With the launch of its new, end-to-end biometric authentication solution—VeridiumID—the security innovator that demoed its technology at FinovateFall 2014 as Hoyos Labs is now Veridium.

Company COO Todd Shollenbarger said, “We’re going to replace what you know (passwords) with what you are (biometrics) to safeguard enterprises from fraud and data breaches.” Pointing to the issues that typically inhibit broader adoption of biometric technology, such as high cost and technical complexity, Shollenbarger added that Veridium’s use of SaaS delivery for the backend—and the user’s smartphone to handle the image-capture for authentication—helps reduce both cost and complexity. “We’re making biometric authentication a solution of today, not tomorrow,” he said.

VeridiumID gives businesses the ability to leave password-based authentication and instead incorporate biometric methods using face, voice, or fingerprint. The combination of biometrics and multiple authentication factors in its new solution gives customers of financial services companies the ability to access their accounts and transact without cards and PIN codes, eliminates the need for insurance cards as an authentication tool in healthcare, and helps governments manage physical access in a more efficient and less cumbersome and costly way.

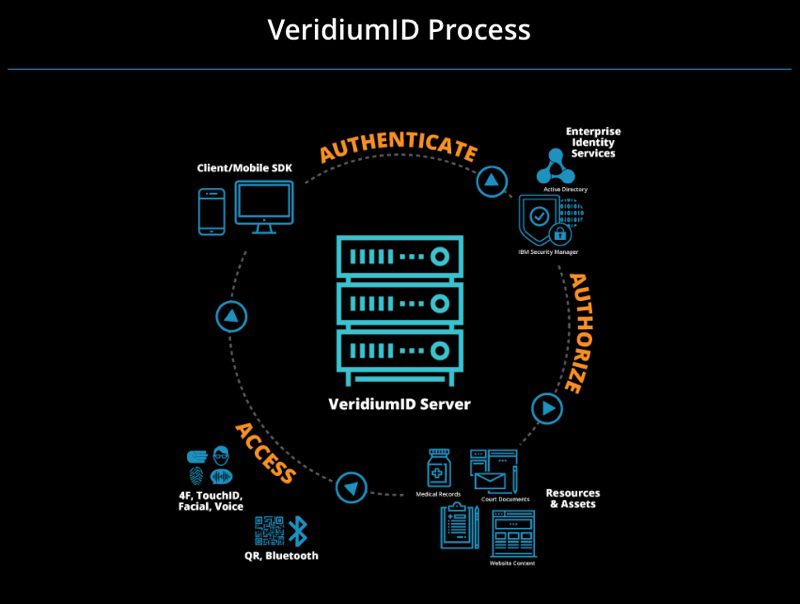

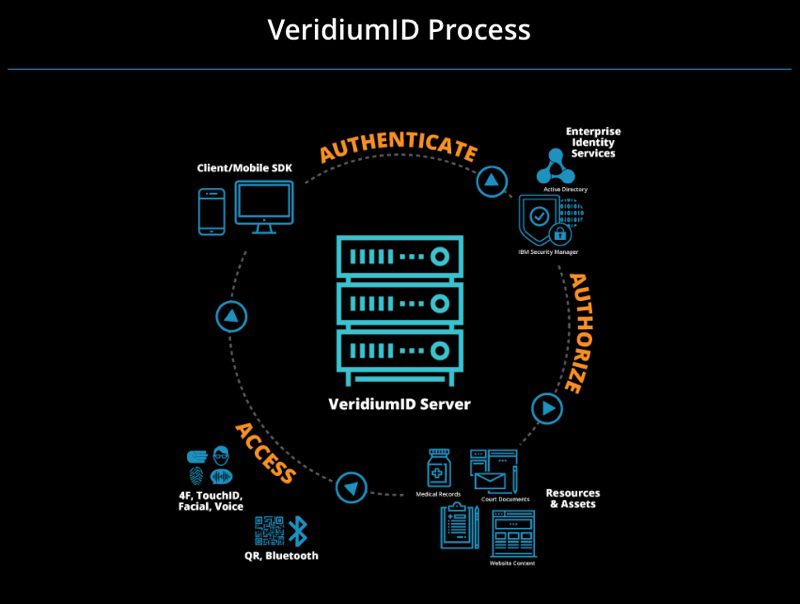

A server-based solution working with a mobile app and a front-end, mobile SDK, the technology uses virtual cryptography to break biometric data into pieces. Storing and distributing the data this way makes it harder for hackers to steal or compromise an entire biometric piece of data, such as a fingerprint. VeridiumID uses liveness detection, accommodates a number of plug-and-play biometric libraries, and provides support for an Active Directory or a FIDO authenticator. Deployable in the cloud or on-site, VeridiumID requires no additional hardware.

The goal of the rebrand from Hoyos Labs to Veridium is to focus the company’s efforts in four key areas: financial services, healthcare, government, and the Global 2000. Veridium says it seeks to leverage its eight patents (with another 34 pending), as well as numerous R&D breakthroughs, to build an open standard for authentication that will defend the enterprise against data breaches today, while remaining flexible enough to “ensure continual iteration and enable the solutions to evolve at the forefront of the industry.”

Founded in 2013 and headquartered in New York City, Veridium demonstrated the mobile app of its identity-assertion platform at FinovateFall 2014. The company also has offices in the U.K. (Oxford and London), as well as in Boston, Massachusetts, and Timisoara, Romania.

FinDEVr Previews highlight companies presenting new developer tools, platforms, and integrations at FinDEVr Silicon Valley 2016, October 18 & 19. Early-bird savings end Friday, so pick up your ticket today to save your spot.