If this is the first time you’ve heard the term proptech, it won’t be the last. Proptech (also known as real estate tech or REtech) and its subset mortgagetech have been around since 2014. Here’s why 2017 is poised to place proptech among the ranks of wealthtech, insurtech, regtech.

This year has already been favorable to mortgagetech and proptech companies. SoFi, for example, is about to close a massive, $500 million round, its competitor LendingHome topped $1 billion in mortgage loan originations last year, and RealtyShares has seen over $300 million raised on its platform. According to CB Insights, since 2012 the real estate technology sector has closed 817 deals worth $6.4 billion. Of that amount, $2.6 billion closed in 2016 alone, which represents a 40% increase from that sector’s funding in 2015.

In the U.S., there are a handful of reasons 2017 will be favorable to real estate. Interest rates are projected to rise for the second time, millennials are starting to buy their first homes, and investors are looking to diversify out of the volatile stock market. On top of all of this, regulations are slated to loosen under the Trump administration, and changing in regulation brings opportunities for innovation.

Players

The broader category of proptech can be broken down into four basic segments.

1- Mortgagetech

These are mostly B2B companies specifically focused on facilitating part of all of the mortgage application process. They do not lend or service the loan.

2- Digital mortgage lending companies

These online lenders facilitate the mortgage application process and service the loan.

3- Real estate investment tech

Companies in this category are focused on the investment aspect of commercial and residential real estate.

4- Pure property plays

These don’t have a fintech angle but play a role in the broader proptech industry. Since this category is out of scope for this blog, this list only encompasses a fraction of companies in this category. Check out CB Insights’ coverage of commercial real estate technology for more.

What’s ahead in 2017

- Expect to see more mortgagetech-bank partnerships along the lines of Roostify’s recent deal with JP Morgan Chase. As banks try to gain a competitive edge for market share, more established banks will need to leverage mortgagetech offerings.

- We’ll see more niche alt-lending solutions such as SoFi that facilitate the application process and save borrowers on closing costs.

- Expect to see more players offering real estate investment technology, coupled with some consolidation in real estate crowdfunding companies.

- Outside of fintech, we’ll see more platforms aimed at cutting out the middle person, the realtor; and more business models such as Knock and GoldenKey that make the selling process easier.

You don’t have to take my word for it

We posed the question, How do you see proptech/ mortgagetech growing in 2017? to these Finovate alums working in the space. Here’s how they responded:

Rajesh Bhat, CEO and cofounder of Roostify:

Rajesh Bhat, CEO and cofounder of Roostify:

“We expect to see further widescale adoption of digital mortgage solutions – to the point where one should expect it to be table stakes in 2018. We should also expect to see more players emerge in the space as investors see larger market adoption and validation.”

Linda Schicktanz, Chief Advisor of CK Mack*:

Linda Schicktanz, Chief Advisor of CK Mack*:

“If there is one area ripe for fintech innovation, it’s real estate investing. Why put 30% down just to gain massive management headaches when you can now invest in rental cashflow online with very similar returns? Fintech and Real Estate are like peanut butter and jelly, they just go together!”

Nima Ghamsari, cofounder and CEO at Blend:

Nima Ghamsari, cofounder and CEO at Blend:

“There is going to be an explosion in the use of data driving the mortgage process in 2017. Both Freddie Mac and Fannie Mae have announced their data initiatives toward the end of 2016, and lenders are starting to push consumer financial data aggregation into the core components of their customer experiences. This ties in nicely to the industry-wide push forward to a more digital, end-to-end process that started in 2016.”

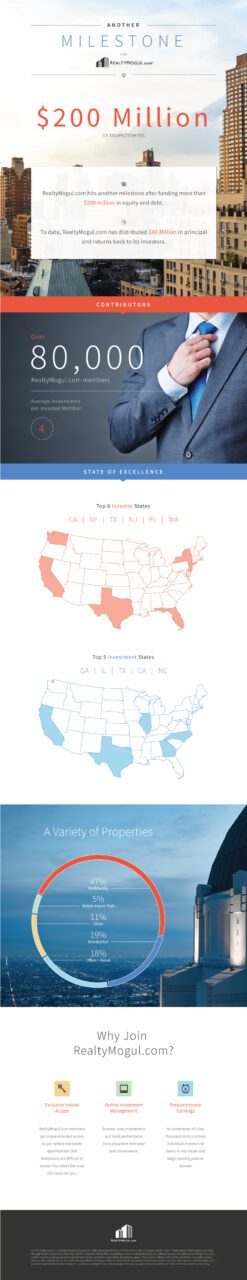

Jilliene Helman, CEO at RealtyMogul

Jilliene Helman, CEO at RealtyMogul

“The impact of digital technology on the real estate industry and mortgage technology is still in its infancy, but I see both less experienced and more sophisticated investors, alike, moving toward a process that takes place entirely online. With over $250 million of capital invested and 100,000 registered investors on the platform, RealtyMogul.com is a testament to this change. The more that technology can offer real estate borrowers and lenders transparency, as well as the efficiency of process and convenience, the faster both sides will adapt.”

*Full disclosure: I’m related to Linda Schicktanz. Yup– she’s my mom.

Linda Schicktanz, Chief Advisor of CK Mack*:

Linda Schicktanz, Chief Advisor of CK Mack*: Nima Ghamsari, cofounder and CEO at Blend:

Nima Ghamsari, cofounder and CEO at Blend: Jilliene Helman, CEO at RealtyMogul

Jilliene Helman, CEO at RealtyMogul