The only thing better than receiving a $500 million investment in February may be getting another $80 million in funding five months later.

Alternative bank Revolut announced late last week that TSG Consumer Partners is the latest investor to join its Series D round. The $80 million investment from the VC firm takes the London, U.K.-based company’s total for the current round to $580 million. Revolut noted that its estimated $5.5 billion valuation in February remains the same.

Company founder and CEO Nikolay Storonsky told Silicon Republic that the additional funding was an instance of TSG Consumer Partners making an offer the company could not refuse. He said that Revolut was not seeking additional funding when the opportunity from TSG developed. “TSG approached us with an exciting proposition to work together,” Storonsky said, adding that the VC firm’s track record of working with “some of the most successful and innovative consumer companies in recent years” was a major plus for the partnership. TSG Consumer Partners has funded companies like BrewDog, Smashbox Cosmetics, and Vitamin Water.

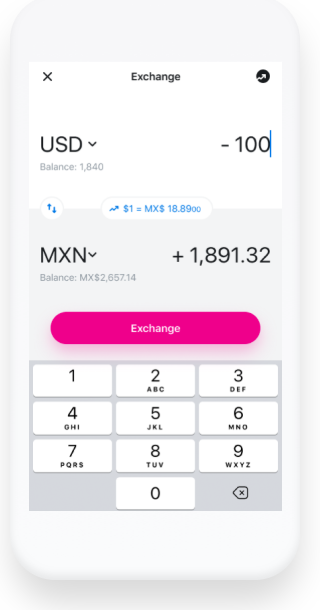

With more than 12 million customers around the world, Revolut offers consumers a variety of banking and personal financial services including a digital bank account with PFM tools, P2P payments, and interbank exchange rate currency exchange. The accounts also come with a prepaid debit card, early payday for direct deposit customers, and stock trading tools.

Founded in 2015 and making its Finovate debut that same year, Revolut launched in the U.S. this spring and has since opened operations in Lithuania, added to its leadership team in Singapore, and reached a milestone of one million customers in Ireland. More recently, the company has expanded its cryptocurrency service to its U.S.-based customers, and partnered with TrueLayer to bring the benefits of open banking technology to its million-plus customers in France.

Photo by Quang Nguyen Vinh from Pexels