave rise to One Room, the World’s leading funeral-streaming service.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

Dunbar: We will be integrating with a number of CRM systems, Advice Platforms and Wealth Platforms globally.

We will also be releasing enhancements to the secure MeetingSpace, that will allow participants to utilize the space completely autonomously of being in a meeting. Such as allowing a party to drop off a document, leave a video or chat message, and manage business at any time convenient to them.

Finovate: Where do you see your company a year or two from now?

Dunbar: SuiteBox has recently expanded into the South African market, opening an office in Johannesburg. Throughout 2016, we will expand into the United Kingdom, Europe and North America.

Check out the demo video from SuiteBox from FinovateEurope 2016.

We spoke with Ian Dunbar (circle photo), country manager, Australia, during rehearsal day at FinovateEurope. We followed up with a few questions about SuiteBox and how entrepreneurs and businesses can take advantage of the technology.

We spoke with Ian Dunbar (circle photo), country manager, Australia, during rehearsal day at FinovateEurope. We followed up with a few questions about SuiteBox and how entrepreneurs and businesses can take advantage of the technology.

Calling the lack of liquidity as a major issue plaguing fixed-income investing, Glocer (right) says, “Algomi’s approach of creating a bank balance-sheet based on actual data, and virtualizing the assets in the market is fascinating, and I’m looking forward to working closely with them.”

Calling the lack of liquidity as a major issue plaguing fixed-income investing, Glocer (right) says, “Algomi’s approach of creating a bank balance-sheet based on actual data, and virtualizing the assets in the market is fascinating, and I’m looking forward to working closely with them.”