Note: Demoing as bankUP at FinovateEurope, the company has since rebranded as banqUp.

There may or may not be a special place in heaven for those entrepreneurs and developers burning the midnight oil in a quest to build a better banking solution for small businesses. But there will always be a spot on the Finovate stage. This year at FinovateEurope, Antwerp, Belgium-based banqUP tossed its hat into the ring with a preview of its small business banking platform.

Calling itself a bank for people who live on their smartphones, banqUP is a digital neo-bank for small business that offers a business current account, credit and debit cards, and a hub of integrated financial solutions in a single, unified platform. As Dimitri Leemans, a partner at Hedera Consulting explained during an introduction to the company’s demo, banqUP is designed to be the kind of bank young entrepreneurs in Europe have been longing for, one that prioritizes personalization, customer insight, and openness.

Pictured (left to right): banqUP’s Lukasz Chmielewski (CTO), Dimitri Leemans (Partner, Hedera Consulting), and Krzysztof Pulkiewicz (CEO) demonstrating the banqUP small business banking platform at FinovateEurope 2017.

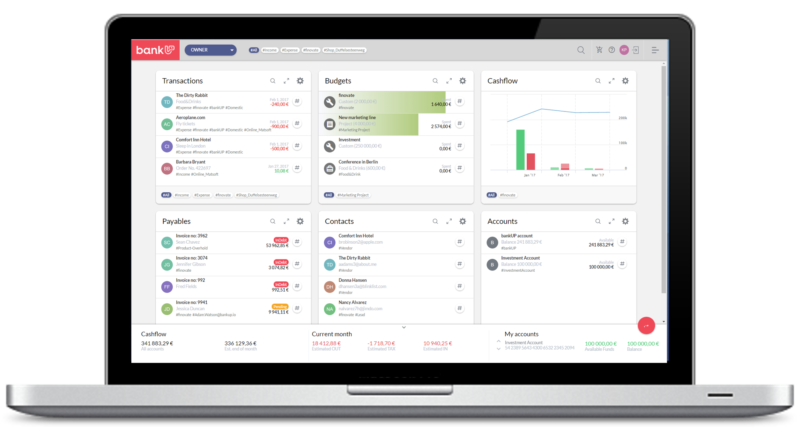

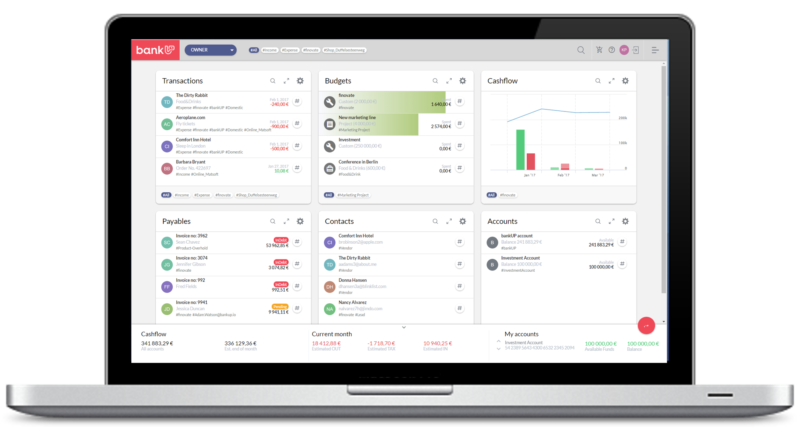

banqUP CEO Krzysztof Pulkiewicz and CTO Lukasz Chmieleswki launched into the demo, showing how the platform provided dashboards with configurable widgets to help business owners track cash flow, budgets, contacts, payables, transactions, and other critical information. banqUP’s smart tagging feature scans transactions and groups them into budgets to keep expenses organized. Create a hashtag for a given expense category, select it, and all of the widgets on the various dashboards will update with information relevant to that category. “This is just the beginning of our smart business bank,” Pulkiewicz said. The platform also enables ready integration for outside parties such as external accounting software or even a real live human accountant, who can be set up on the platform’s accounting dashboard on banqUP and review the details of all transactions, including the original documents, and even leave notes right on the document image.

With its technology still in beta, banqUP is eagerly anticipating its official launch in the coming months. “We are still finalizing the development of our solution to provide our future users with the best possible digital banking solution,” Pulikiewicz said, adding “We have come a long way in a short time already and we are tremendously motivated to go even faster and keep ourselves continuously (focused) toward customer success.”

Company facts

- Headquartered in Antwerp, Belgium

- Founded in 2016

- Partnered with German solarisBank AG

- Launched as a PSD2-ready smart bank in Q1 2017

We met with the banqUP team at FinovateEurope 2017 and followed up with a few additional questions by e-mail. Here are the responses from CEO Krzysztof Pulkiewicz.

We met with the banqUP team at FinovateEurope 2017 and followed up with a few additional questions by e-mail. Here are the responses from CEO Krzysztof Pulkiewicz.

What problem does your small business banking platform solve?

Krzysztof Pulkiewicz: banqUP is a digital fintech bank for small and medium enterprises (SMEs). We are offering core banking products including business current account and MasterCard, combined with a hub of integrated fintech services and functionalities that over a web and mobile business platform. We use mobile and web together with smart data analytics to solve the day-to-day problems of SMEs. By using banqUP, entrepreneurs can control all the aspects of their business via just one platform. Some of our features include personalized dashboards, the organization of your incoming and outgoing payments by simply tagging them (and yes, we have automated this as much as possible for you), the possibility to connect your account with all your team members including your accountant to delegate financial tasks easily … These are just a few of banqUP’s innovative features.

The SME segment is significantly underserved by the banks and as a team of entrepreneurs we aim to change this situation. We offer a tailor-made, unique digital banking experience for SMEs, providing a one-stop shop combination of core banking products and integrated fintech services. Business owners of SMEs are focused on driving their businesses and expect more from banks than just selling traditional banking products and processing transactions. It is all about partnering, insights, relevance, predictions, and integrating more into the business itself.

banqUP’s dashboard consists of configurable modules for managing everything from budgets and transactions to contacts and accounts.

Finovate: How does your technology solve the problem better?

Pulkiewicz: We provide the standard banking services seamlessly integrated with fintech services and business apps of the users’ choice. We do not believe in a “one fits all” approach. Based on your business type, industry and stage in the SME life cycle, we build a personalized user experience with features that are most relevant for your business. At the core of the personalized experience, we have advanced data analytics, and we learn from your historical data how we can help you now and in the future. In addition, we use machine learning and data tagging in order to organize your budgets, provide cashflow estimations, and setup the proactive business notifications you expect from the smart banking solution.

banqUP is open. We give you a free choice to work with your favorite accounting software (you can connect to it with a few clicks) or to work with your accountant. banqUP helps you to collaborate better and fully digitalizes this process (starting from uploads, OCR to online document sharing and one-click payments).

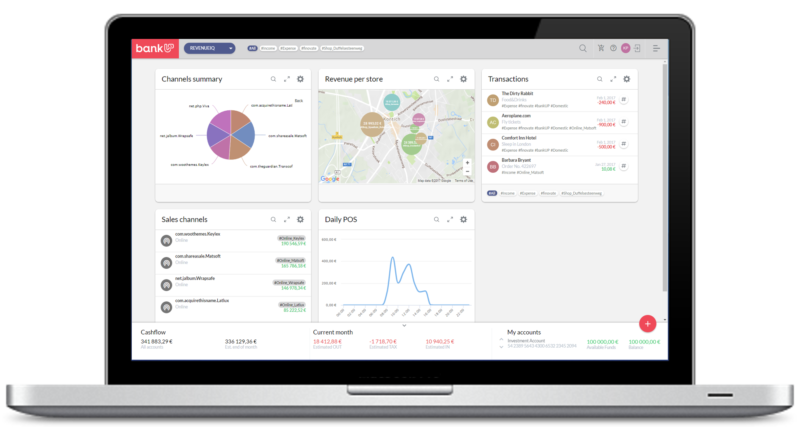

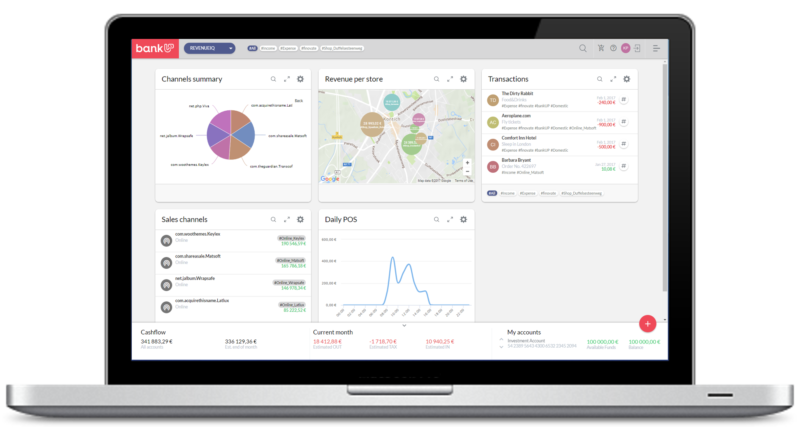

A look at banqUP’s RevenueIQ dashboard, which features a set of widgets that provide ongoing insight into the company’s revenue stream.

Finovate: Who are your primary customers?

Pulkiewicz: banqUP has a double commercial model:

1. A direct, go-to-market model where banqUP focuses on “millennipreneurs” – a young generation of business owners and freelancers. Millennials experience life, work, and business through technology and they expect seamless interactions between their bank and the different tools for running the day-to-day activities of their business. We are determined to meet the needs of young entrepreneurs and bring them the tools they desire the most. But, of course, all digitally-minded and savvy business owners will see the digital added value of banqUP and form the target client group for banqUP.

2. An indirect, go-to-market model where banqUP offers its platform. This option redesigns business banking from the ground up by leveraging BaaS (Bank as a platform) to deliver SME banking services in the EU and to banks across Europe. Our platform is an enabler for banks; we are working to customize digital banking to a selected group of customers and provide them with fully personalized and relevant services. We are PSD2 ready!

Finovate: Tell us about your favorite implementation of your technology.

Pulkiewicz: We are extremely proud of our own banking brand – banqUP and SME banking service – and we will start offering to small and medium businesses in the EU this year. This is a great example how our platform allowed us to enter the market and build a competitive value proposition in a very short marketing time and in an extremely agile way.

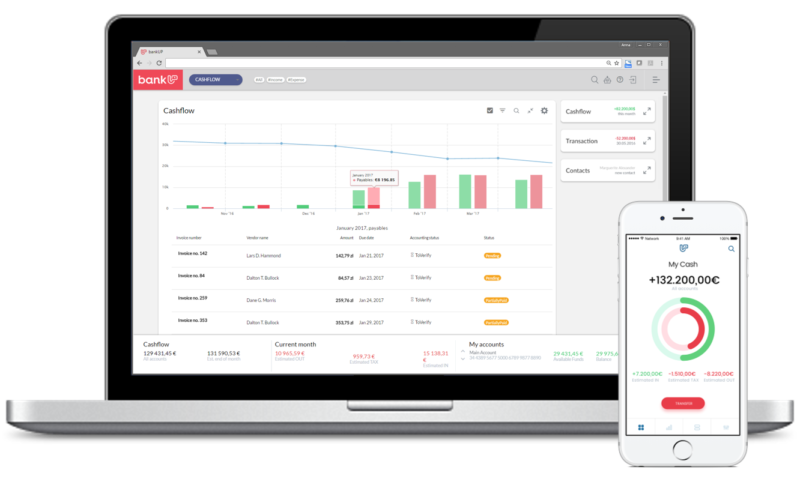

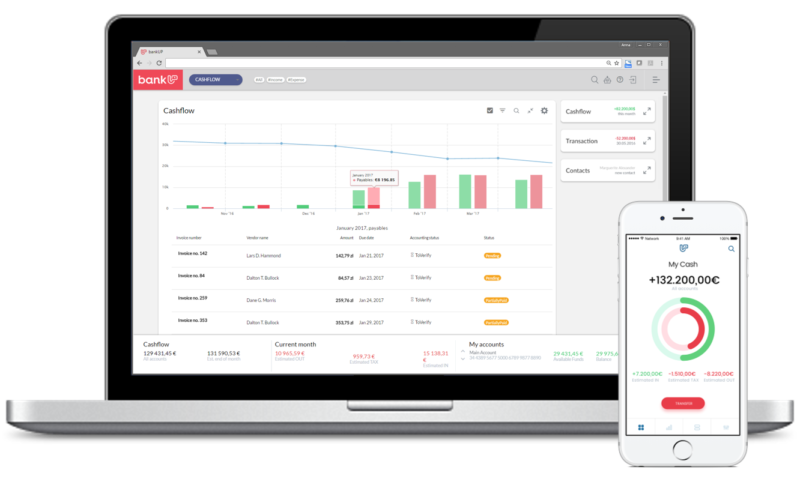

banqUp’s Cashflow planner provides a visualization of past cash flow to give business owners a sense of what future cash flow may look like.

Finovate: What in your background gave you the confidence to tackle this challenge?

Pulkiewicz: We are a group of entrepreneurs on a mission to solve the day-to-day problems of SMEs and we started banqUP to design the bank we, and many other business owners, desperately need. We know and acknowledge that every small business is different and operates in different contexts so we want to create better banks, which can be customized to the needs of specific industries, business models, and personal needs of entrepreneurs.

Finovate: What are some upcoming initiatives from banqUP that we can look forward to over the next few months?

Pulkiewicz: Our main goal for the upcoming months is to finally officially launch our banking service. We are still finalizing the development of our solution to provide our future users with the best possible digital banking experience. We will attend some international conferences in order to present our idea to experts from the banking and fintech industry. We have come a long way in a short time already, and we are tremendously motivated to go even faster and keep ourselves continuously sharp towards customer success.

Finovate: Where do you see your company a year or two from now?

Pulkiewicz: There are many important steps on our planned roadmap where we want to launch banqUP and make it available on the market throughout Europe. We will quickly extend our operations and service availability to EU countries as well as connect with new, global and local partners that offer financial services that truly add value for business owners and entrepreneurs.

Lukasz Chmielewski (CTO), Dimitri Leemans (Partner), and Krzysztof Pulkiewicz (CEO) demonstrating the banqUP small business banking platform at FinovateEurope 2017.

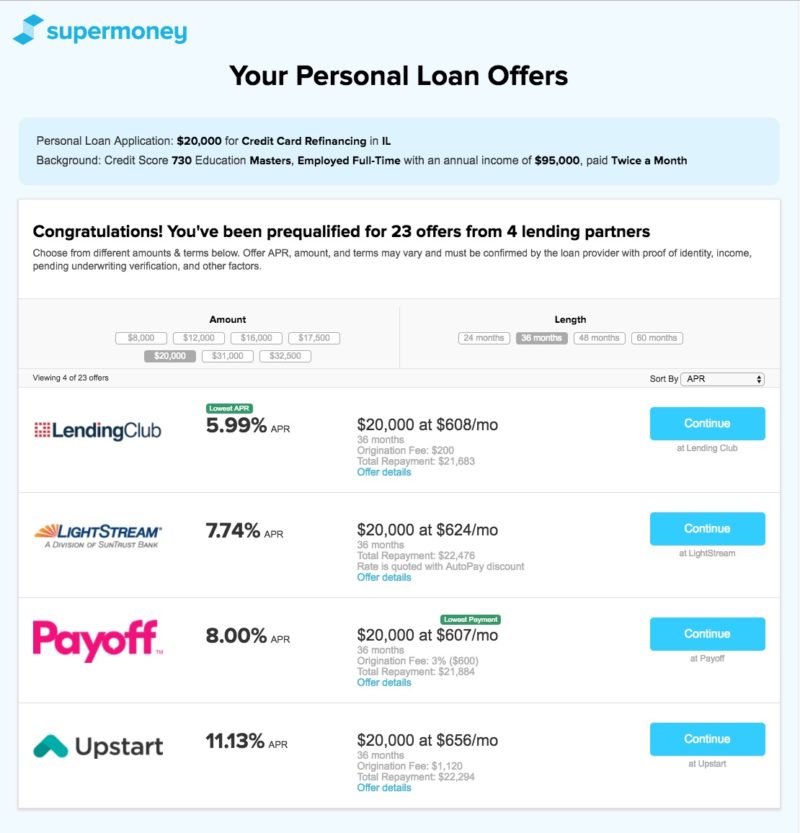

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

We caught up with the SuperMoney team briefly at FinovateSpring during rehearsals and followed up with a few questions for company CEO Miron Lulic. Here are his responses.

We met with the banqUP team at FinovateEurope 2017 and followed up with a few additional questions by e-mail. Here are the responses from CEO Krzysztof Pulkiewicz.

We met with the banqUP team at FinovateEurope 2017 and followed up with a few additional questions by e-mail. Here are the responses from CEO Krzysztof Pulkiewicz.

We met with Caxton CEO and founder Rupert Lee-Browne and his team at FinovateEurope to learn more about the company’s technology. We followed up with a few questions by e-mail. Below are his responses.

We met with Caxton CEO and founder Rupert Lee-Browne and his team at FinovateEurope to learn more about the company’s technology. We followed up with a few questions by e-mail. Below are his responses.