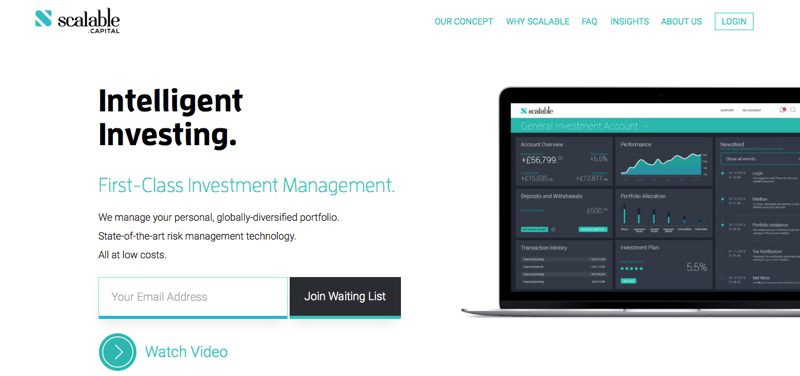

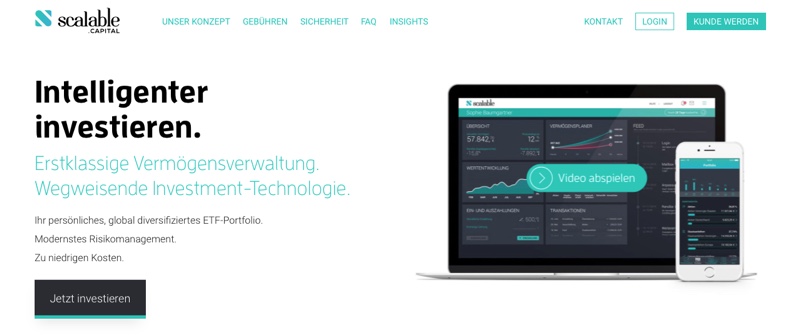

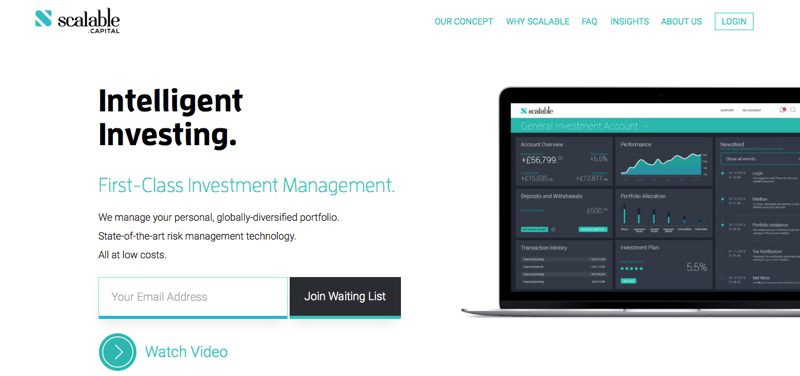

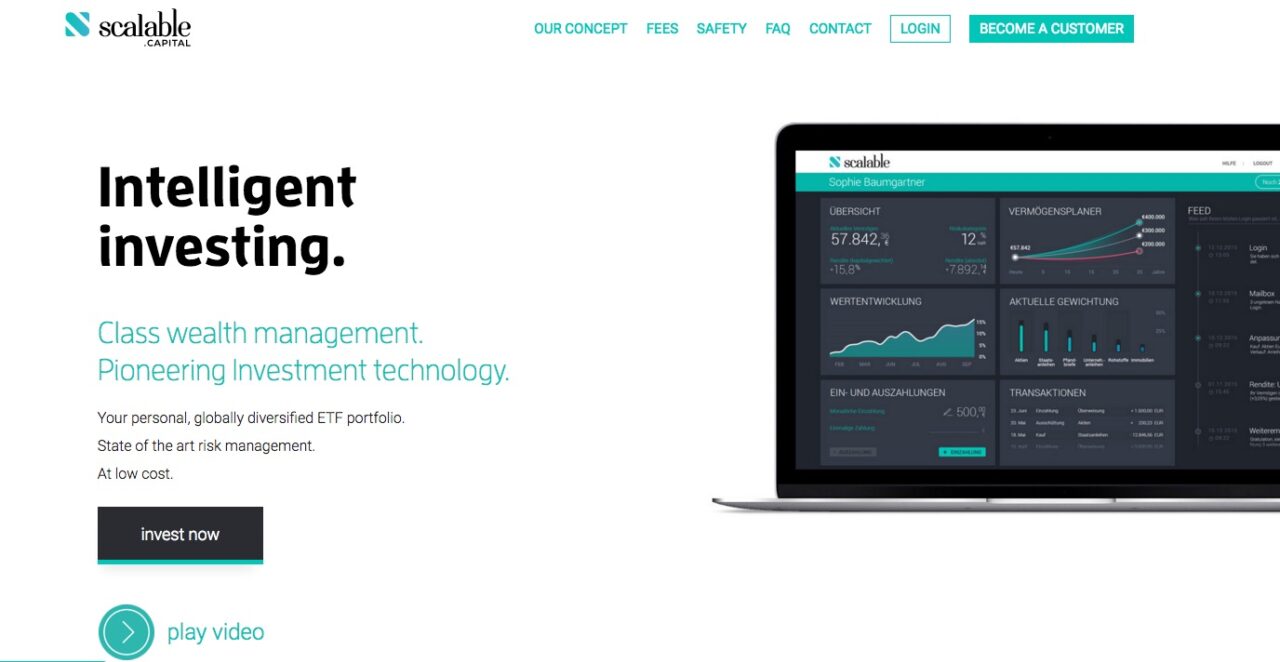

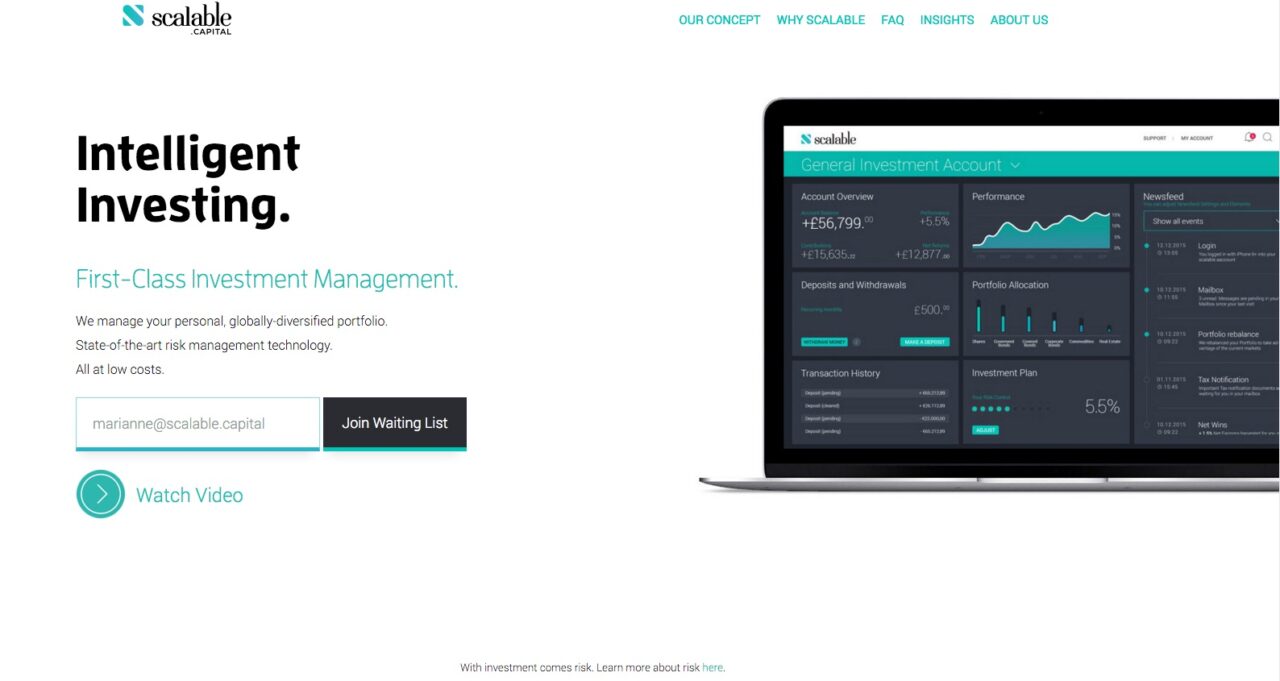

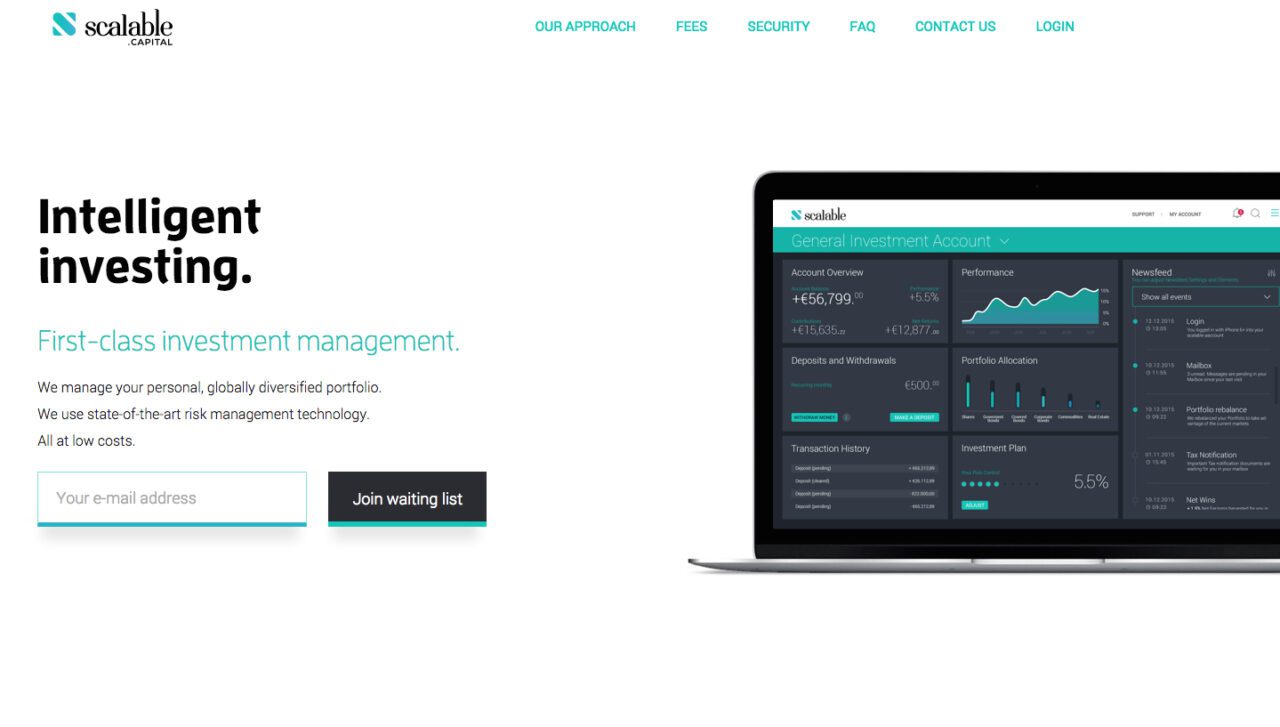

Why does the world need another robo-adviser, the founders of Scalable Capital, a Europe-based automated investment platform, asked from the Finovate stage in London earlier this year.

In the case of Scalable Capital, what’s new and noteworthy about their effort to make investing easier is its proprietary risk management technology. From Scalable Capital’s perspective, the average individual investor can never keep up with high-net-worth and institutional investors because they have access to superior risk modeling and risk management. Give average investors the same level of risk management as wealthier investors and watch the investment returns for individual investors improve.

Pictured (left to right): Co-founders Erik Podzuweit, co-CEO, and Adam French. UK managing director, demonstrated Scalable Capital at FinovateEurope 2016 in London.

Scalable Capital’s technology is based on the research of German economist Stefan Mittnik who is known for his work on financial risk modeling and portfolio optimization. Mittnik is chair of Financial Econometrics at the Ludwig Maximilians University of Munich and a fellow of the Center for Financial Studies (located in Frankfurt am Main). He serves as an adviser to Scalable Capital, which he helped co-found.

Described as providing a service that is “so cost-efficient, so honest and transparent that even a banker could use it,” Scalable Capital uses exchange-traded funds to provide investors with a globally diversified portfolio. The portfolio is automatically monitored and optimized based on preset risk-parameters, as well as adjusted for market conditions. As French has emphasized, these efficiencies are part of what makes Scalable Capital unique among robo-advisers.

“What we do—and this is truly unique for private investors—is quantify the risks, and we attach an institutional risk measurement to it,” French explained. “We use ‘value at risk’ for each portfolio, which [shows] the maximum loss that won’t be breached with a 95% likelihood over a one-year horizon.”

This emphasis on risk, French said, is what separates the average investor from the professional or institutional investor, and it’s what Scalable Capital focuses on. “Risk, apart from costs, is the most important factor in investing,” he said. “Risk is the currency [that] buys long-term performance. And our clients should decide for themselves how much of that currency they want to put on the table.”

Company facts:

- Founded in December 2014

- Headquartered in Munich Germany & London, United Kingdom

- Total funding of more than €11 million

- Employs 35 in its Munich and London offices

We spoke briefly with Adam French at FinovateEurope in February. This was shortly after learning that Scalable Capital, the first independent “InvestTech” company to receive a license to operate in Germany, had received FCA approval to operate as a regulated digital investment manager in the U.K. We followed up with a few questions by email.

Finovate: What problem does Scalable Capital solve?

Finovate: What problem does Scalable Capital solve?

Adam French: Our mission is to revolutionize the current wealth management offering. We want to eliminate the historical shortcomings of wealth managers having high fees and human interference eroding the gains that retail investors should be making.

Instead, we want our clients to be confident that their money is allocated into investments with suitable risks to match their investment goals.

Scalable Capital is a unique new digital investment adviser that offers savvy retail investors institutional-quality products at a low cost. We use a smart, cost-effective, technology-based approach, which offers investors:

- Globally diversified ETF portfolios, tailored to each customer’s risk preference.

- A unique dynamic risk management technology, which controls the risk of loss while optimizing performance, developed in collaboration with renowned German economist, Professor Stefan Mittnik.

- No hidden fees, and a total cost of 0.75% p.a.

Finovate: Who are your primary customers?

French: Scalable Capital meets the needs of savvy customers who understand the value of investing in the capital markets, but don’t have the time to structure their own portfolios. Our service is aimed at professionals too busy to invest on their own and smart enough not to get ripped off.

Finovate: How does your technology solve the problem better?

French: Our dynamic risk management technology takes the digital investment industry to the next level. In contrast to traditional wealth managers, Scalable Capital adopts a fluid approach to the weighting of asset classes in its portfolios. This allows investors to capitalize on markets where risk is rewarded, and limit exposure to excess risk in more volatile conditions. This state-of-the-art technology is an institutional class investment product, available, for the first time, to retail investors, at a fraction of the cost.

Scalable Capital ensures that performance is not eroded by unnecessary costs. The total cost is 0.75 percent p.a. of the average invested capital. This includes account-management and custody fees, as well as all trading costs for portfolio adjustments. For comparison, the total costs of using a traditional investment management service average around 2-3% in the U.K.

Finovate: Tell us about your favorite implementation of Scalable Capital.

Finovate: Tell us about your favorite implementation of Scalable Capital.

French: During the recent market turbulence, we were able to really see the value of our solution. We use a unique risk management technology to dynamically adjust our customers’ portfolios so that the risk they are exposed to remains consistent over time and does not fluctuate in tandem with the market.

In Germany, we have dramatically reduced the equity allocations last autumn. We were able to keep the risk level in line with client requirements and significantly mitigate or completely avoid the dramatic market slumps since the beginning. That’s exactly what our model should do in turbulent market times.

Finovate: What in your background gave you the confidence to tackle this challenge?

French: Our friends often asked ‘how should I invest my money?’ but we didn’t have a good answer to that question, as we didn’t feel comfortable recommending any of the existing investment products and services available to regular retail customers. So we decided to build Scalable Capital, building on the investment knowledge we’ve acquired during our time at Goldman Sachs.

Scalable Capital is our answer to the question of what a modern, fair, and professional investment service aimed at retail customers should look like—especially for a digital-savvy target audience. We have focused on eliminating all of the costs of traditional investment management, which have no added value for the customer, and on managing risks in a way that allows our customers to stay invested in the capital markets in the long run.

Finovate: Where do you see your company a year or two from now?

French: We are intrinsically a European company and have already launched in Germany. We have received regulatory approval from the FCA this year, and plan to continue our European expansion in the coming months.

We have a very healthy funding position and limited operating costs which means we are well-positioned to run and grow the business for the foreseeable future. Last year we closed one of the largest seed funding rounds in European fintech, receiving funding of almost €4 million. Last week, we closed another €7 million in funding. Subscribers to the round included Holtzbrinck Ventures, Peng T. Ong’s Monk Hill Ventures, The German Startups Group, and MPGI, all of whom contributed to our first round of funding in 2015. New investors including Tengelmann Ventures also participated.

Check out Scalable Capital’s demonstration video from FinovateEurope 2016.

Finovate: What problem does Scalable Capital solve?

Finovate: What problem does Scalable Capital solve? Finovate: Tell us about your favorite implementation of Scalable Capital.

Finovate: Tell us about your favorite implementation of Scalable Capital.

Presenters

Presenters Adam French, Founder and U.K. Managing Director

Adam French, Founder and U.K. Managing Director